Art of Accounting: No pipeline myth

Accounting Today

JULY 17, 2023

Today's new partners will be tomorrow's leaders, just as yesterday's new partners are today's leaders.

Accounting Today

JULY 17, 2023

Today's new partners will be tomorrow's leaders, just as yesterday's new partners are today's leaders.

Blake Oliver

JULY 17, 2023

Relay now has Savings Accounts! Watch this 2-minute video to learn how to pair Savings Accounts with Auto Transfer Rules to help clients save a little bit every day AND earn interest — all without lifting a finger.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Accounting Today

JULY 17, 2023

Despite the return to the office following the easing of the COVID pandemic, some accountants who work with nonprofit organizations are still working remotely as well.

Insightful Accountant

JULY 17, 2023

In addition to the US, the new QuickBooks Workforce app is available to users in Canada, the UK and Australian. Users now can manage their work, pay and benefits within a single app.

Speaker: Victor C. Barnes, CPA, MBA

In the climb from contributor to leader, the rules quietly change. But if you’re aiming for the summit, the air gets thinner, and what got you here won’t be enough to get you to the top. 🗻 What made you successful early in your finance career—technical accuracy, sharp analysis, flawless execution—won’t be what carries you to the next level. The higher you go, the more your effectiveness depends on how you connect, adapt, and communicate.

Accounting Today

JULY 17, 2023

Small Business Administration loan expert Shannon Hay talks about the changes to the SBA's new SOP around lending, and what they mean for accounting firms and their clients.

Accounting Tools

JULY 17, 2023

Related Courses Bookkeeping Guidebook How to Audit Receivables New Controller Guidebook A bad debt can be written off using either the direct write off method or the provision method. The first approach tends to delay recognition of the bad debt expense. It is necessary to write off a bad debt when the related customer invoice is considered to be uncollectible.

Financial Ops World brings together the best financial operations content from the widest variety of thought leaders.

Accounting Tools

JULY 17, 2023

Related Courses GAAP Guidebook International Accounting GAAP is short for Generally Accepted Accounting Principles. GAAP is a cluster of accounting standards and common industry usage that have been developed over many years. It is used by organizations to properly organize their financial information into accounting records , summarize the accounting records into financial statements , and disclose certain supporting information.

Accounting Today

JULY 17, 2023

The audit fee for the combined group is expected to be less than the sum of the standalone audits, but would still be one of the highest in global banking.

Enterprise Recovery: Accounts Receivable

JULY 17, 2023

If your business is in a situation where goods or services have been provided, but your customer has failed to pay their invoice on time, it's up to your accounts receivable team to follow up. Your A/R department, however, can only do so much to ensure that your business receives the payment it deserves and maintains a healthy cash flow. It's crucial to provide a detailed process for escalating past-due invoices beyond accounts receivable to collections.

Accounting Tools

JULY 17, 2023

Related Courses Accounting for Inventory How to Audit Inventory Inventory Management What is the Cost of Inventory? Inventory cost includes the costs to order and hold inventory , as well as to administer the related paperwork. This cost is examined by management as part of its evaluation of how much inventory to keep on hand. This can result in changes in the order fulfillment rate for customers, as well as variations in the production process flow.

Speaker: Kim Beynon, CPA, CGMA, PMP

The most overlooked, yet most critical, element of transformation is preparing people for change. Automation and AI aren't just technical upgrades, they’re cultural shifts which can challenge identities. That’s why change management isn’t a side project—it’s the foundation. In finance, where precision and process rule, navigating change can feel especially disruptive.

Tipalti

JULY 17, 2023

Discover the ultimate Business Travel Index, a definitive resource providing insights into the world of corporate travel. Stay informed about the latest trends, rankings, and tips for successful business travel.

Insightful Accountant

JULY 17, 2023

In our upcoming webinar, join Tax Titans' Alan Blakeborough as he discusses why succession planning matters for today's solo accountants and small firms. Join us, Wednesday, July 19, at noon (EST). You can register here.

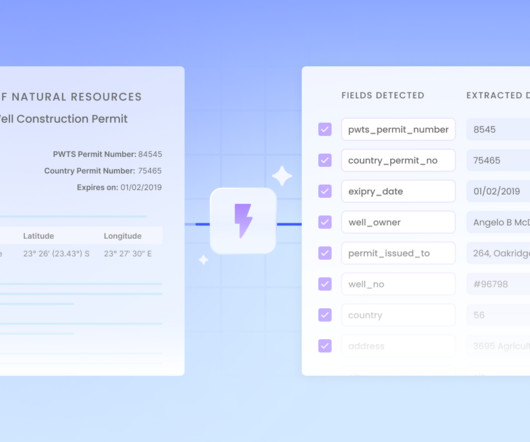

Nanonets

JULY 17, 2023

Artificial intelligence and machine learning have become indispensable tools in today’s fast-paced business world. One of the key issue issues has been the time, cost, and expertise required to automate processes like document automation. This is where Zero Shot Learning (ZSL) comes in. Today, automation is necessary for companies looking to streamline operations, reduce costs, and improve accuracy.

Insightful Accountant

JULY 17, 2023

Learn how to protect yourself and ensure compliance with the mandates of the FTC and IRS when it comes to safeguarding personal information you obtain as part of financial transactions in the course of business.

Speaker: Mark Gilham, FCCA, CPP

Finance used to be the function that counted, now it's the one that’s counted on. 📊 For accounting firms, controllers, and finance leaders, expectations are rising faster than headcount. Businesses want agile forecasts, granular analysis, seamless reporting, and smart automation—often without added resources while demanding uncompromised accuracy and compliance.

CloudZero

JULY 17, 2023

The need to optimize cloud costs is a fact of life for SaaS companies — it’s required to stay competitive. But to optimize effectively, you’ll first need to find a way to accurately allocate all costs to the resources, teams, products, features, and customers that generated them.

CapActix

JULY 17, 2023

The practice of spending money on an in-house team of accounting experts is outdated. Now, businesses understand the worth of outsourcing bookkeeping services as it gives financial and mental relief to business owners. This has uplifted the market of CPAs and somewhere, it has also increased the workload on businesses offering CPA services in the USA and worldwide.

Accounting Tools

JULY 17, 2023

Related Courses Corporate Cash Management Corporate Finance Treasurer's Guidebook What is a Mortgage? A mortgage is a loan that is used to pay for a portion of the price of real estate. The loan typically requires a fixed schedule of repayments. The underlying real estate is used as collateral on the loan. If the borrower does not make loan payments on a timely basis, the lender can seize and sell the property, using the proceeds to pay off the remaining loan balance.

Accounting Tools

JULY 17, 2023

Related Courses How to Audit Revenue Revenue Recognition What is the Cost Recovery Method? Under the cost recovery method, a business does not recognize any income related to a sale transaction until the cost element of the sale has been paid in cash by the customer. Once the cash payments have recovered the seller's costs, all remaining cash receipts (if any) are recorded in income as received.

Advertiser: Paycor

Great leadership development is the key to sustainable business growth. Are you ready to design an effective program? HR can use Paycor’s framework to: Set achievable goals. Align employee and company needs. Support different learning styles. Empower the next generation of leaders. Invest in your company’s future with a strong leadership development program.

Accounting Tools

JULY 17, 2023

Related Courses Business Combinations and Consolidations What are Group Financial Statements? Group financial statements are financial statements that include the financial information for more than one component. A component is an entity or business activity for which financial information is separately prepared, and which is included in the group financial statements.

Accounting Tools

JULY 17, 2023

What is a Markdown Cancellation? A markdown cancellation occurs when a previously announced markdown is terminated or reduced in scope. This can mean that an existing markdown now applies to fewer products or services.

Accounting Tools

JULY 17, 2023

Related Courses Budgeting Capital Budgeting What is the Selling and Administrative Expense Budget? The selling and administrative expense budget is comprised of the budgets of all non-manufacturing departments, such as the sales, marketing, accounting, engineering, and facilities departments. In aggregate, this budget can rival the size of the production budget , and so is worthy of considerable attention.

Accounting Tools

JULY 17, 2023

Related Courses Corporate Finance Treasurer's Guidebook What is the Market Interest Rate? The market interest rate is the prevailing interest rate offered on cash deposits. This rate is driven by multiple factors, including central bank interest rates, the flow of funds into and out of a country, the duration of deposits, and the size of deposits.

Speaker: Andrew Skoog, Founder of MachinistX & President of Hexis Representatives

Manufacturing is evolving, and the right technology can empower—not replace—your workforce. Smart automation and AI-driven software are revolutionizing decision-making, optimizing processes, and improving efficiency. But how do you implement these tools with confidence and ensure they complement human expertise rather than override it? Join industry expert Andrew Skoog as he explores how manufacturers can leverage automation to enhance operations, streamline workflows, and make smarter, data-dri

Accounting Tools

JULY 17, 2023

Related Courses Operations Management What is a Manufacturing Cell? A manufacturing cell is a grouping of machines on the production floor. This grouping is designed to promote high levels of product quality by having a few people handle several processing steps within a compressed area. This arrangement can save a substantial amount of floor space, and minimizes the transport of goods within a facility.

Accounting Tools

JULY 17, 2023

Related Courses Human Resources Guidebook Optimal Accounting for Payroll Payroll Management What is a Shift Differential? A shift differential is an extra boost in pay given to employees when they work on late shifts. For example, a company increases the pay of anyone working on its graveyard shift by 10%, or an emergency care clinic pays its doctors an extra $300 to work the second shift.

Accounting Tools

JULY 17, 2023

Related Courses Essentials of Business Math What is a Moving Average? A moving average is the average price of something, which is constantly adjusted over time to reflect the addition of new data. For example, someone might want to track the moving average of a company's stock on the open market, and so develops a 90-day moving average; this average is calculated based on the ending stock price for just the past 90 days.

Accounting Tools

JULY 17, 2023

Related Courses Mergers and Acquisitions New Manager Guidebook What is a Management Audit? A management audit is an assessment of the capabilities of the management team of an organization. The analysis is intended to evaluate how well this group is able to achieve the objectives of the business. The audit may address strategic and tactical planning, decision making, the financial and operational results of the business, and risk management.

Speaker: Cheryl J. Muldrew-McMurtry

Distributed finance teams are rewriting how the back-office runs, and attackers are taking notes. Disconnected workflows, process blind spots, and rising cyber threats are more than just growing pains—they’re liabilities. The challenge isn’t just going remote. It’s building resilient systems that protect accuracy, control, and speed across every transaction and touchpoint.

Accounting Tools

JULY 17, 2023

Related Courses Constraint Management Inventory Management Purchasing Guidebook What is Materials Management? Materials management is a cluster of processes used to plan for and control the flow of inventory into, through, and out of a business. These processes are concerned with identifying the need for inventory, procuring and storing it, scheduling the inventory into production, and warehousing and distributing the finished product.

Accounting Tools

JULY 17, 2023

Related Courses Accounting for Mining Fixed Asset Accounting Oil and Gas Accounting What is the Depletion Method? Depletion is a periodic charge to expense for the use of natural resources. Thus, it is used in situations where a company has recorded an asset for such items as oil reserves, coal deposits, or gravel pits. The calculation of depletion involves these steps: Compute a depletion base Compute a unit depletion rate Charge depletion based on units of usage The resulting net carrying amou

Let's personalize your content