Regulating crypto

Accounting Today

JULY 24, 2023

Accountants are helping clients stay abreast of the latest accounting, tax and regulatory issues around cryptoassets.

Accounting Today

JULY 24, 2023

Accountants are helping clients stay abreast of the latest accounting, tax and regulatory issues around cryptoassets.

CloudZero

JULY 24, 2023

At CloudZero, we’re pretty proud of the fact that our platform allows you to maximize your profitability by understanding your unit costs. In fact, our platform’s ability to help you easily track and analyze unit costs is one of the things that sets us apart the most from our competitors.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Accounting Today

JULY 24, 2023

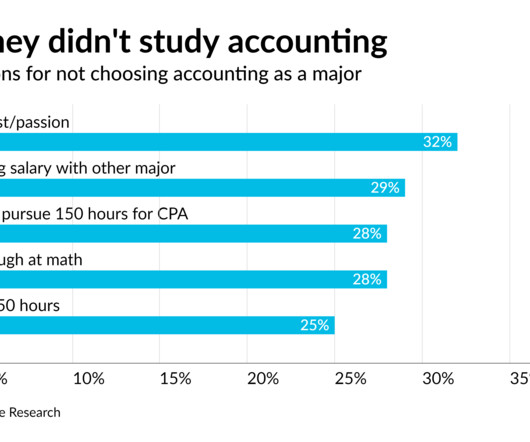

Recent research shows that students aren't moving into accounting because it doesn't strike a spark with them — but the 150-rule isn't helping.

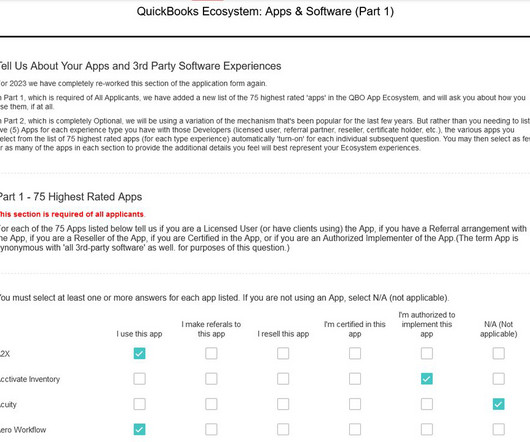

Insightful Accountant

JULY 24, 2023

Murph provides 'wannabe' Top 100 ProAdvisors with valuable tips and statistics from this year's Top 100 and Award recipients.

Speaker: Victor C. Barnes, CPA, MBA

In the climb from contributor to leader, the rules quietly change. But if you’re aiming for the summit, the air gets thinner, and what got you here won’t be enough to get you to the top. 🗻 What made you successful early in your finance career—technical accuracy, sharp analysis, flawless execution—won’t be what carries you to the next level. The higher you go, the more your effectiveness depends on how you connect, adapt, and communicate.

Accounting Today

JULY 24, 2023

The service is stopping most unannounced visits to taxpayers' residences and businesses after a rising number of threats has put its employees' safety at risk.

Accounting Tools

JULY 24, 2023

Related Courses The Balance Sheet The Income Statement The Statement of Cash Flows The key components of the financial statements are the income statement , balance sheet , and statement of cash flows. These statements are designed to be taken as a whole, to present a complete picture of the financial condition and results of a business. A case can be made for each of the financial statements being the most important, though the ultimate answer depends on the needs of the user.

Financial Ops World brings together the best financial operations content from the widest variety of thought leaders.

Accounting Tools

JULY 24, 2023

Related Courses Credit and Collection Guidebook Effective Collections Essentials of Collection Law What is the Cash Collection Cycle? The cash collection cycle is the number of days it takes to collect accounts receivable. The measure is important for tracking the ability of a business to grant a reasonable amount of credit to worthy customers, as well as to collect receivables in a timely manner.

Accounting Today

JULY 24, 2023

Students aren't majoring in accounting because they don't have a passion for the subject, and because they perceive barriers in cost and time, especially Black and Hispanic students.

Accounting Tools

JULY 24, 2023

Related Courses Accountants’ Guidebook Bookkeeper Education Bundle Bookkeeping Guidebook What is a Temporary Account? A temporary account is an account that begins each fiscal year with a zero balance. At the end of the year, its ending balance is shifted to a different account, ready to be used again in the next fiscal year to accumulate a new set of transactions.

Accounting Today

JULY 24, 2023

A bookkeeper reportedly stole from her employer in an effort to retain the affections of her estranged boyfriend.

Speaker: Kim Beynon, CPA, CGMA, PMP

The most overlooked, yet most critical, element of transformation is preparing people for change. Automation and AI aren't just technical upgrades, they’re cultural shifts which can challenge identities. That’s why change management isn’t a side project—it’s the foundation. In finance, where precision and process rule, navigating change can feel especially disruptive.

Accounting Tools

JULY 24, 2023

Related Courses Business Combinations and Consolidations CPA Firm Mergers and Acquisitions Mergers and Acquisitions How to Account for a Consolidation Consolidation accounting is the process of combining the financial results of several subsidiary companies into the combined financial results of the parent company. This method is typically used when a parent entity owns more than 50% of the shares of another entity.

Accounting Today

JULY 24, 2023

You'd think the last thing accounting firms would want to do is to disrupt themselves — yet that may be exactly what they need to do, says Bob Lewis of The Visionary Group.

Accounting Tools

JULY 24, 2023

Related Courses Fraud Schemes Fraud Examination Guidebook How to Audit for Fraud What is Off the Books? Off the books refers to any cash payment or receipt that is not recorded in a firm’s accounting records. This is typically done in order to avoid paying income taxes on cash receipts or use taxes or payroll taxes on payments made. Off the books transactions are especially common when an employer pays undocumented immigrant workers, who could not otherwise work for the firm.

Accounting Today

JULY 24, 2023

Sales of non-fungible tokens are taking place across jurisdictions, both state and national, and tax authorities are starting to take notice.

Speaker: Mark Gilham, FCCA, CPP

Finance used to be the function that counted, now it's the one that’s counted on. 📊 For accounting firms, controllers, and finance leaders, expectations are rising faster than headcount. Businesses want agile forecasts, granular analysis, seamless reporting, and smart automation—often without added resources while demanding uncompromised accuracy and compliance.

Accounting Tools

JULY 24, 2023

Related Courses Capital Budgeting Fixed Asset Accounting How to Audit Fixed Assets What is Capitalize in Accounting? An item is capitalized when it is recorded as an asset , rather than an expense. This means that the expenditure will appear in the balance sheet , rather than the income statement. You would normally capitalize an expenditure when it meets both of the criteria noted below.

Accounting Today

JULY 24, 2023

It's a low-hurdle opportunity that firms can embrace to start quickly making the shift into client advisory services.

Accounting Tools

JULY 24, 2023

Related Courses Accountants’ Guidebook Bookkeeper Education Bundle Bookkeeping Guidebook What are the Basics of Financial Accounting? This article gives an overview of financial accounting basics for the non-accountant. Its orientation is toward recording financial information about a business. First, what do we mean by "financial" accounting? This refers to the recordation of information about money.

Accounting Today

JULY 24, 2023

Look at the resumes of the tax partners you aspire to become and make the necessary changes in your career path.

Advertiser: Paycor

Great leadership development is the key to sustainable business growth. Are you ready to design an effective program? HR can use Paycor’s framework to: Set achievable goals. Align employee and company needs. Support different learning styles. Empower the next generation of leaders. Invest in your company’s future with a strong leadership development program.

Accounting Tools

JULY 24, 2023

Related Courses Corporate Finance Treasurer's Guidebook What are Equity Accounts? There are several types of accounts used to record shareholders’ equity. Each one is used to store different information about the interests of owners in a business. The types of equity accounts differ, depending on whether a business is organized as a corporation or a partnership.

Accounting Today

JULY 24, 2023

The federal contractor reached one of the largest procurement fraud settlements in history over a civil investigation related to its cost accounting.

Accounting Tools

JULY 24, 2023

Related Courses Accountants’ Guidebook Bookkeeping Guidebook The Balance Sheet What are Stockholders’ Equity Accounts? The stockholders' equity accounts contain those accounts that express the monetary ownership interest in a business. In effect, these accounts contain the net difference between the recorded assets and liabilities of a company. If assets are greater than liabilities, then the equity accounts contain a positive balance; if not, they contain a negative balance.

Accounting Today

JULY 24, 2023

The Association of International Certified Professional Accountants unveiled a new educational report on climate resilience, the fourth in a series.

Speaker: Andrew Skoog, Founder of MachinistX & President of Hexis Representatives

Manufacturing is evolving, and the right technology can empower—not replace—your workforce. Smart automation and AI-driven software are revolutionizing decision-making, optimizing processes, and improving efficiency. But how do you implement these tools with confidence and ensure they complement human expertise rather than override it? Join industry expert Andrew Skoog as he explores how manufacturers can leverage automation to enhance operations, streamline workflows, and make smarter, data-dri

Remote Quality Bookkeeping

JULY 24, 2023

If you’re a small business owner or entrepreneur, you’ve probably heard of GAAP, the Generally Accepted Accounting Principles. This set of accounting principles provides standard rules and methods for businesses to collect and report financial information. In the United States, the Securities and Exchange Commission (SEC) requires publicly-traded companies to follow GAAP in their financial reporting.

Billing Platform

JULY 24, 2023

Have you traded your brick-and-mortar storefront to sell your products and services over the internet? If so, you’re part of a growing number of businesses that are either complementing their storefronts with an eCommerce payment processing website or ditching physical locations in favor of online only sales. While the trend towards eCommerce shopping has created opportunities for businesses to reach a larger target market and increase revenue, it has also resulted in payment processing challeng

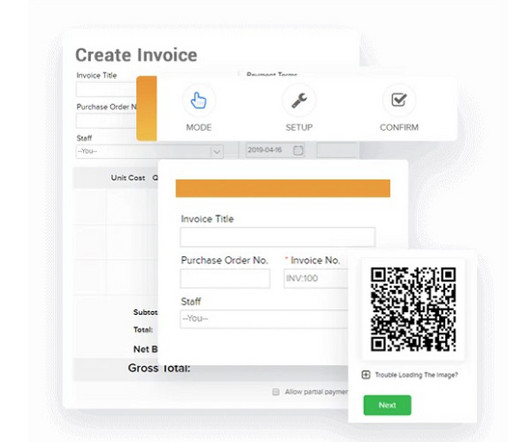

Invoicera

JULY 24, 2023

Do you also belong to the gig economy? If so, you’re likely a freelancer or contractor navigating the unique challenges of this dynamic landscape. One of the most critical, yet often overlooked, aspects of this journey is mastering the art of invoicing. Invoicing can be a game-changer. It is the key to resisting all financial constraints. We know you are a talented professional, willing to walk that extra mile to deliver outstanding results.

CSI Accounting & Payroll

JULY 24, 2023

A majority of established small businesses work with annual accountants, but annual accounting firms offer limited services. They only deal with your finances when the year is over, so they aren’t in touch with your business operations in real time. This means you won't have timely data to help you make quick decisions. There is an alternative to annual accounting, though: monthly accounting.

Speaker: Cheryl J. Muldrew-McMurtry

Distributed finance teams are rewriting how the back-office runs, and attackers are taking notes. Disconnected workflows, process blind spots, and rising cyber threats are more than just growing pains—they’re liabilities. The challenge isn’t just going remote. It’s building resilient systems that protect accuracy, control, and speed across every transaction and touchpoint.

Insightful Accountant

JULY 24, 2023

Tax Practice News' Christine Gervais and Insightful Accountant's Gary DeHart talk practice niches in the latest episode of Accounting Insiders—only on our YouTube Channel.

Plooto

JULY 24, 2023

Treasury management is vital to promoting growth and financial health in your business. It ensures sufficient cash flow for business needs, and tracks debts and investments, all while minimizing risk.

Insightful Accountant

JULY 24, 2023

Tax Practice News' Christine Gervais and Insightful Accountant's Gary DeHart talk practice niches in the latest episode of Accounting Insiders—only on our YouTube Channel.

Nanonets

JULY 24, 2023

Finance reconciliation plays a pivotal role in ensuring the reliability and accuracy of a business's financial records. This essential practice involves comparing transactions and other financial activities with supporting documentation and resolving any discrepancies that may arise. Financial reconciliation is a recurring process that encompasses various sources of financial information within a business.

Advertiser: Paycor

Before you can achieve success, you have to define it. Objectives and Key Results (OKRs) give you the framework to do just that. Paycor’s free guide includes a step-by-step process leaders can use to work toward – and achieve – their loftiest business goals.

Let's personalize your content