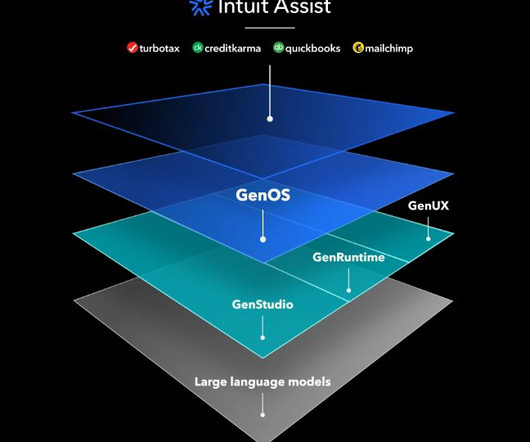

Introducing Intuit Assist

Intuit

SEPTEMBER 6, 2023

Intuit Assist delivers personalized recommendations and does the hard work for you. Today, we introduced Intuit Assist, a new generative AI (GenAI)-powered assistant that will provide personalized, intelligent recommendations to help consumer and small business customers make smart financial decisions with less work and complete confidence, enabling them to put more money in their pockets.

Let's personalize your content