Accounting firm owners band together to end late client payments

Accounting Today

AUGUST 28, 2023

Dozens of firms have signed onto an initiative to stop underselling the worth of accountants and collect payments on time from clients.

Accounting Today

AUGUST 28, 2023

Dozens of firms have signed onto an initiative to stop underselling the worth of accountants and collect payments on time from clients.

FinOps in Practice

AUGUST 28, 2023

The main parts of the scheme, which describes key MLOps processes, are horizontal blocks, inside of which the procedural aspects of MLOps are described (they are assigned letters A, B, C, D). Each of them is designed to solve specific tasks within the framework of ensuring the uninterrupted operation of the company’s ML services. To understand the scheme better, it would be good to start with Experimentation.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Accounting Today

AUGUST 28, 2023

Accounting firms have been facing problems in filling their open positions as the number of new accountants declines, and one solution may involve rehiring past employees.

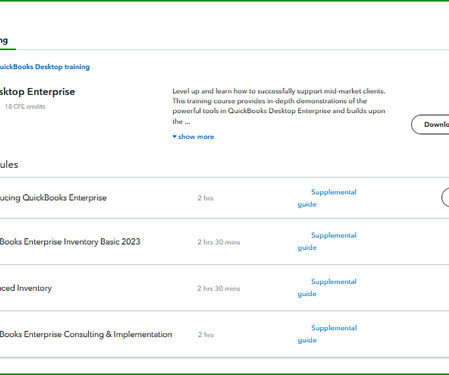

Insightful Accountant

AUGUST 28, 2023

Murph clues you in to the advantages of possessing a QuickBooks Desktop Enterprise ProAdvisor Certification.

Speaker: Victor C. Barnes, CPA, MBA

In the climb from contributor to leader, the rules quietly change. But if you’re aiming for the summit, the air gets thinner, and what got you here won’t be enough to get you to the top. 🗻 What made you successful early in your finance career—technical accuracy, sharp analysis, flawless execution—won’t be what carries you to the next level. The higher you go, the more your effectiveness depends on how you connect, adapt, and communicate.

Accounting Today

AUGUST 28, 2023

The Internal Revenue Service correctly calculated the allowable Recovery Rebate Credit for the vast majority of 2021 tax returns, but some erroneous payments were made, according to a new report.

AvidXchange

AUGUST 28, 2023

Labor Day is the unofficial end to summer for many. A last chance to enjoy the pool and regroup as children begin a new school year. For business finance staff, it’s a respite prior to the Q4 push. This year, in addition to relaxing with family and friends, we think Labor Day should be a time to reflect on how to make your job less “laborious.” And it just so happens our 2023 AP Career Satisfaction Survey results have some tips on how to do just that.

Financial Ops World brings together the best financial operations content from the widest variety of thought leaders.

Accounting Tools

AUGUST 28, 2023

Related Courses Business Combinations and Consolidations CPA Firm Mergers and Acquisitions Divestitures and Spin-Offs Mergers & Acquisitions How to Value an Acquisition Target Acquisition valuation involves the use of multiple analyses to determine a range of possible prices to pay for an acquisition candidate. There are many ways to value a business, which can yield widely varying results, depending upon the basis of each valuation method.

Accounting Today

AUGUST 28, 2023

Buy-sell agreements provide some calm during an upsetting period.

Tipalti

AUGUST 28, 2023

The bargaining power of suppliers is one of Porter’s Five Forces, and is the concept that suppliers can apply pressure to companies by lowering product quality or availability, or raising product prices.

Accounting Today

AUGUST 28, 2023

In absence of secure systems that clients and staff will use, horror stories abound.

Speaker: Kim Beynon, CPA, CGMA, PMP

The most overlooked, yet most critical, element of transformation is preparing people for change. Automation and AI aren't just technical upgrades, they’re cultural shifts which can challenge identities. That’s why change management isn’t a side project—it’s the foundation. In finance, where precision and process rule, navigating change can feel especially disruptive.

Insightful Accountant

AUGUST 28, 2023

Join us for the September edition of 'TPN's Tax Talks,' where Tax Practice News' Christine Gervais will show you how to re-examine your approach to tax planning. Sign up here for the Sept. 23 webinar.

Outsourced Bookeeping

AUGUST 28, 2023

QuickBooks is an easy-to-use accounting software that automates accounting tasks like bookkeeping, invoicing, time tracking, expense tracking, and inventory tracking. It is considered to be the best accounting software for small businesses. QuickBooks offers a variety of accounting and finance opportunities to small businesses with its immediate tools, such as QuickBooks Payroll, QuickBooks Commerce, QuickBooks Online, QuickBooks Live, QuickBooks Payment, and QuickBooks Time.

CloudZero

AUGUST 28, 2023

Have your SaaS costs been fluctuating recently? The latest cloud cost news may help you anticipate where the winds will shift in the near future.

Accounting Tools

AUGUST 28, 2023

Related Courses How to Audit Payroll Optimal Accounting for Payroll Payroll Management Piece Rate Pay Overview A piece rate pay plan can be used by a business that wants to pay its employees based on the number of units of production that they complete. Using this type of pay plan converts compensation into a cost that directly varies with sales , assuming that all produced goods are immediately sold.

Speaker: Mark Gilham, FCCA, CPP

Finance used to be the function that counted, now it's the one that’s counted on. 📊 For accounting firms, controllers, and finance leaders, expectations are rising faster than headcount. Businesses want agile forecasts, granular analysis, seamless reporting, and smart automation—often without added resources while demanding uncompromised accuracy and compliance.

Accounting Tools

AUGUST 28, 2023

Related Courses Corporate Finance Crowdfunding Treasurer's Guidebook What is Accounts Receivable Financing? Accounts receivable financing involves the sale of one’s accounts receivable in exchange for a working capital loan. Receivables are considered a highly liquid asset, and so are one of the best forms of collateral for loans. The amount loaned is somewhat less than the amount of the receivables being used as collateral, which can be up to 90% of the face value of the receivables.

Accounting Tools

AUGUST 28, 2023

Related Courses Business Combinations and Consolidations Divestitures and Spin-Offs Mergers and Acquisitions What are the Antitrust Regulations? There is antitrust legislation in both the United States and the European Union that prevent some acquisitions from being completed if they are expected to result in an excessive reduction of competition within an industry.

Accounting Tools

AUGUST 28, 2023

Related Courses Business Combinations and Consolidations Divestitures and Spin-Offs Mergers and Acquisitions What is an Asset Purchase? An asset purchase occurs when an acquirer only buys the assets of an acquiree. Doing so has a number of ramifications, which are noted below. Contract Terminations If the acquirer only buys the assets of the seller, it is not acquiring any contracts with the business partners of the seller.

Accounting Tools

AUGUST 28, 2023

Related Courses Business Combinations and Consolidations CPA Firm Mergers and Acquisitions Divestitures and Spin-Offs Mergers and Acquisitions What is a Closing Memorandum? The parties to an acquisition may want to revisit the terms of the agreement for several years after the deal has closed, if only to understand why certain terms were included in the agreement.

Advertiser: Paycor

Great leadership development is the key to sustainable business growth. Are you ready to design an effective program? HR can use Paycor’s framework to: Set achievable goals. Align employee and company needs. Support different learning styles. Empower the next generation of leaders. Invest in your company’s future with a strong leadership development program.

Accounting Tools

AUGUST 28, 2023

Related Courses Business Combinations and Consolidations CPA Firm Mergers and Acquisitions Divestitures and Spin-Offs Mergers and Acquisitions What is a Hostile Takeover? A hostile takeover occurs when an acquirer buys another entity despite the objections of the managers of the target organization. A hostile takeover can be accomplished either through a tender offer or a proxy fight.

Accounting Tools

AUGUST 28, 2023

Related Courses Business Combinations and Consolidations CPA Firm Mergers and Acquisitions Divestitures and Spin-Offs Mergers and Acquisitions Paying for an Acquisition With Cash The form of payment generally preferred by the shareholders of the acquiree is cash. It is particularly appreciated by shareholders who are unable to sell their stock by other means, which is the case for most privately-held companies.

Accounting Tools

AUGUST 28, 2023

Related Courses Business Combinations and Consolidations CPA Firm Mergers and Acquisitions Divestitures and Spin-Offs Mergers and Acquisitions What is Acquisition Strategy? Acquisition strategy involves finding a methodology for the acquisition of target companies that generates value for the acquirer. The use of an acquisition strategy can keep a management team from buying businesses for which there is no clear path to achieving a profitable outcome.

Accounting Tools

AUGUST 28, 2023

Related Courses Business Combinations and Consolidations CPA Firm Mergers and Acquisitions Divestitures and Spin-Offs Mergers and Acquisitions What is a Tax-Free Acquisition? A tax-free acquisition is the purchase of a target company in which the recognition of a gain can be deferred. The deferral of gain recognition is of considerable importance, since it delays the payment of income taxes.

Speaker: Andrew Skoog, Founder of MachinistX & President of Hexis Representatives

Manufacturing is evolving, and the right technology can empower—not replace—your workforce. Smart automation and AI-driven software are revolutionizing decision-making, optimizing processes, and improving efficiency. But how do you implement these tools with confidence and ensure they complement human expertise rather than override it? Join industry expert Andrew Skoog as he explores how manufacturers can leverage automation to enhance operations, streamline workflows, and make smarter, data-dri

Accounting Tools

AUGUST 28, 2023

Related Courses Business Combinations and Consolidations CPA Firm Mergers and Acquisitions Divestitures and Spin-Offs Mergers and Acquisitions What is an Acquisition Term Sheet? The term sheet is a brief document submitted by the acquirer to the target company , in which it states the price and conditions under which it offers to acquire the company.

Accounting Tools

AUGUST 28, 2023

Related Courses Business Combinations and Consolidations CPA Firm Mergers and Acquisitions Divestitures and Spin-Offs Mergers and Acquisitions What is an Acquisition Purchase Agreement? The acquisition purchase agreement governs the final sale of an acquiree to an acquirer. The contents of the purchase agreement can vary significantly, depending on the legal structure of the deal (such as an asset purchase or a stock purchase) and other factors.

Accounting Tools

AUGUST 28, 2023

Related Courses Business Combinations and Consolidations CPA Firm Mergers and Acquisitions Divestitures and Spin-Offs Mergers and Acquisitions What is a Triangular Merger? In a triangular merger, the acquirer creates a wholly-owned subsidiary , which in turn merges with the selling entity. The selling entity then liquidates. The acquirer is the sole remaining shareholder of the subsidiary.

Accounting Tools

AUGUST 28, 2023

Related Courses Business Combinations and Consolidations CPA Firm Mergers and Acquisitions Divestitures and Spin-Offs Mergers and Acquisitions What is a Tender Offer? A tender offer is an offer to buy some portion of the outstanding shares issued by a corporation. An acquirer may resort to a tender offer when it has made a friendly offer to management that has been turned down.

Speaker: Cheryl J. Muldrew-McMurtry

Distributed finance teams are rewriting how the back-office runs, and attackers are taking notes. Disconnected workflows, process blind spots, and rising cyber threats are more than just growing pains—they’re liabilities. The challenge isn’t just going remote. It’s building resilient systems that protect accuracy, control, and speed across every transaction and touchpoint.

Accounting Tools

AUGUST 28, 2023

Related Courses Business Combinations and Consolidations CPA Firm Mergers and Acquisitions Divestitures and Spin-Offs Mergers and Acquisitions How to Deal With Cultural Issues in a Merger Corporate culture is the manner in which a company does its business. It begins with the general concept of how the senior management team wants to operate the business, and percolates down through the organization in the form of management structure, how decisions are made, policies and procedures, the types o

Let's personalize your content