QuickBooks Desktop 2024 – Enhanced Item Categorization

Insightful Accountant

OCTOBER 8, 2023

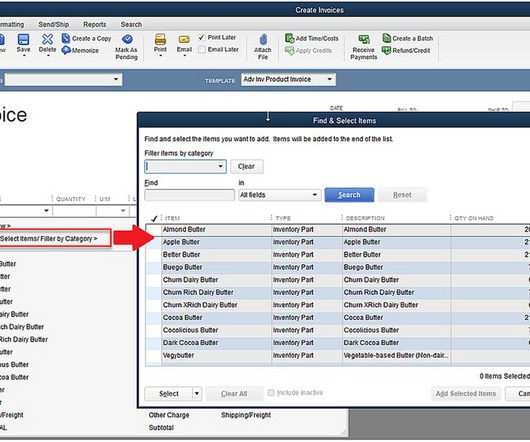

Murph reviews the enhanced functionality of Item Categories found in QuickBooks Enterprise v24.

Insightful Accountant

OCTOBER 8, 2023

Murph reviews the enhanced functionality of Item Categories found in QuickBooks Enterprise v24.

Accounting Tools

OCTOBER 8, 2023

Related Courses Accounting Information Systems Bookkeeping Guidebook New Controller Guidebook Accounting software is used to collect information about and report on the financial viability of a business. This software is critical to the proper administration of an organization. Before deciding upon which software package to use, it is important to understand the different types of accounting software, and under what circumstances each one should be used.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

IMA's Count Me

OCTOBER 8, 2023

Looking for expert advice on fractional leadership? Look no further! Join host Adam Larson and guest Ben Wolf as they dive into the world of fractional executives. Ben is the founder and CEO for Wolf's Edge Integrators , a premier fractional COO organization. From fractional CFOs and CMOs to COOs and beyond, Ben will share his insights and experiences on how to hire, manage, and maximize the impact of fractional leaders.

Accounting Tools

OCTOBER 8, 2023

Related Courses Budgeting Capital Budgeting Financial Forecasting and Modeling What is Budgetary Planning? Budgetary planning is the process of constructing a budget and then utilizing it to control the operations of a business. The purpose of budgetary planning is to mitigate the risk that an organization's financial results will be worse than expected.

Speaker: Victor C. Barnes, CPA, MBA

In the climb from contributor to leader, the rules quietly change. But if you’re aiming for the summit, the air gets thinner, and what got you here won’t be enough to get you to the top. 🗻 What made you successful early in your finance career—technical accuracy, sharp analysis, flawless execution—won’t be what carries you to the next level. The higher you go, the more your effectiveness depends on how you connect, adapt, and communicate.

NextProcess

OCTOBER 8, 2023

Every company needs procurement. Being able to reliably source needed supplies (everything from printer paper to essential parts) is vital to keeping a business running smoothly. In many companies, though, procurement is a process that’s challenging to manage efficiently. As of 2017, only 6% of surveyed companies reported total visibility into their supply chains ( GEODIS, cited by Finances Online ).

Accounting Tools

OCTOBER 8, 2023

Related Courses Corporate Cash Management Corporate Finance Treasurer's Guidebook What is the Assignment of Accounts Receivable? Under an assignment of accounts receivable arrangement, a lender pays a borrower in exchange for the borrower assigning certain of its receivable accounts to the lender. If the borrower does not repay the loan , the lender has the right to collect the assigned receivables.

Financial Ops World brings together the best financial operations content from the widest variety of thought leaders.

Accounting Tools

OCTOBER 8, 2023

Related Courses Auditing Nonprofit Entities Nonprofit Accounting What are the Key Financial Statements for a Nonprofit? A nonprofit entity issues a somewhat different set of financial statements than the statements produced by a for-profit entity. One of the statements is entirely unique to nonprofits. The financial statements issued by a nonprofit are noted below.

Insightful Accountant

OCTOBER 8, 2023

The partnership will expand The Bonadio Group’s presence in the Dallas–Fort Worth metroplex.

Accounting Tools

OCTOBER 8, 2023

Related Courses Accounting for Inventory Cost Accounting Fundamentals The Interpretation of Financial Statements Certain cost accounting formulas should be monitored on a regular basis in order to spot spikes or drops in the performance of an organization. These issues can then be investigated to see if remedial action should be taken, with the intent of enhancing profits.

Insightful Accountant

OCTOBER 8, 2023

Our 'Future Forward 2023 Rewind' continues with Will Hill, who provides a breakdown on how technology provides a wealth of opportunities and creates an abundance of distractions.

Speaker: Kim Beynon, CPA, CGMA, PMP

The most overlooked, yet most critical, element of transformation is preparing people for change. Automation and AI aren't just technical upgrades, they’re cultural shifts which can challenge identities. That’s why change management isn’t a side project—it’s the foundation. In finance, where precision and process rule, navigating change can feel especially disruptive.

Accounting Tools

OCTOBER 8, 2023

Related Courses Fraud Examination Fraud Schemes How to Audit for Fraud What is Fraud? Fraud is a false representation of the facts, resulting in the object of the fraud receiving an injury by acting upon the misrepresented facts. Fraud results in a person giving up something of value or giving up a legal right. It is proven in court by showing that the actions of a person committing fraud involved the following elements: A false statement of a material fact; Knowledge that the statement was untr

Invoicera

OCTOBER 8, 2023

Are you tired of generating manual invoices or following up with clients to get paid on time? If yes, you are wasting your energy, time, and effort. You can ease the job of creating invoices and can do work of many hours in minutes. In today’s fast-paced world, where time is of the essence, you must adopt an automated system for invoicing. It will help maximize efficiency, and boost your business grow.

Accounting Tools

OCTOBER 8, 2023

Related Courses Bookkeeper Education Bundle Bookkeeping Guidebook A bookkeeper records the accounting transactions for a smaller business and issues financial statements to the owners. This is one of the higher-paying positions available to a person without a college degree, making it one of the better career opportunities. To become a bookkeeper, a person should concentrate on certain key skill sets while in high school, and expand upon them over the following years.

Accounting Tools

OCTOBER 8, 2023

Related Courses Inventory Management Purchasing Guidebook What are Ordering Costs? Ordering costs are the expenses incurred to create and process an order to a supplier. These costs are included in the determination of the economic order quantity for an inventory item. Examples of ordering costs are as follows: Cost to prepare a purchase requisition Cost to prepare a purchase order Cost of the labor required to inspect goods when they are received Cost to put away goods once they have been recei

Speaker: Mark Gilham, FCCA, CPP

Finance used to be the function that counted, now it's the one that’s counted on. 📊 For accounting firms, controllers, and finance leaders, expectations are rising faster than headcount. Businesses want agile forecasts, granular analysis, seamless reporting, and smart automation—often without added resources while demanding uncompromised accuracy and compliance.

Accounting Tools

OCTOBER 8, 2023

Related Courses GAAP Guidebook International Accounting What is the GAAP Hierarchy? The GAAP hierarchy defines the level of authority of different accounting pronouncements. When researching an accounting issue, you should first look for relevant advice at the top of the GAAP hierarchy. If there is no relevant information at the top of the hierarchy, then work down through the various levels of the hierarchy until you find the relevant pronouncement.

Accounting Tools

OCTOBER 8, 2023

Related Courses Activity-Based Costing Cost Accounting Fundamentals What is Meant by Overabsorbed? The overabsorbed concept applies to factory overhead costs. These costs are not directly associated with the production of specific goods, so they must be allocated to goods instead, using a standard overhead rate. This rate is typically calculated at the beginning of a firm’s fiscal year , based on the expected amount of factory overhead costs that will be incurred and the expected number of units

Accounting Tools

OCTOBER 8, 2023

Related Courses Business Ratios Guidebook Financial Analysis The Interpretation of Financial Statements What is Horizontal Analysis? Horizontal analysis is the comparison of historical financial information over a series of reporting periods. It may also apply to the ratios derived from this information. The analysis is most commonly a simple grouping of information that is sorted by period, but the numbers in each succeeding period can also be expressed as a percentage of the amount in the base

Accounting Tools

OCTOBER 8, 2023

Related Courses Working Capital Management What is Working Capital? Working capital is the amount of an entity's current assets minus its current liabilities. This represents the amount of assets that can be liquidated in the near future to pay off a firm’s more pressing obligations. How to Use Working Capital Analysis Working capital analysis is used to determine the liquidity and sufficiency of current assets in comparison to current liabilities.

Advertiser: Paycor

Great leadership development is the key to sustainable business growth. Are you ready to design an effective program? HR can use Paycor’s framework to: Set achievable goals. Align employee and company needs. Support different learning styles. Empower the next generation of leaders. Invest in your company’s future with a strong leadership development program.

Accounting Tools

OCTOBER 8, 2023

Related Courses Bookkeeping Guidebook Cost Accounting Fundamentals What are Nonmanufacturing Overhead Costs? Nonmanufacturing overhead costs are expenditures not associated with product costs. Since they are not associated with products, these costs are not allocated to products in the determination of the cost of ending inventory or the cost of goods sold.

Accounting Tools

OCTOBER 8, 2023

Related Courses Cost Accounting Fundamentals Operations Management What is a Job Cost Record? A job cost record is used to aggregate the costs of direct materials , direct labor , and the overhead to be applied to a specific job. As such, it is a source document for a job costing system, in which costs are accumulated for batches of units. The materials listed on the record are extracted from material requisition forms, while the hours listed on it are taken from employee and contractor timeshee

Accounting Tools

OCTOBER 8, 2023

Related Courses Excel Formulas and Functions Financial Analysis Introduction to Excel What is the Effective Interest Rate? The effective interest rate is that rate of interest actually earned on an investment or loan over the course of a year, incorporating the effects of compounding. Thus, an investment that has a stated (nominal) interest rate of 5% may actually have a higher effective interest rate, once the impact of compounding is added to the calculation of interest.

Accounting Tools

OCTOBER 8, 2023

Related Courses Cost Accounting Fundamentals Cost Management Guidebook Types of Overhead Variances Overhead variances arise when the actual overhead costs incurred differ from the expected amounts. Managers want to understand the reasons for these differences, and so should consider computing one or more of the overhead variances described below. Each of these variances applies to a different aspect of overhead expenditures.

Speaker: Andrew Skoog, Founder of MachinistX & President of Hexis Representatives

Manufacturing is evolving, and the right technology can empower—not replace—your workforce. Smart automation and AI-driven software are revolutionizing decision-making, optimizing processes, and improving efficiency. But how do you implement these tools with confidence and ensure they complement human expertise rather than override it? Join industry expert Andrew Skoog as he explores how manufacturers can leverage automation to enhance operations, streamline workflows, and make smarter, data-dri

Accounting Tools

OCTOBER 8, 2023

Related Courses Bookkeeping Guidebook Credit and Collection Guidebook The Balance Sheet How to Determine Cash Realizable Value in Accounting Cash realizable value is the cash remaining after the uncollectable amount has been subtracted from an account receivable. This net amount can be found by combining the receivable balance and the allowance for doubtful accounts on a company’s balance sheet.

Accounting Tools

OCTOBER 8, 2023

Related Courses Accountants’ Guidebook The Balance Sheet The Income Statement What is the Statement of Comprehensive Income? The statement of comprehensive income contains those revenue and expense items that have not yet been realized. It accompanies an organization’s income statement , and is intended to present a more complete picture of the financial results of a business.

Accounting Tools

OCTOBER 8, 2023

Related Courses Fraud Examination Fraud Schemes How to Audit for Fraud What is Option Backdating? Option backdating is the practice of altering the official date on which a stock option is granted. The intent of this change is to set the option date to the date on which the market price of a company's stock was as low as possible. By doing so, the recipient is given a very low exercise price , and so will realize the largest possible gain when he or she eventually sells the shares.

Accounting Tools

OCTOBER 8, 2023

Related Courses Law Firm Accounting Partnership Accounting Partnership Tax Guide The Nature of a Partnership A partnership is a business arrangement in which two or more people own an entity, and personally share in its profits , losses , and risks. The exact form of partnership used can give some protection to the partners. A partnership can be formed by a verbal agreement, with no documentation of the arrangement at all.

Speaker: Cheryl J. Muldrew-McMurtry

Distributed finance teams are rewriting how the back-office runs, and attackers are taking notes. Disconnected workflows, process blind spots, and rising cyber threats are more than just growing pains—they’re liabilities. The challenge isn’t just going remote. It’s building resilient systems that protect accuracy, control, and speed across every transaction and touchpoint.

Let's personalize your content