The 20 best states to be rich

Accounting Today

JUNE 18, 2024

Residents with high earnings in these 20 states get a bigger break on their taxes, paying a smaller percentage of their income.

Accounting Today

JUNE 18, 2024

Residents with high earnings in these 20 states get a bigger break on their taxes, paying a smaller percentage of their income.

Accounting Department

JUNE 18, 2024

We are thrilled to share that AccountingDepartment.com has been selected for inclusion in the Inc. Best Workplaces list, for the third year in a row! This recognition in 2024 highlights the success of the workplace environment we have cultivated over the last 20 years. We are grateful for the privilege of being acknowledged as an Inc. Best Workplace for the last 3 years now, and we extend our appreciation to our entire staff, who make it such a wonderful place to be every day.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Accounting Today

JUNE 18, 2024

The Internal Revenue Service is easing the rules for claiming a tax refund tied to a claim for the research and development tax credit.

Intuit

JUNE 18, 2024

In 2022, a study by Lever found that 25% of millennials want their leaders to prioritize internal mobility and 38% of Gen Z want their leaders to prioritize flexibility. So, how can organizations better support internal mobility to meet their employees where they are, and enhance retention and satisfaction? In the same vein, LinkedIn’s Workplace Learning Report 2024 tells us only 1 in 5 employees feel confident about their ability to transition internally.

Advertisement

Change is difficult, whether in our private or work life. However, without change, growth and learning are difficult not to mention keeping up with the market and staying competitive. We have all worked for or ourselves are the bosses that prefer to keep the status quo. We will discuss how to address the "change challenge" to enable you to be a changemaker and a graceful recipient of change.

Accounting Today

JUNE 18, 2024

The Treasury Department and the Internal Revenue Service released prevailing wage and registered apprenticeship requirements for clean energy projects and jobs to qualify for tax credits under the Inflation Reduction Act.

Bookkeeping Essentials

JUNE 18, 2024

Focus on Bookkeeping takes a look at the IRS audit techniques for cash businesses, Canadian sales tax common audit issues and examines my research on U.S. and Canadian payroll tax audit issues.

Financial Ops World brings together the best financial operations content from the widest variety of thought leaders.

Insightful Accountant

JUNE 18, 2024

The Opening Keynote for Scaling New Height was highlighted with a presentation from Dr. Michio Kaku, Theoretical Physicist and Renowned Futurist.

Accounting Today

JUNE 18, 2024

The current wave of M&A activity is driven at least in part by the need for firms to build out their CAS practices quickly, said Joe Woodard at Scaling New Heights

Ace Cloud Hosting

JUNE 18, 2024

We’re back with yet another series. In this five-blog series, we’ll cover different aspects of QuickBooks Cloud Accounting, including what it is, how it works, the common challenges, and why.

Accounting Today

JUNE 18, 2024

The Public Company Accounting Oversight Board levied sanctions against firms in the U.S., Canada and the United Arab Emirates for violating various rules and standards.

Advertisement

Setting the stage for successful organizational change always begins with clear, thoughtful communication. When it comes to rolling out a new travel and expense (T&E) policy, establishing a well-structured communication plan is key to ensuring that all employees understand the changes and their impact. By following a step-by-step approach, you can guide your organization through the transition, fostering smooth adoption from the outset and improving compliance.

Less Accounting

JUNE 18, 2024

Outsourcing has become a strategic imperative for many small businesses looking to optimize operations, reduce costs, and focus on core competencies. When it comes to financial management, outsourcing bookkeeping services can offer significant benefits, but how do you measure the return on investment (ROI)? In this blog post, we’ll explore the factors to consider when evaluating the ROI of outsourcing bookkeeping for small businesses.

Accounting Today

JUNE 18, 2024

Automaton has led to specialized solutions taking on more features to create powerful combos of capacities, but firms must also keep security in mind.

Nanonets

JUNE 18, 2024

As all people involved in it will tell you, doing procurement for your business is a complex and tricky process. Why is this? Three typical concerns that always arise for businesses doing procurement are - Finding the Right Suppliers: Just like finding the perfect pair of shoes or the perfect laptop for you, finding reliable suppliers who meet your quality, price, and delivery needs can be tough.

Accounting Today

JUNE 18, 2024

Reform's many aspects; healing your energy; BOI deadline problem; and other highlights from our favorite tax bloggers.

Advertisement

Time and time again we tell ourselves and others NOT take action on something that is not "broken." We apply that mindset at home and at work. Sometimes, it doesn’t work out so well. Because when it's truly broken, it's usually an emergency, costs more and causes stress. Join us in this webinar where we share ways where you are able to anticipate your needs, understand benefits that you will get from getting better now instead of later, and relieving your team of tasks that they don't need to be

CSI Accounting & Payroll

JUNE 18, 2024

When you own a small business, you know that you don’t know everything. Your area of expertise is in providing a quality product or service, but many other things go into running and growing a business.

oAppsNet

JUNE 18, 2024

In the digital age, efficiency and security are paramount for any business operation, particularly financial transactions. Automated payment systems streamline this process, ensuring businesses can securely handle transactions. Setting up a computerized payment system can seem daunting, but with the right approach, it is pretty manageable. This guide will walk you through the steps to implement an automated payment system effectively. 1.

Jetpack Workflow

JUNE 18, 2024

Accounting can be a rewarding career. And especially if you go out on your own and start a firm. Yet like any business, there will be challenging and stressful times. But for small accounting firms, you’ll often face other hardships that are a bit different from being a general large business owner. Recently, we saw this LinkedIn post diving into this topic and wanted to highlight some of the common responses.

Plooto

JUNE 18, 2024

As your business grows, you’ll be responsible for managing more and more business information and customer data. Even though growth is positive, k eeping up with data as it’s shared between platforms while maintaining it safely can feel overwhelming. If you’re worried about how to keep your data safe while scaling your business, cloud-based automation is a worthwhile solution to look into.

Advertisement

Global business travel is surging, with companies spending as much as or more than they did before the pandemic. This trend is expected to continue, with more growth on the horizon. The types of travelers are also changing, with millennials and Gen Zers taking on the majority of the load. Business travel is evolving, and younger generations expect less hassle, even though there are more ways to book and pay for travel than ever before.

CSI Accounting & Payroll

JUNE 18, 2024

As a small business owner, you may have heard about estimated quarterly tax payments. However, you may not know why some people make the payments – and some people don’t.

Insightful Accountant

JUNE 18, 2024

Check out this special edition of QB Talks, where Alicia Katz Pollock dives into the newest updates and features of Modern Invoices in QuickBooks Online.

Earmark Accounting Podcast

JUNE 18, 2024

John Briggs, founder of Incite Tax and author of "The 3.3 Rule" joins Blake to explain his approach to ending burnout in accounting while increasing productivity, which involves working for up to three hours followed by a 30% recovery period. They explore how this method can double productivity compared to the traditional 8-hour workday, and John provides practical tips for implementing it in accounting firms.

Bookkeeping Essentials

JUNE 18, 2024

A brief look at what you can do NOW and throughout the year to ensure a smooth yearend by having a clean set of books.

Speaker: Don Gallianza, Credit Manager at Chevron Phillips Chemical and Indy Chakrabarti, Chief Marketing Officer at HighRadius

4 Case Studies to Optimize DSO 26 Days Sales Outstanding. Already better than most. But, should you improve on that? Why would 3 fewer days even matter? It matters because it fundamentally transforms business outcomes. Join this webinar to explore 4 things companies do to reclaim hard dollars - not just soft costs - and go from good to great! What You'll Learn 6 operational KPIs every AR manager should track: Define and track these metrics to enhance performance, drive efficiency, and make infor

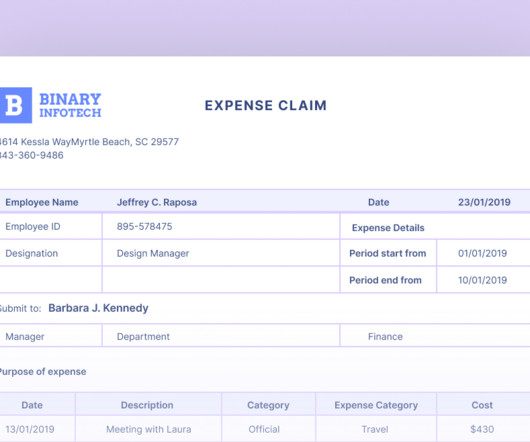

Nanonets

JUNE 18, 2024

Did you know that processing an expense report for an overnight hotel stay can take up to 20 minutes and cost an average of $58 ? According to a GBTA report , out-of-pocket costs an employee has paid expense reports contains errors or missing information, costing an additional $52 and 18 minutes to correct each. Now consider all the hundreds of expenses and reports employees file, and imagine the resource drain it could be costing you.

Nanonets

JUNE 18, 2024

Introduction to Account Reconciliation Account reconciliation is the critical process of comparing your general ledger with internal and external sources. Each balance should match its corresponding entry in the general ledger for any source. Matching and validating entries would mean data consolidation across sub-ledgers, vendor invoices, bank statements, receipts, and account receivables to ensure timely and accurate month-end and year-end closing of the financial books.

Let's personalize your content