What is Financial Reporting Automation?

Nanonets

JULY 25, 2023

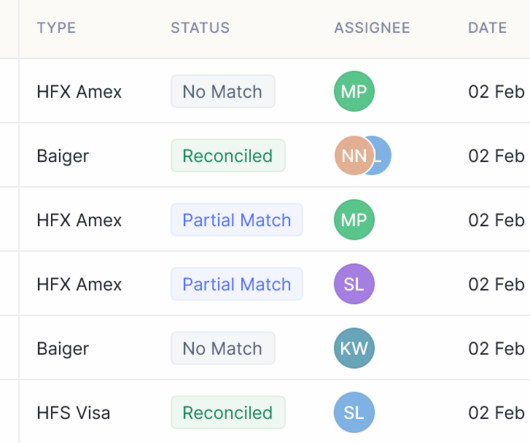

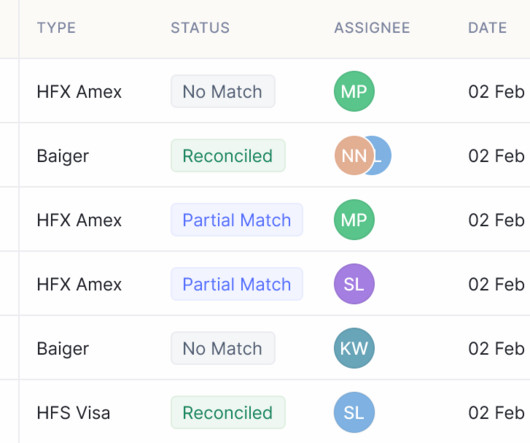

Business today face the challenge of managing large volumes of financial data, producing accurate and timely reports so as to draw actionable insights from them. This is where financial reporting automation comes into play. What is financial reporting automation?

Let's personalize your content