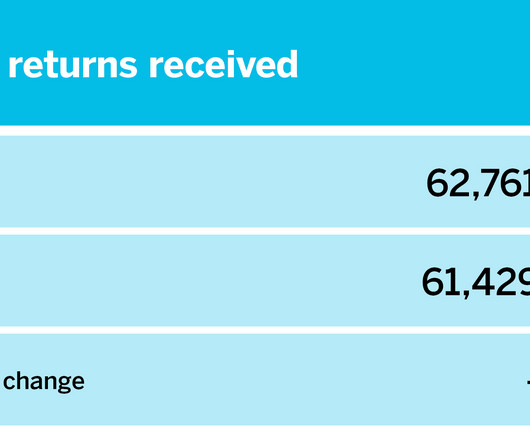

Tax season 2025 so far: By the numbers

Accounting Today

MARCH 24, 2025

With tax season underway, here are the filing statistics, updated weekly.

Accounting Today

MARCH 24, 2025

With tax season underway, here are the filing statistics, updated weekly.

Compleatable

MARCH 24, 2025

The Department for Educations recent release of the National Insurance Contributions (NICs) grant methodology for April 2025 to March 2026 highlights a critical issue for school and trust leaders: the growing complexity of cash flow management in the face of rising employment costs. While the grant itself is welcome support in principle, intended to help schools meet increased NICs liabilities from April 2025, the reality is that the money wont land in school accounts until October.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Accounting Today

MARCH 24, 2025

The interim final rule removes the requirement under the Corporate Transparency Act for U.S. companies and people to report beneficial ownership information.

Fit Small Business

MARCH 24, 2025

To learn how to add a signature in Outlook, first check if you have Outlooks new or classic version because the process differs slightly for each. The new Outlook was just released in 2024 and runs on Windows 11. Meanwhile, any version before that is Outlook classic. Adding a signature in Outlooks new version involves. The post How to Add a Signature in Outlook (New & Classic) appeared first on Fit Small Business.

Advertiser: Paycor

Mid-year performance reviews aren’t just boxes for HR to check. Paycor’s toolkit empowers leaders to: Identify high-potential team members. Boost engagement with meaningful feedback. Support struggling employees. Nurture top talent to drive results. Learn how to ignite employee potential through meaningful feedback. When you nurture top talent, everybody wins.

Accounting Today

MARCH 24, 2025

Tax season usually is the most stressful period of the year for accountants. Staying calm will help you, your clients and staff.

Gaviti

MARCH 24, 2025

In today’s competitive landscape, B2B customer retention has become a critical focus for businesses aiming for sustainable growth. Companies often overlook the roles that finance teams play in the customer relationship equation. When customers have a good relationship with the people who serve them of which finance is one of them, it fosters customer loyalty and minimizes churn.

Financial Ops World brings together the best financial operations content from the widest variety of thought leaders.

Counto

MARCH 24, 2025

Regulatory Updates On Nominee Directors: What SMEs Must Know In 2025 In Singapores effort to strengthen corporate governance and transparency, regulatory changes affecting nominee directors came into effect in 2024 and are fully enforced in 2025. These updates impact how small and medium-sized enterprises (SMEs) appoint nominee directors and manage corporate compliance.

Accounting Today

MARCH 24, 2025

All too often, what accountants are selling are services that clients have to endure, says Joe Woodard, not the sort of thing that they really value.

Counto

MARCH 24, 2025

Provisional Tax Planning: How Small Business Owners Can Avoid Year-End Surprises Running a small business in Singapore means wearing many hats from managing daily operations to planning for growth. Amidst it all, tax obligations can sometimes fall to the bottom of the priority list, only to return at year-end in the form of an unexpected tax bill. The key to avoiding this?

Accounting Today

MARCH 24, 2025

GASB released a study on utilization of GAAP among state and local governments and found all the states are using GAAP, but only about three-quarters of localities are.

Speaker: Victor C. Barnes, CPA, MBA

In the climb from contributor to leader, the rules quietly change. But if you’re aiming for the summit, the air gets thinner, and what got you here won’t be enough to get you to the top. 🗻 What made you successful early in your finance career—technical accuracy, sharp analysis, flawless execution—won’t be what carries you to the next level. The higher you go, the more your effectiveness depends on how you connect, adapt, and communicate.

Counto

MARCH 24, 2025

Why Startups Need a Professional Company Secretary from Day One Starting a business in Singapore is exciting but in the rush to launch, many entrepreneurs overlook one of the most important compliance roles: the company secretary. While it may seem like an administrative formality, engaging a professional company secretary from day one can save you time, prevent legal issues, and keep your business running smoothly.

Accounting Today

MARCH 24, 2025

ERP solutions provider Acumatica announced the rollout of its R1 release, sporting enhanced AI features as well as more industry-specific solutions.

Counto

MARCH 24, 2025

How to Find Affordable Accounting Services for SMEs in Singapore For many small and medium-sized enterprises (SMEs) in Singapore, managing finances effectively is essential but hiring a full-time accountant or engaging a large firm may feel out of reach. The good news? There are cost-effective accounting solutions tailored to SMEs that balance affordability with compliance and support.

Accounting Today

MARCH 24, 2025

When small CPA shops suddenly end, clients are left to scramble for a replacement and any enterprise value that the owner may have had withers away.

Speaker: Kim Beynon, CPA, CGMA, PMP

The most overlooked, yet most critical, element of transformation is preparing people for change. Automation and AI aren't just technical upgrades, they’re cultural shifts which can challenge identities. That’s why change management isn’t a side project—it’s the foundation. In finance, where precision and process rule, navigating change can feel especially disruptive.

Counto

MARCH 24, 2025

Is Your Business Ready For GST Registration Key Indicators To Watch As your business grows, youll eventually ask the question: Do I need to register for GST? In Singapore, Goods and Services Tax (GST) registration isnt just about crossing a revenue threshold its about knowing when, and how, to comply with IRAS requirements. Heres how to know if your business is ready or required to register for GST, and the key indicators you should be tracking now.

Fit Small Business

MARCH 24, 2025

Long-term business loans can provide you with the opportunity for longer repayment periods, helping maintain cash flow and allowing for overall business growth. The best long-term business loans will have a wide range of repayment terms, favorable interest rates, and flexible qualification requirements. Ive reviewed the best options across various lenders offering long-term financing.

Counto

MARCH 24, 2025

Accounting For Project-Based Businesses: Tracking Profitability By Job If your business delivers services on a project or job basis such as construction, design, consulting, or IT tracking overall revenue isnt enough. To truly understand your financial performance, you need to know which projects are profitable and which ones are not. Thats where job-level accounting comes in.

Invoicera

MARCH 24, 2025

We are excited to announce the newest features added to Invoicera that will transform how you customize invoices, do recurring and time-based billing, and manage expenses. These additions are created to prioritize simplicity, making your invoice management more accurate and time-saving. Lets look at whats new and how it can optimize your invoicing process.

Speaker: Mark Gilham, FCCA, CPP

Finance used to be the function that counted, now it's the one that’s counted on. 📊 For accounting firms, controllers, and finance leaders, expectations are rising faster than headcount. Businesses want agile forecasts, granular analysis, seamless reporting, and smart automation—often without added resources while demanding uncompromised accuracy and compliance.

Counto

MARCH 24, 2025

Cash Vs. Accrual Accounting: Which Method Suits Your Small Business? One of the first financial decisions a small business owner must make is how to recognise income and expenses in other words, choosing between cash basis and accrual accounting. Each method offers a different view of your financial position and has implications for tax reporting, cash flow management, and compliance.

Insightful Accountant

MARCH 24, 2025

The IRS's recent return-to-office mandate has created significant operational disruptions that may impact tax practitioners' interactions with the agency. Understanding these changes can help tax practice managers better navigate.

Counto

MARCH 24, 2025

Leave And Claims Management: The Overlooked Role Of Payroll Services When you think about payroll, its easy to focus on salaries, CPF contributions, and payslips. But for small businesses, especially in Singapore, leave and claims management is just as critical and it often falls under the radar. The truth is, that payroll services play a key role in streamlining leave and claims processes, ensuring compliance, and reducing admin headaches.

Insightful Accountant

MARCH 24, 2025

If you haven't voted for the 2025 ProAdvisor Awards now is the time to cast your ballot for this year's candidates for both U.S. and International award candidates. Voting ends April 1, so don't miss this opportunity to vote for the awards.

Advertiser: Paycor

Great leadership development is the key to sustainable business growth. Are you ready to design an effective program? HR can use Paycor’s framework to: Set achievable goals. Align employee and company needs. Support different learning styles. Empower the next generation of leaders. Invest in your company’s future with a strong leadership development program.

Counto

MARCH 24, 2025

How Accounting Services Simplify Estimated Chargeable Income (ECI) Filing For many business owners, Estimated Chargeable Income (ECI) filing can feel like just another item on an already long to-do list. But in Singapore, this isnt something to overlook. Filing your ECI accurately and on time is a key compliance requirement set by IRAS and getting it wrong can lead to unnecessary penalties or tax issues.

Insightful Accountant

MARCH 24, 2025

While this is our third trip (of the imagination) for this year, but the first of my 'battlefield' explorations. We will spend the night in Washington, DC and then take a day-long tour of Gettysburg, followed by a tour of Manassas Battlefield Park.

Counto

MARCH 24, 2025

Choosing The Right Reporting Frequency: Monthly Vs. Quarterly Vs. Yearly When it comes to financial reports, timing matters. How often you review your numbers can influence everything from day-to-day decisions to long-term planning. But whats the right reporting frequency for your business monthly, quarterly, or yearly? The answer depends on your business size, complexity, goals, and regulatory obligations.

Ace Cloud Hosting

MARCH 24, 2025

Tax and accounting firms handle a wealth of sensitive client data, making compliance with privacy laws a legal necessity and a critical aspect of maintaining trust and reputation. If youre.

Speaker: Andrew Skoog, Founder of MachinistX & President of Hexis Representatives

Manufacturing is evolving, and the right technology can empower—not replace—your workforce. Smart automation and AI-driven software are revolutionizing decision-making, optimizing processes, and improving efficiency. But how do you implement these tools with confidence and ensure they complement human expertise rather than override it? Join industry expert Andrew Skoog as he explores how manufacturers can leverage automation to enhance operations, streamline workflows, and make smarter, data-dri

Counto

MARCH 24, 2025

Visualising Business Performance: The Power of Dashboards in Accounting When youre running a business, the numbers matter but finding time to interpret rows of data or lengthy reports isnt always realistic. Thats where accounting dashboards come in. They offer real-time visual insights that help you track performance, make decisions, and stay in control without needing to be a financial expert.

Black Ink Tax & Accounting

MARCH 24, 2025

Table of Contents Self-Employed Housekeeper Tax Return: The Ultimate Guide If you are a self-employed housekeeper, you have the flexibility […] The post Form 3922 on Tax Return appeared first on bitaccounting.

Accounting Today

MARCH 24, 2025

The Internal Revenue Service is reportedly getting close to an agreement to share information such as taxpayers' addresses with ICE officials upon request.

Counto

MARCH 24, 2025

Singapores Move to a Single Identification Number: Key Impacts for SMEs and Businesses Singapore is known for efficient, forward-thinking governance and one area now under review is the national identification system. As discussions about consolidating NRIC, FIN, and TIN into a single identification number gain traction, businesses should understand the potential implications.

Speaker: Cheryl J. Muldrew-McMurtry

Distributed finance teams are rewriting how the back-office runs, and attackers are taking notes. Disconnected workflows, process blind spots, and rising cyber threats are more than just growing pains—they’re liabilities. The challenge isn’t just going remote. It’s building resilient systems that protect accuracy, control, and speed across every transaction and touchpoint.

Let's personalize your content