Tax Strategy: Year-end 2023 tax planning

Accounting Today

OCTOBER 25, 2023

In spite of the lack of new tax legislation so far this year, taxpayers and tax preparers have plenty to focus on in preparing 2023 returns.

Accounting Today

OCTOBER 25, 2023

In spite of the lack of new tax legislation so far this year, taxpayers and tax preparers have plenty to focus on in preparing 2023 returns.

Insightful Accountant

OCTOBER 25, 2023

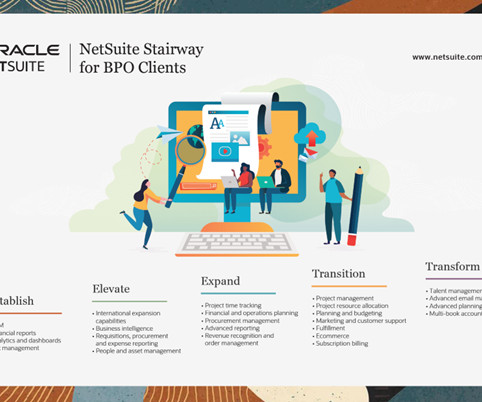

If you are a BPO or CAAS provider struggling with your current desktop or cloud accounting systems to support all of your clients, it might be time to look at NetSuite.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Accounting Today

OCTOBER 25, 2023

A firm's strength lies in its dedicated team of professionals committed to ensuring client satisfaction, regulatory compliance, and streamlined operations.

Accounting Tools

OCTOBER 25, 2023

Related Courses The Income Statement Public Company Accounting and Finance What are Interim Financial Statements? Interim financial statements are financial statements that cover a period of less than one year. They are used to convey information about the performance of the issuing entity prior to the end of the normal reporting year, and so are closely followed by investors.

Speaker: Victor C. Barnes, CPA, MBA

In the climb from contributor to leader, the rules quietly change. But if you’re aiming for the summit, the air gets thinner, and what got you here won’t be enough to get you to the top. 🗻 What made you successful early in your finance career—technical accuracy, sharp analysis, flawless execution—won’t be what carries you to the next level. The higher you go, the more your effectiveness depends on how you connect, adapt, and communicate.

Accounting Today

OCTOBER 25, 2023

Lauterbach & Amen's innovation competition has enhanced firm creativity and team spirit.

Accounting Tools

OCTOBER 25, 2023

Related Courses Accounting for Hedge Funds Corporate Cash Management Treasurer's Guidebook A hedge fund pools the money of contributing investors and tries to achieve above-market returns through a wide variety of investment strategies. Larger investors are attracted to the higher returns advertised by hedge funds, though actual returns are not necessarily better than the average market rate of return.

Financial Ops World brings together the best financial operations content from the widest variety of thought leaders.

Accounting Tools

OCTOBER 25, 2023

Related Courses Guide to Audit Sampling How to Conduct an Audit Engagement What is Attribute Sampling? Attribute sampling involves selecting a small number of transactions and making assumptions about how their characteristics represent the full population of which the selected items are a part. The concept is frequently used by auditors to test a population for certain characteristics, such as the presence of an authorizing signature or approval stamp on a document.

Accounting Today

OCTOBER 25, 2023

The NFRA has requested files and communications related to S.R. Batliboi's audits on some companies going as far back as 2014, sources said.

Accounting Tools

OCTOBER 25, 2023

Related Courses Financial Analysis The Interpretation of Financial Statements What is the Accounting Breakeven Point? The accounting breakeven point is the sales level at which a business generates exactly zero profits , given a certain amount of fixed costs that it must pay for in each period. This concept is used to model the financial structure of a business.

Accounting Today

OCTOBER 25, 2023

In this Vendor Spotlight we talk to Andrew Hoyen, CEO of cybersecurity solutions provider Infinite Group Inc.

Speaker: Kim Beynon, CPA, CGMA, PMP

The most overlooked, yet most critical, element of transformation is preparing people for change. Automation and AI aren't just technical upgrades, they’re cultural shifts which can challenge identities. That’s why change management isn’t a side project—it’s the foundation. In finance, where precision and process rule, navigating change can feel especially disruptive.

Accounting Tools

OCTOBER 25, 2023

Related Courses Bookkeeping Guidebook How to Audit Equity New Controller Guidebook What is the Accounting for Reserves? A reserve is profits that have been appropriated for a particular purpose. Reserves are sometimes set up to purchase fixed assets , pay an expected legal settlement, pay bonuses, pay off debt , pay for repairs and maintenance, and so forth.

Accounting Today

OCTOBER 25, 2023

While marking its 25th anniversary at its annual user conference, the accounting software vendor announced a number of new products and capabilities.

Accounting Tools

OCTOBER 25, 2023

Related Courses How to Audit Payroll Optimal Accounting for Payroll Payroll Management How to Process Payroll The processing of payroll can produce errors in several places, which calls for a detailed process flow that also incorporates several controls. This procedure can be used to ensure that payroll is handled consistently on a repetitive basis.

Accounting Today

OCTOBER 25, 2023

Nowadays a career in accounting requires more decisions and more self-knowledge — and more skillsets — than ever before.

Speaker: Mark Gilham, FCCA, CPP

Finance used to be the function that counted, now it's the one that’s counted on. 📊 For accounting firms, controllers, and finance leaders, expectations are rising faster than headcount. Businesses want agile forecasts, granular analysis, seamless reporting, and smart automation—often without added resources while demanding uncompromised accuracy and compliance.

Jetpack Workflow

OCTOBER 25, 2023

You’re an expert bookkeeper ready, willing, and able to help other businesses keep their accounts in balance. However, before you begin tracking client transactions, you need to build the foundation of your own bookkeeping business. That requires several steps, including filing the proper permits, calculating your rates, and attracting your first clients.

Accounting Today

OCTOBER 25, 2023

CPA.com, in light of the technology's sudden popularity, has released a set of resources for accountants to educate themselves on artificial intelligence and assess its risks and opportunities.

Bookkeeping Express

OCTOBER 25, 2023

As a small business owner, you’re likely accustomed to wearing many hats, from managing day-to-day operations to handling customer inquiries. With so much on your plate, it’s easy to overlook one critical aspect of your business – its financial health. Regularly assessing your small business’s financial well-being is essential for long-term success.

Economize

OCTOBER 25, 2023

Performance tuning in AWS S3 is a critical aspect that enterprises need to address to ensure that their cloud storage operates efficiently and effectively. S3, known for its scalability and reliability, often faces challenges regarding latency, which can impede the swift access and processing of data.

Advertiser: Paycor

Great leadership development is the key to sustainable business growth. Are you ready to design an effective program? HR can use Paycor’s framework to: Set achievable goals. Align employee and company needs. Support different learning styles. Empower the next generation of leaders. Invest in your company’s future with a strong leadership development program.

CSI Accounting & Payroll

OCTOBER 25, 2023

As a business owner, taxes can be confusing. Unfortunately, for nearly all businesses, taxes are a year-round activity - usually when it comes to sales and use tax. At CSI Accounting & Payroll, we’ve worked with small business taxes since the 1960s. Since then, we’ve heard a lot of questions about sales and use tax from small business owners, including: What is sales tax?

Tipalti

OCTOBER 25, 2023

Fintech innovations are a game-changer for financial inclusion in America. Traditional banking can be inaccessible and costly for many people, particularly people from minority groups.

Future Firm

OCTOBER 25, 2023

A good onboarding process can be a significant factor in retaining clients. Consider these 4 tactics to leave a lasting impression. The post 4 Wow Moments to Level Up Your Onboarding Process appeared first on Future Firm.

Blake Oliver

OCTOBER 25, 2023

Have you ever dreamed of working at a top tech company like Google? It may seem out of reach, but my latest podcast guest Mike Manalac, CPA is living proof that it's possible. Mike took a leap of faith by quitting his public accounting job and moving across the country to San Francisco with no job lined up. After countless interviews and rejections, he finally cracked the code and landed his "dream job" at Google.

Speaker: Andrew Skoog, Founder of MachinistX & President of Hexis Representatives

Manufacturing is evolving, and the right technology can empower—not replace—your workforce. Smart automation and AI-driven software are revolutionizing decision-making, optimizing processes, and improving efficiency. But how do you implement these tools with confidence and ensure they complement human expertise rather than override it? Join industry expert Andrew Skoog as he explores how manufacturers can leverage automation to enhance operations, streamline workflows, and make smarter, data-dri

Accounting Tools

OCTOBER 25, 2023

Related Courses Form 1099 Compliance Payroll Management What is Working Off the Books? The concept of working off the books means that a person is being compensated in cash for services performed, but the payments are not recorded on the books of the employing business. The business offers this sort of arrangement in order to avoid paying any payroll taxes , as well as to avoid paying for workers' compensation insurance and any of the benefits normally offered to its employees, including medical

NACM

OCTOBER 25, 2023

From risk mitigation to financial analysis, credit professionals are constantly learning. And no matter how long they've been in the credit industry, there's always something new to learn. By earning a designation through NACM's Professional Certification Program, credit professionals are not only tested on their credit knowledge, but they are grow.

Accounting Tools

OCTOBER 25, 2023

Related Courses Activity-Based Costing Activity-Based Management Cost Accounting Fundamentals What is the Direct Allocation Method? The direct allocation method is a technique for charging the cost of service departments to other parts of a business. This concept is used to fully load operating departments with those overhead costs for which they are responsible.

Cloud Accounting Podcast

OCTOBER 25, 2023

Blake and David discuss the factors that impact accountant salaries, including location, experience, and industry, and highlight the correlation between accounting salaries and overall economic conditions, noting that periods of economic growth can lead to higher salaries. They also take a look at the partnership between PwC and OpenAI and speculate on the potential impact of AI on accounting consulting and fraud detection.

Speaker: Cheryl J. Muldrew-McMurtry

Distributed finance teams are rewriting how the back-office runs, and attackers are taking notes. Disconnected workflows, process blind spots, and rising cyber threats are more than just growing pains—they’re liabilities. The challenge isn’t just going remote. It’s building resilient systems that protect accuracy, control, and speed across every transaction and touchpoint.

Accounting Tools

OCTOBER 25, 2023

Related Courses Cost Accounting Fundamentals What is Cost Incurred? A cost incurred is a cost for which a business has become liable, even if it has not yet received an invoice from a supplier as documentation of the cost. This is an accrual accounting concept. It is not used under the cash basis of accounting. Example of a Cost Incurred A manufacturing operation uses a large amount of electricity during the month of January, after which the local power company bills it $25,000 for the electrici

Accounting Tools

OCTOBER 25, 2023

Related Courses Economic Indicators Investing Guidebook What is a Yield Curve? A yield curve is a graphical representation of the yield on a particular type of bond , based on its maturity date. A normal yield curve shows a gradual increase in yield for bonds that mature further in the future, since it is riskier to hold the bonds for a longer period of time.

Accounting Tools

OCTOBER 25, 2023

Related Courses Divestitures and Spin-Offs Mergers and Acquisitions What is a Breakup Fee? A breakup fee is inserted into an acquisition agreement to prevent the seller from backing out of the deal. If the seller does so, it must pay the breakup fee to the acquirer. A seller might back out of a deal in order to accept a higher offer from another acquirer, or to go public.

Accounting Tools

OCTOBER 25, 2023

Related Courses Cost Accounting Fundamentals Public Company Accounting and Finance What is Compliance Cost? Compliance cost is the total cost incurred by a firm to comply with applicable regulations. These regulations may cover such areas as tax reporting, environmental topics, transport, and finances. Compliance costs can include the cost of the systems needed to collect information for compliance reporting, the cost of the personnel needed to construct and monitor the compliance systems, and t

Advertiser: Paycor

Before you can achieve success, you have to define it. Objectives and Key Results (OKRs) give you the framework to do just that. Paycor’s free guide includes a step-by-step process leaders can use to work toward – and achieve – their loftiest business goals.

Let's personalize your content