Collections Dashboard: Why Is It an Essential Growth Tool?

Gaviti

NOVEMBER 29, 2022

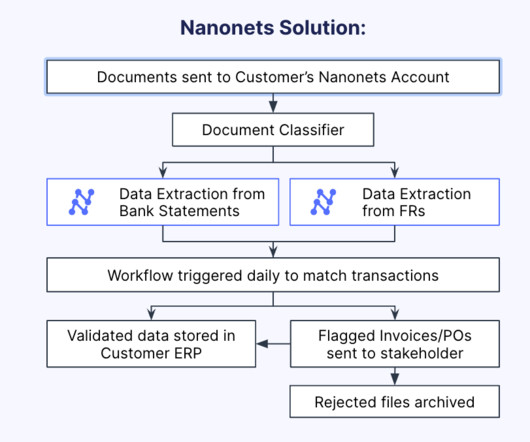

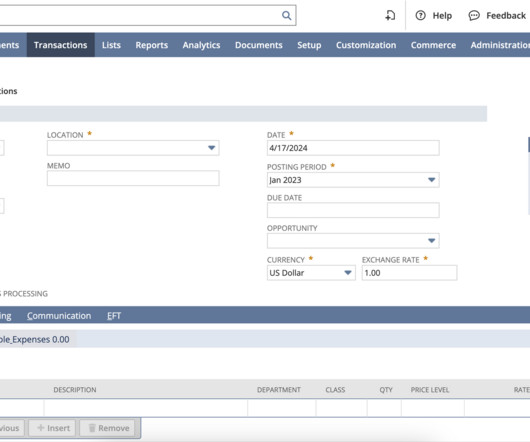

It also gives companies the ability to move away from manual tracking in spreadsheets, to a real-time dashboard, which saves time and gives a full and reliable visualization of the current state of collections. So, how can using a collection dashboard help, and why is it so indispensable as a growth tool? First Pass Yield.

Let's personalize your content