Misunderstandings keep families from claiming tax credits

Accounting Today

MAY 20, 2025

Lack of awareness, fear of mistakes and penalties, and the cost of filing are preventing many families from claiming millions of dollars in tax credits.

Accounting Today

MAY 20, 2025

Lack of awareness, fear of mistakes and penalties, and the cost of filing are preventing many families from claiming millions of dollars in tax credits.

Ascend Software blog

MAY 20, 2025

In a space filled with buzzwords like "intelligent automation" and "AI-powered workflows," it's easy to lose sight of what actually makes great software workespecially in enterprise environments with massive invoice volume, strict compliance needs, and cross-departmental complexity.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Accounting Today

MAY 20, 2025

The Financial Reporting Council found EY "demonstrated a complete lack of professional skepticism" and failed "to be alert to conditions that may have indicated possible fraud.

Ace Cloud Hosting

MAY 20, 2025

Cybercrime is no longer a distant threatits a global crisis accelerating at an alarming rate. By 2025, the cost of cybercrime is expected to reach $10.5 trillion annually, effectively making.

Speaker: Joe Wroblewski, Sales Engineer Manager

Automating time-consuming manual tasks can save your firm hundreds of hours–and thousands of dollars. But it can also have longer-lasting benefits, like helping you attract and retain the next generation of CPAs, and we don’t need to tell you how important that is amid the current generational staffing crisis in the tax and accounting profession. You'll want to save your seat for this new webinar with industry expert Joe Wroblewski, where we'll explore how to: Maximize ROI with Cost-Effective Te

Insightful Accountant

MAY 20, 2025

The revenue and billing automation platform for professional services, Ignition, has announced that Tammy Hahn, an award-winning leader in product development and innovation, has joined the Ignition executive team as Senior Vice President of Product.

Accounting Today

MAY 20, 2025

No more paper checks; death and tax debt; the perfect time to onboard software; and other highlights from our favorite tax bloggers.

Financial Ops World brings together the best financial operations content from the widest variety of thought leaders.

Accounting Today

MAY 20, 2025

The bill would levy a 5% tax on remittances for noncitizens and foreign nationals, on top of a roughly 5% to 10% fee already charged on the payments.

Compleatable

MAY 20, 2025

Redefining Procurement with AIpowered Amazon Punch-In Were thrilled to see Amazon Business highlighting the role of AI in modern procurement. As it rightly notes, artificial intelligence is transforming how organizations purchase, manage spend, and drive value. But for us, this isnt just a trend on the horizon, its a reality weve been shaping for years.

Accounting Today

MAY 20, 2025

With the number of extensions, many practitioners are seeing tax season continue through the summer and fall.

Stephanie Peterson

MAY 20, 2025

By Stephanie Peterson, Advanced QuickBooks ProAdvisor | Superior Virtual Bookkeeping LLCIn todays digital world, its easier than ever for someone to start calling themselves a bookkeeper even if they have zero accounting background or real experience. As a result, countless small business owners are hiring the wrong help and ending up with messy books, missed deductions, and major headaches come tax time.

Advertisement

Automation generally supercharges any process and brings its value to the forefront. See how infusing automation such as ART (our month-end close solution), into your close can get you to the next level of closing. We will share a live demo of SkyStem's solution, ART and share the key elements of month-end close automation. Through ART, we'll take a look at: What month-end close automation entails Which process steps can and should be automated Benefits of achieving process automation, and Why i

Accounting Today

MAY 20, 2025

Minnesota approved a bill on Monday night to create additional pathways to CPA licensure, and it awaits the signature of Gov. Tim Walz.

Insightful Accountant

MAY 20, 2025

In this episode, host Gary DeHart speaks with tech visionary and industry veteran Randy Johnston about the critical trends shaping the future of accounting and advisory firms in 2025 and beyond.

Accounting Today

MAY 20, 2025

Accountants can turn the audit playbook into an AI assurance framework that policymakers have been groping for.

Insightful Accountant

MAY 20, 2025

If you want to know what certifications will be required for the 2026 U.S. ProAdvisor Awards, this article is for you.

Advertiser: Paycor

Mid-year performance reviews aren’t just boxes for HR to check. Paycor’s toolkit empowers leaders to: Identify high-potential team members. Boost engagement with meaningful feedback. Support struggling employees. Nurture top talent to drive results. Learn how to ignite employee potential through meaningful feedback. When you nurture top talent, everybody wins.

Accounting Today

MAY 20, 2025

Compliance professionals at Grant Thornton will be making use of the improved CompliAI platform, infused with generative AI to enhance service delivery.

finout

MAY 20, 2025

Understanding cloud spend isn't just about tracking numbersit's about making strategic decisions to maximize the value of every dollar. Key Performance Indicators (KPIs) are essential tools that enable organizations to measure, manage, and optimize cloud costs effectively. This blog explores practical strategies and actionable insights for integrating effective KPIs at each stage of your FinOps maturity, based on insights from industry leaders at Roku and Finout.

Accounting Today

MAY 20, 2025

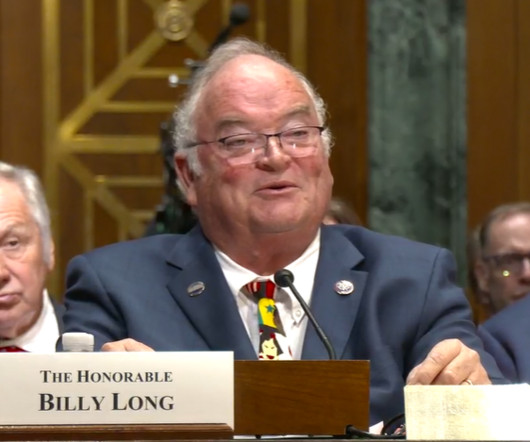

The Senate Finance Committee questioned Trump's nominee about his plans for the beleaguered agency and promotion of dubious tax credits.

finout

MAY 20, 2025

What Is Cloud Budgeting? Cloud budgeting involves planning, tracking, and managing cloud expenditure within an organization to ensure financial control and resource efficiency. It requires accurately forecasting expected usage patterns and costs, monitoring real-time cloud resource spending, and adapting to changes in cloud usage.

Speaker: Victor C. Barnes, CPA, MBA

In the climb from contributor to leader, the rules quietly change. If you’re aiming for the summit, the air gets thinner—and what got you here won’t be enough to get you to the top (a concept first popularized by Marshall Goldsmith in his book What Got You Here Won’t Get You There ). What made you successful early in your finance career—technical accuracy, sharp analysis, flawless execution—won’t be what carries you to the next level.

Accounting Today

MAY 20, 2025

In a private meeting, Trump singled out the lawmakers from New York, New Jersey and California who have rejected the $30,000 deduction limit.

Let's personalize your content