FASB nixes potential projects on future agenda

Accounting Today

DECEMBER 28, 2023

The Financial Accounting Standards Board has decided not to add several projects to its technical agenda, including one on commodities, despite requests.

Accounting Today

DECEMBER 28, 2023

The Financial Accounting Standards Board has decided not to add several projects to its technical agenda, including one on commodities, despite requests.

Accounting Department

DECEMBER 28, 2023

Each year, our team gears up to attend events all over the United States that AccountingDepartment.com proudly sponsors. As a proud supporter of Vistage International, Entrepreneurs’ Org, EOS Worldwide, CEO Coaching International, Genius Network, Small Giants Summit, HubZone, Women Presidents’ Organization, and B2B CFO®, our team gets to experience many great events, meet many amazing people, and see our clients from all over.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Accounting Today

DECEMBER 28, 2023

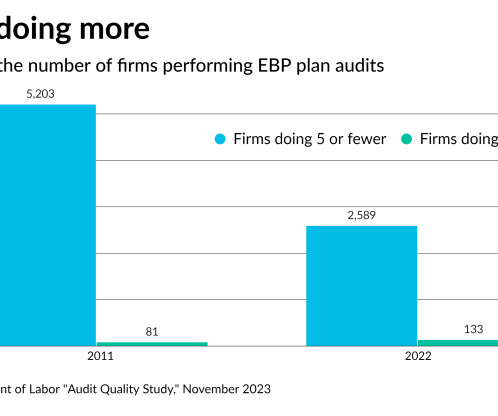

A DOL study uncovered problems in almost a third of employee benefit plan audits — but that's actually an improvement.

Accounting Tools

DECEMBER 28, 2023

What is the Long-Term Debt to Equity Ratio? The long-term debt to equity ratio is a method used to determine the leverage that a business has taken on. When the ratio is comparatively high, it implies that a business is at greater risk of bankruptcy , since it may not be able to pay for the interest expense on the debt if its cash flows decline. This is more of a problem in periods when interest rates are increasing, or when the cash flows of a business are subject to a large amount of variation

Speaker: Nancy Wu, Head of Sales and Customer Success at SkyStem

Join us for an enlightening webinar as we delve into the transformative realm of modern accounting practices. In today's digital age, the convergence of outsourcing and automation has revolutionized how businesses manage their financial operations. In this webinar we will explore the synergistic potential of these two strategies to streamline processes, enhance accuracy, save cost and drive strategic decision-making.

Accounting Today

DECEMBER 28, 2023

Good-bye, sailor; concrete evidence; lack of protection; and other highlights of recent tax cases.

Accounting Tools

DECEMBER 28, 2023

What is a Trial Balance? A trial balance is an accounting report that states the ending balance in each general ledger account. This means that it states the ending balance for each asset, liability, equity, revenue, gain, and loss account in an accounting system. This report is printed as part of the period-ending closing process, as stated in the closing procedure.

Financial Ops World brings together the best financial operations content from the widest variety of thought leaders.

Accounting Tools

DECEMBER 28, 2023

What are Operating Activities? Operating activities are those functions of a business that are required for it to provide goods and services to its customers. These constitute its core operating activities. Operating activities is also a classification of cash flows within the statement of cash flows. Items classified within this area are an entity’s primary revenue -producing activity, so cash flows are generally associated with revenues and expenses.

Accounting Today

DECEMBER 28, 2023

The Treasury Department and the Internal Revenue Service issued guidance for producers of clean electricity and other forms of renewable energy if they begin constructing projects next year that fall short of the necessary requirements for domestically manufactured components.

Insightful Accountant

DECEMBER 28, 2023

We sat down with Tailor to get his thoughts on being a Top 25 Up-N-Coming ProAdvisor, his journey, path to success, and constant evolution to give their clients the best value.

Accounting Today

DECEMBER 28, 2023

The arguments in Moore v. U.S. carry major potential implications, but these 14 excerpts suggest SCOTUS will deliver a less sweeping decision next year.

Speaker: Robbie Bhathal, Founder & CEO, and Matthew Acalin, Head of Credit Intelligence

In today's volatile financial environment, how confident are you in your company’s financial forecasting? To get the most accurate cash predictions that will lead to long-term financial survival, real-time data is critical. Innovative cash management strategies can lead to better credit opportunities, more sustainable growth, and long-term financial prosperity.

Outsourced Bookeeping

DECEMBER 28, 2023

Why Choose Xero Could Be The Best Choice for your Accounting and Bookkeeping Needs Searching for the best bookkeeping and accounting solution? Presenting Xero, a financial management industry game-changer. Xero stands out as a leader in helping businesses manage complex financial environments because it offers an all-inclusive collection of tools that streamline accounting procedures.

Accounting Today

DECEMBER 28, 2023

Firms of any size can inspire a world-changing culture that starts from the inside of the organization and expands into other spheres of influence.

Analytix Finance & Accounting

DECEMBER 28, 2023

For many small businesses, the year-end accounting process can feel overwhelming. From tax preparation to budgeting and planning for the next year to ensuring you’re on top of technology and software updates, it can feel like there’s a lot to do within a short time. But there are many benefits to getting everything in order before the end of the financial year.

Accounting Today

DECEMBER 28, 2023

The company said the city used the presence of its Cruise self-driving unit to tie its tax bill to a portion of its global revenue.

Advertisement

All accounting teams know what it is like to dread the inevitable month-end scaries. If there was a way to feel less burdened and maybe even a little enthusiastic to work on your month-end close and reconciliation process, would you do it? No, don't answer that, of course you would! Automate your month-end close process by up to 40% with SkyStem's ART and see how much more alive you feel!

Insightful Accountant

DECEMBER 28, 2023

StanfordTax is a "tax 'information' collector" app. It saves both you and your clients time using the power of AI.

Accounting Today

DECEMBER 28, 2023

The profession's leaders discuss how they are influencing their potential successors.

finout

DECEMBER 28, 2023

?Explore Datadog's magic: Learn what is Datadog, what does Datadog do, and what Datadog is used for in modern businesses. ?

Accounting Today

DECEMBER 28, 2023

As part of this year's Top 100 Most Influential People survey, Accounting Today asked, "Do you currently mentor someone? What do you get out of it?

Advertisement

The status quo for AP in small and mid-market companies is broken. It consists of messy tech stacks of siloed solutions that give rise to manual work, a lack of control, wasted spend, and unnecessary risks. The benefits of shifting to spend management are tangible, measurable, and are felt across the whole organization. Spend management is a different way of thinking and an innovation whose time has come.

Tipalti

DECEMBER 28, 2023

Discover the versatility of ACH APIs and their real-world applications. Learn how this powerful technology simplifies financial transactions and revolutionizes online payments.

Accounting Today

DECEMBER 28, 2023

Honkamp, a Regional Leader based in Dubuque, Iowa, merged in Schowalter & Jabouri, one of the 20 largest CPA firms in the St. Louis metro area, effective Dec. 2, 2023.

Accounting Tools

DECEMBER 28, 2023

What is a Paycheck? A paycheck is a check issued by an employer to its employees, to compensate them for the work they have performed for the organization. A paycheck contains the net amount of salary or wages paid to an employee. A pay stub is normally attached to a paycheck, detailing an employee’s gross pay , itemized deductions, and net pay. Paychecks may be replaced by electronic payments, such as direct deposit , that send the pay amount directly into an employee’s bank account.

Accounting Today

DECEMBER 28, 2023

Through international cooperation and greater transparency, the OECD's Inclusive Framework suggests countries can develop more effective rules to minimize tax avoidance.

Speaker: Carolina Aponte - Owner and CEO, Caja Holdings LLC

In today's rapidly changing business environment, building a resilient balance sheet is crucial to the survival of any business. A resilient balance sheet allows a company to withstand financial shocks and adapt to changing market conditions. To achieve this, companies need to focus on key strategies such as maintaining adequate liquidity, managing debt levels, diversifying revenue streams, and prioritizing profitability over growth.

Accounting Tools

DECEMBER 28, 2023

What is Indirect Labor? Indirect labor is the cost of any labor that supports the production process, but which is not directly involved in the active conversion of materials into finished products. Depending on the complexity of an organization’s production and materials sourcing operations, indirect labor can be greater than the direct labor incurred in its production activities.

Accounting Today

DECEMBER 28, 2023

There is a shift among successful accounting firms, from an individual book of business model to the cultivation of revenue segment leaders.

Accounting Tools

DECEMBER 28, 2023

What is a Trend Line? A trend line is a series of plotted data points that indicate a direction. The trend line may be extended to indicate a future direction by using a moving average calculation, exponential smoothing, or some similar technique. Trend line analysis is useful for budgeting and forecasting, and is commonly used in technical analysis.

Tipalti

DECEMBER 28, 2023

Ready to maximize business efficiency? Compare top Ramp alternatives to see which provides the most seamless AP automation and expense management automation solutions.

Speaker: Wayne Spivak, President and CFO of SBA * Consulting Ltd., Industry Writer, Public Speaker

If you’re lost in the world of spend management needs and your GAP analysis is lacking perspective on the future state of your business performance, listen up! With the advancement of technology, the implementation of spend management best practices and concrete GAP analyses is more streamlined and accessible than ever before. And while this may sound like great news for you and your clients, it won’t be worthwhile unless you have the latest techniques to back up your ambitions!

Accounting Tools

DECEMBER 28, 2023

What is Overburden? Overburden is the rock or soil overlying a mineral deposit. The removal of overburden can occur during the development and production phases of a mine. It is removed when a mining company intends to access the mineral deposit from the surface. It can eventually be used to cover over (restore) a decommissioned mining site. Accounting for Overburden Stripping costs are incurred when removing overburden in order to obtain access to a commercially-producible mineral deposit.

Tipalti

DECEMBER 28, 2023

Ramp and BILL (formerly Bill.com) offer invoice management and payment solutions–but with different approaches. Which solution fits your business needs?

Accounting Tools

DECEMBER 28, 2023

What is Historical Cost? Historical cost is the original cost of an asset , as recorded in an entity's accounting records. Many of the transactions recorded in an organization's accounting records are stated at their historical cost. This concept is clarified by the cost principle , which states that you should only record an asset, liability , or equity investment at its original acquisition cost.

NACM

DECEMBER 28, 2023

In the final Extra Credit episode of 2023, we reflect on the trends of the Credit Managers' Index (CMI). The CMI points to a considerable decline in credit conditions that are leading indicators of economic activity.Complete the CMI every month for the next 12 months and automatically be entered into a drawing to win a gift card worth between $100-.

Advertisement

Developing a consistent month-end close doesn’t need to be a mystery. We’re sharing our top 10 secrets (plus one bonus!) for streamlining your close.

Let's personalize your content