Small Business Accounting Guidelines: Steps For Running & Scaling Your Business

Outsourced Bookeeping

MAY 14, 2024

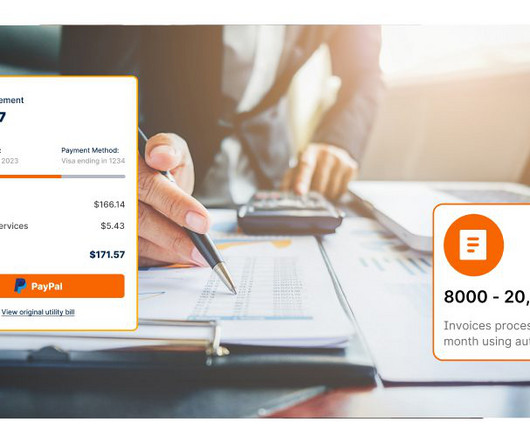

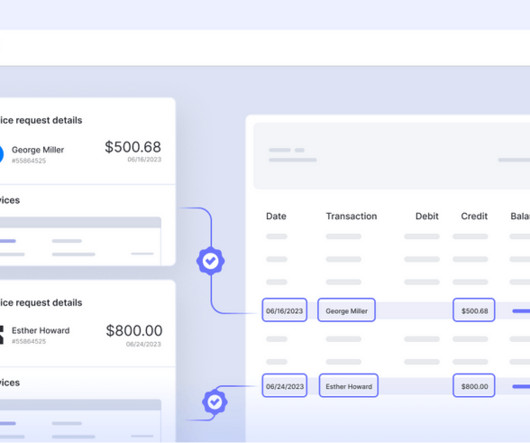

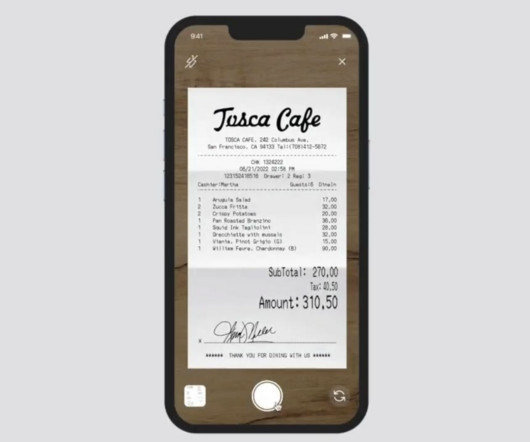

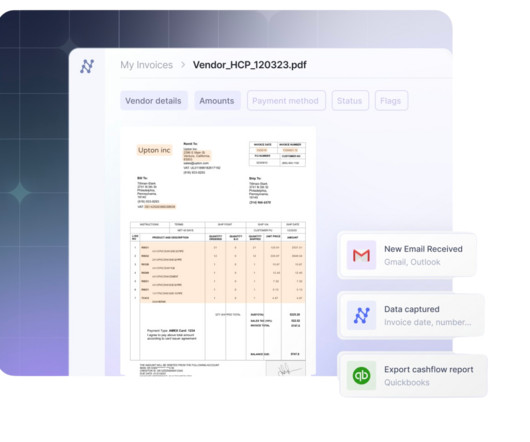

Running a small business can cause you to shoulder a lot of burdens, especially in the financial realm. Keeping track of revenues and expenditures to maintain a proper cash flow must be cautiously organized so that you are not off track on your funds or financial records when you are filing taxes.

Let's personalize your content