CFOs seeking tech solutions need change management

Accounting Today

MAY 16, 2024

Partly in response to the talent crunch, CFOs are reaching for digital platforms to automate, streamline and spare the highest-value talent for highest-value work.

Accounting Today

MAY 16, 2024

Partly in response to the talent crunch, CFOs are reaching for digital platforms to automate, streamline and spare the highest-value talent for highest-value work.

Accounting Department

MAY 16, 2024

Outsourced client accounting services play a crucial role in helping businesses take control of their financials. These services involve outsourcing the accounting and bookkeeping tasks to a third-party service provider, allowing businesses to focus on their core operations. The role of outsourced client accounting services goes beyond basic bookkeeping; it includes managing accounts payable and receivable, payroll processing, financial reporting, and more.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Accounting Today

MAY 16, 2024

The Top 10 Firm based in Chicago is adding a Top 75 Firm headquartered in Redwood City, California in July, only a few months after receiving private equity funding.

Fidesic blog

MAY 16, 2024

Healtchcare AP Automation Case Study Fidesic and MB2 Dental. Dental practice management service provider saves 100s of hours using Fidesic.

Speaker: Joe Wroblewski, Sales Engineer Manager

Automating time-consuming manual tasks can save your firm hundreds of hours–and thousands of dollars. But it can also have longer-lasting benefits, like helping you attract and retain the next generation of CPAs, and we don’t need to tell you how important that is amid the current generational staffing crisis in the tax and accounting profession. You'll want to save your seat for this new webinar with industry expert Joe Wroblewski, where we'll explore how to: Maximize ROI with Cost-Effective Te

Accounting Today

MAY 16, 2024

The American Institute of CPAs' Auditing Standards Board voted to approve a set of revisions to the rules for attestation engagements to align them with the AICPA's quality management standards.

Insightful Accountant

MAY 16, 2024

Insightful Accountant is hosting Future Forward 2024 next Tuesday and Wednesday. If you are a QuickBooks Pro or Premier user you will want to attend my two sessions on Migration from those products.

Financial Ops World brings together the best financial operations content from the widest variety of thought leaders.

Accounting Tools

MAY 16, 2024

What is a Tangible Asset? A tangible asset is physical property - it can be touched. The term is most commonly associated with fixed assets , such as machinery, vehicles, and buildings. It is not used to describe shorter-term assets, such as inventory , since these items are intended for sale or conversion to cash. Tangible assets comprise the key competitive advantage of some organizations, especially if they use the assets efficiently to produce sales.

Accounting Today

MAY 16, 2024

This beauty's a steal; what a Lady; medical miscreants; and other highlights of recent tax cases.

AvidXchange

MAY 16, 2024

As the workplace evolves, the shift towards electronic invoicing represents more than a technological upgrade; electronic invoicing and payments transform how businesses manage their financial processes. For finance and accounting teams, e-invoicing benefits many aspects of their work – from improving visibility into transactions to facilitating remote work.

Accounting Today

MAY 16, 2024

Proposals to crack down on private placement insurance contracts aren't close to becoming law. Here's how advisors and their clients can use them for the time being.

Advertisement

Automation generally supercharges any process and brings its value to the forefront. See how infusing automation such as ART (our month-end close solution), into your close can get you to the next level of closing. We will share a live demo of SkyStem's solution, ART and share the key elements of month-end close automation. Through ART, we'll take a look at: What month-end close automation entails Which process steps can and should be automated Benefits of achieving process automation, and Why i

Tipalti

MAY 16, 2024

Learn how to create a purchase order step-by-step and optimize the purchase order creation process so your business can streamline PO management.

Accounting Today

MAY 16, 2024

A KPMG survey found 72% of companies are using AI in their financial reporting process to some extent, and executives expect auditors will start examining controls around the technology.

oAppsNet

MAY 16, 2024

Managing past-due invoices is a delicate task that requires a careful balance between maintaining healthy cash flows and preserving strong customer relationships. When invoices become overdue, it disrupts a business’s financial planning and signals a need for effective communication and negotiation strategies. This article explores comprehensive approaches for handling past due invoices, emphasizing practical strategies, communication tips, and legal considerations to recover owed funds wh

Accounting Today

MAY 16, 2024

There is still a dispute between the defense and government as to whether Bryan Waugh knowingly engaged in insider trading using information Joe Lewis provided.

Advertiser: Paycor

Mid-year performance reviews aren’t just boxes for HR to check. Paycor’s toolkit empowers leaders to: Identify high-potential team members. Boost engagement with meaningful feedback. Support struggling employees. Nurture top talent to drive results. Learn how to ignite employee potential through meaningful feedback. When you nurture top talent, everybody wins.

accountingfly

MAY 16, 2024

Top Remote Accounting Candidates This Week Looking for remote accountants? Accountingfly can help! With our ‘ Always-On Recruiting ‘ program, you can access highly skilled and experienced remote accountants with no upfront cost. These are just a few of our top candidates this week. Sign up now to receive the full list of top accounting candidates available weekly!

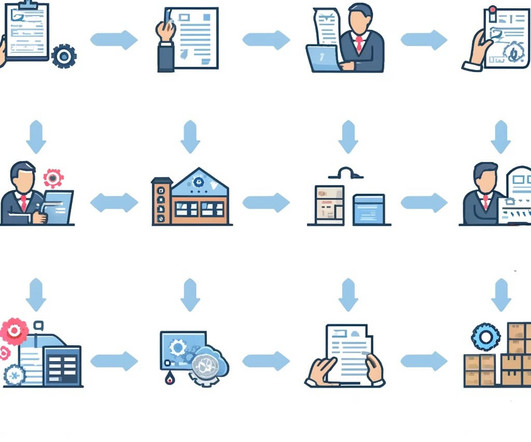

Nanonets

MAY 16, 2024

The advent of AI and automated workflows in recent years have paved the way for procure to pay software - and these tools have completely streamlined the cumbersome processes associated with the procure to pay cycle. Businesses are increasingly aiming to streamline their P2P process with the aid of procure to pay software and stay ahead of the competition.

Accounting Tools

MAY 16, 2024

What is a Tax Loss? A tax loss occurs when total expenses are greater than total revenues under the tax reporting rules of the applicable government jurisdiction. A tax loss reduces an entity's tax liability only in proportion to its tax bracket. Businesses and individuals will frequently reduce their reportable revenues or increase their reportable expenses for tax purposes in order to reduce their tax payments.

Accounting Today

MAY 16, 2024

The measures include expanded tariffs, tax policy guidance that could heighten demand for some U.S.-made solar equipment and promises of heightened vigilance for signs of unfair trade.

Speaker: Victor C. Barnes, CPA, MBA

In the climb from contributor to leader, the rules quietly change. If you’re aiming for the summit, the air gets thinner—and what got you here won’t be enough to get you to the top (a concept first popularized by Marshall Goldsmith in his book What Got You Here Won’t Get You There ). What made you successful early in your finance career—technical accuracy, sharp analysis, flawless execution—won’t be what carries you to the next level.

Accounting Tools

MAY 16, 2024

A tax position is taxpayer’s decision regarding how to treat a line item on their tax return. The position taken may be a specific interpretation of the tax laws or regulations as they pertain to a variety of tax-related items, such as an asset classification, the recognition of income, or when to record a transaction. A tax position can yield a permanent reduction or deferral of income taxes payable.

Accounting Tools

MAY 16, 2024

What is a Troubled Debt Restructuring? A troubled debt restructuring occurs when a creditor grants a concession to a debtor that it would not normally consider. A concession may involve restructuring the terms of a debt (such as a reduction in the interest rate or principal due, or an extension of the maturity date ) or payment in some form other than cash , such as an equity interest in the debtor.

Accounting Tools

MAY 16, 2024

What is a Treasury Note? A treasury note is an interest -bearing debt security that is issued by the United States government. It has the following characteristics: Maturity. A treasury note matures anywhere within a range of one to 10 years. Interest rate. The interest rate associated with a treasury note is fixed. Payment intervals. Interest payments are made to investors at six-month intervals.

Accounting Tools

MAY 16, 2024

What is a Treasury Bond? A treasury bond is an interest -bearing debt security that is issued by the United States government. It has the following characteristics: Maturity. A treasury bond matures over a period of more than 20 years. Interest rate. The interest rate associated with a treasury bond is fixed. Interest payments. Interest payments are made to investors at six-month intervals.

Speaker: Kim Beynon, CPA, CGMA, PMP

The most overlooked, yet most critical, element of transformation is preparing people for change. Automation and AI aren't just technical upgrades, they’re cultural shifts which can challenge identities. That’s why change management isn’t a side project—it’s the foundation. In finance, where precision and process rule, navigating change can feel especially disruptive.

Accounting Tools

MAY 16, 2024

What is a Time Variance? A time variance is the difference between the standard hours and actual hours assigned to a job. The concept is used in standard costing to identify inefficiencies in a production process. The variance is then multiplied by the standard cost per hour to quantify the monetary value of the variance. How to Calculate Time Variance In order to calculate a time variance, subtract the actual duration of an activity from its planned duration.

Accounting Tools

MAY 16, 2024

What is a Time Ticket? A time ticket is a document used by an employee to record hours worked. The purpose of a time ticket is to accumulate the hours that an employee will be paid in the next payroll. Once a pay period has ended, they are used by the payroll staff to compile hours worked, which is the basis for the calculation of gross pay. A common format for a time ticket is for it to be printed in an oblong heavy paper format, which is then inserted into a time clock when an employee clocks

Accounting Tools

MAY 16, 2024

What are Trading Securities? Trading securities is a category of securities that includes both debt securities and equity securities , and which an entity intends to sell in the short term for a profit that it expects to generate from increases in the price of the securities. This is the most common classification used for investments in securities.

Accounting Tools

MAY 16, 2024

Temporarily restricted net assets are the assets of a nonprofit entity that have a special restriction imposed by the donor. There are two variations on this restriction, which are as follows: Usage restriction. There is a restriction on the assets that requires the assets to be used in a certain way, such as for a student meal program. Time restriction.

Speaker: Mark Gilham, FCCA, CPP

Finance used to be the function that counted, now it's the one that’s counted on. 📊 For accounting firms, controllers, and finance leaders, expectations are rising faster than headcount. Businesses want agile forecasts, granular analysis, seamless reporting, and smart automation—often without added resources while demanding uncompromised accuracy and compliance.

Accounting Tools

MAY 16, 2024

What is a Treasury Bill? A treasury bill is a short-term debt security that is issued by the United States government to raise money. It has the following characteristics: Maturity dates. It is issued with maturity dates of either four weeks, 13 weeks, or 26 weeks. Interest rate. There is no stated interest rate on the instrument; instead, it is sold at a discount to the face amount, and the buyer earns interest on the difference between the discounted purchase price and the redemption amount.

Accounting Tools

MAY 16, 2024

What is Double Taxation? Double taxation occurs whenever income tax is paid twice on the same income. The situation arises in a C corporation , where the corporation pays income tax on its earnings and then issues dividends to its shareholders , who are taxed again on their dividend income. This situation arises because a C corporation is considered to be a separate legal entity from its shareholders.

Accounting Tools

MAY 16, 2024

What is a Rubber Check? A rubber check is a check that has been rejected by the bank on which it was drawn. This situation arises when the maker did not have sufficient funds in the underlying account to cover the amount of the check. A rubber check is a sign of poor cash management by the maker. When this situation occurs, the bank will likely charge a fee to the maker.

Accounting Tools

MAY 16, 2024

The redemption of bonds payable refers to the repurchase of bonds by their issuer. There are several ways in which the issuer can accomplish this, which are as follows: Redemption at maturity date. The most common redemption approach is for the issuer to repurchase bonds when they reach their maturity date. This purchase is made at the face value of the bonds.

Advertiser: Paycor

Great leadership development is the key to sustainable business growth. Are you ready to design an effective program? HR can use Paycor’s framework to: Set achievable goals. Align employee and company needs. Support different learning styles. Empower the next generation of leaders. Invest in your company’s future with a strong leadership development program.

Let's personalize your content