How are your customers feeling?

Xero

MAY 31, 2023

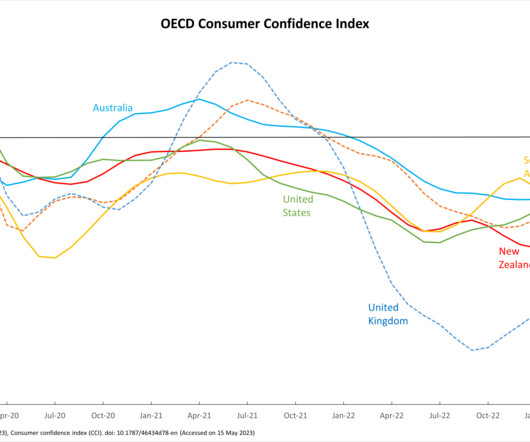

With the cost of living continuing to rise, putting pressure on many households, it’s timely for small business owners to think about consumer confidence. Consumer confidence is an important economic indicator for small businesses that mainly sell to households, because “consumers” is really just another word for your “customers” Looking at the most recent figures, the OECD Consumer Confidence Index remains below 100 in Australia, Canada, New Zealand, South Africa, the

Let's personalize your content