Claim edits mastery: Leveraging best edits and best practices to expedite payments

SSI Healthcare Rev Cycle Solutions

JUNE 14, 2023

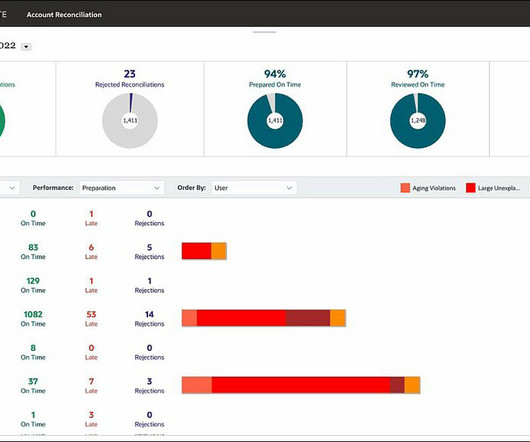

Claim edits mastery: Leveraging best edits and best practices to expedite payments [Live Webinar] Although often overlooked, claim edits play a critical role in thwarting denials and accelerating payments. Your ability to efficiently manage and promptly correct edits, utilizing a claim scrubber or billing application, has substantial implications on your cash flow.

Let's personalize your content