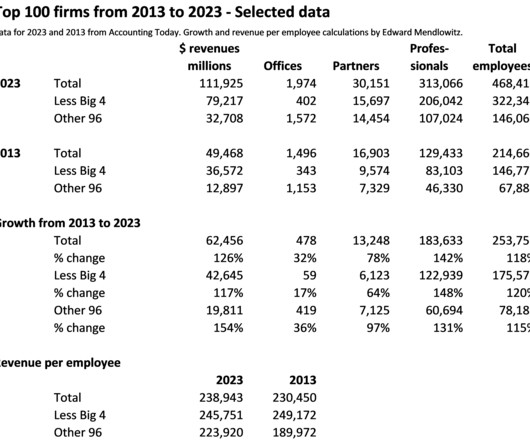

Art of Accounting: 5th to 100th largest firms growing more than Big Four

Accounting Today

SEPTEMBER 4, 2023

The Other 96 are surpassing the growth of the Big Four in revenues per employee.

Accounting Today

SEPTEMBER 4, 2023

The Other 96 are surpassing the growth of the Big Four in revenues per employee.

Insightful Accountant

SEPTEMBER 4, 2023

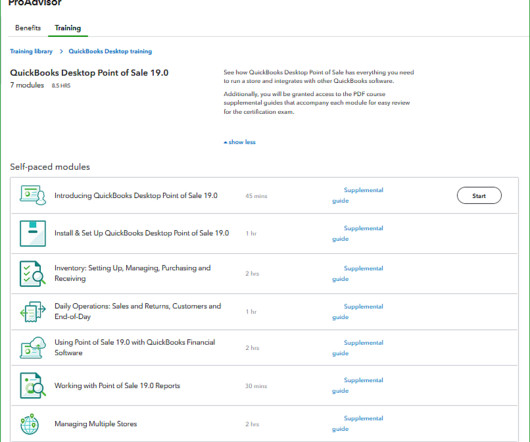

Murph clues you in on why the Top 100 2024 process will still award points for QuickBooks Desktop Point-of-sale ProAdvisor Certification even if Intuit drops the certification after it stops supporting QBPOS on Oct. 3, 2023.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

CSI Accounting & Payroll

SEPTEMBER 4, 2023

You own a small business in the Baltimore area, and you’ve been swamped handling your accounting and payroll yourself - or you’ve gone through the same experience that so many others have with big-name national payroll services and online accounting services. The next step is finding a reputable, local accounting and payroll provider to help you get back on your feet.

Insightful Accountant

SEPTEMBER 4, 2023

Following the acquisition of Wiley Efficient Learning, Roger CPA Review, and welcoming Peter Olinto, UWorld raises the bar ahead of its 2024 CPA Review product release.

Speaker: Victor C. Barnes, CPA, MBA

In the climb from contributor to leader, the rules quietly change. But if you’re aiming for the summit, the air gets thinner, and what got you here won’t be enough to get you to the top. 🗻 What made you successful early in your finance career—technical accuracy, sharp analysis, flawless execution—won’t be what carries you to the next level. The higher you go, the more your effectiveness depends on how you connect, adapt, and communicate.

CloudZero

SEPTEMBER 4, 2023

If you’ve done any shopping around for a cloud cost intelligence platform, you may have heard about the “single pane of glass” approach to presenting cloud cost data. It’s a descriptive phrase uttered by almost every cloud cost company in one form or another. We may not all say it in a similar way, but it’s the same concept across the board.

Insightful Accountant

SEPTEMBER 4, 2023

Liz Scott checks in on some new exciting stuff coming for all of you QuickBooks Time users. Check out what you can expect—and more.

Financial Ops World brings together the best financial operations content from the widest variety of thought leaders.

Accounting Tools

SEPTEMBER 4, 2023

Related Courses Corporate Cash Management Treasurer's Guidebook What is Cash Sweeping? A cash sweeping system (also known as physical pooling) is designed to move the cash in a company’s outlying bank accounts into a central concentration account, from which it can be more easily invested. By concentrating cash in one place, a business can place funds in larger financial instruments at higher rates of return.

Accounting Tools

SEPTEMBER 4, 2023

Related Courses Corporate Cash Management Enterprise Risk Management Treasurer's Guidebook What are Currency Futures? A currency futures contract is a contract to buy or sell currency at a specific price on a future date. This contract is used to hedge against foreign exchange risk by fixing the price at which a currency can be obtained. A futures contract is traded on an exchange, so it has a standard amount, expiry date, and settlement rules.

Accounting Tools

SEPTEMBER 4, 2023

Related Courses Accounting for Derivatives and Hedges Enterprise Risk Management Treasurer's Guidebook What is a Currency Swap? A currency swap involves the swapping of currency holdings with another party that already has the required currency. The two entities engage in a swap transaction by agreeing upon an initial swap date, the date when the cash positions will be reversed back to their original positions, and an interest rate that reflects the comparative differences in interest rates betw

Accounting Tools

SEPTEMBER 4, 2023

Related Courses Accounting for Derivatives and Hedges Corporate Cash Management Foreign Currency Accounting What is a Foreign Currency Option? A foreign currency option gives its owner the right, but not the obligation, to buy or sell currency at a certain price (known as the strike price ), either on or before a specific date. In exchange for this right, the buyer pays an up-front premium to the seller.

Speaker: Kim Beynon, CPA, CGMA, PMP

The most overlooked, yet most critical, element of transformation is preparing people for change. Automation and AI aren't just technical upgrades, they’re cultural shifts which can challenge identities. That’s why change management isn’t a side project—it’s the foundation. In finance, where precision and process rule, navigating change can feel especially disruptive.

Accounting Tools

SEPTEMBER 4, 2023

Related Courses Corporate Cash Management Enterprise Risk Management Treasurer's Guidebook Working Capital Management What are the Functions of a Corporate Treasury? The general mission of the treasury department is to manage the liquidity of a business. This means that all current and projected cash inflows and outflows must be monitored to ensure that there is sufficient cash to fund company operations, as well as to ensure that excess cash is properly invested.

Accounting Tools

SEPTEMBER 4, 2023

Related Courses Corporate Cash Management Treasurer's Guidebook A bank account is a record maintained by a banking institution, in which it records an ongoing series of cash inflows and outflows on behalf of a customer. The bank account also shows the current balance of cash in the record as of any point in time. If there is more than one individual who has access to the account, it is known as a joint account.

Accounting Tools

SEPTEMBER 4, 2023

Related Courses Corporate Cash Management Treasurer's Guidebook What is Notional Pooling? Notional pooling is a cash concentration system that allows cash to remain under local control, but which is recorded at the bank as though the cash has been centralized. If a bank offers notional pooling, it simply combines the ending balances in all of a company’s accounts to arrive at an aggregate net balance.

Accounting Tools

SEPTEMBER 4, 2023

Related Courses Corporate Cash Management Foreign Currency Accounting What is a Forward Exchange Contract? A forward exchange contract is an agreement under which a business agrees to buy a certain amount of foreign currency on a specific future date. The purchase is made at a predetermined exchange rate. By entering into this contract, the buyer can protect itself from subsequent fluctuations in a foreign currency's exchange rate.

Speaker: Mark Gilham, FCCA, CPP

Finance used to be the function that counted, now it's the one that’s counted on. 📊 For accounting firms, controllers, and finance leaders, expectations are rising faster than headcount. Businesses want agile forecasts, granular analysis, seamless reporting, and smart automation—often without added resources while demanding uncompromised accuracy and compliance.

Accounting Tools

SEPTEMBER 4, 2023

Related Courses Accounting for Derivatives and Hedges Corporate Cash Management What are Interest Rate Futures? An interest rate futures contract is a futures contract, based on an underlying financial instrument that pays interest. It is used to hedge against adverse changes in interest rates. Such a contract is conceptually similar to a forward contract, except that it is traded on an exchange, which means that it is for a standard amount and duration.

Accounting Tools

SEPTEMBER 4, 2023

Related Courses Corporate Cash Management Enterprise Risk Management Treasurer's Guidebook What is an Interest Rate Swap? An interest rate swap is a customized contract between two parties to swap two schedules of cash flows. The most common reason to engage in an interest rate swap is to exchange a variable-rate payment for a fixed-rate payment, or vice versa.

Accounting Tools

SEPTEMBER 4, 2023

Related Courses Corporate Cash Management Payables Management What is Foreign Currency Netting? There are circumstances where a company has subsidiaries in multiple countries that actively trade with each other. If so, they should have accounts receivable and payable with each other, which could give rise to a flurry of foreign exchange transactions in multiple currencies that could trigger any number of hedging activities.

Accounting Tools

SEPTEMBER 4, 2023

Related Courses Corporate Cash Management Corporate Finance Investing Guidebook Treasurer's Guidebook Investment strategy refers to the guidelines used when selecting investments. A number of possible investment strategies are noted below, which incorporate varying levels of risk tolerance. When considering the options, please note that the more active ones require accurate cash forecasts, which may not be available.

Advertiser: Paycor

Great leadership development is the key to sustainable business growth. Are you ready to design an effective program? HR can use Paycor’s framework to: Set achievable goals. Align employee and company needs. Support different learning styles. Empower the next generation of leaders. Invest in your company’s future with a strong leadership development program.

Accounting Tools

SEPTEMBER 4, 2023

Related Courses Essentials of Business Law What is Recourse? Recourse is the legal right of a lender to take over pledged collateral when a borrower is unable to pay back a loan. Recourse lending greatly reduces the risk for lenders, since it gives them a second source from which repayment can be made (besides the cash flows of the borrower). A full recourse lending arrangement leaves the borrower liable for the full amount of the underlying debt , which may be more than the amount that the lend

Accounting Tools

SEPTEMBER 4, 2023

Related Courses Corporate Cash Management Treasurer's Guidebook What is a Bank Overlay Structure? When a company operates in multiple countries, it may have difficulty reconciling its use of local banking partners (with whom it may have had relations for many years) with the need to run a cash concentration system that efficiently funnels its cash into investment instruments.

Accounting Tools

SEPTEMBER 4, 2023

Related Courses Constraint Management The capacity of a work center is its maximum output level. There are three ways to categorize capacity, as noted next. Productive Capacity Productive capacity is the amount of work center capacity required to process all production work that is currently stated in the production schedule. Protective Capacity Protective capacity is an additional layer of production capacity that is maintained to provide additional units as needed to keep the bottleneck operat

Accounting Tools

SEPTEMBER 4, 2023

Related Courses Constraint Management What is the Constraint Buffer? A constraint buffer is the inventory reserve that is positioned directly in front of a bottleneck operation (the constraint ). This buffer keeps the bottleneck operation from being forced to shut down by ensuring that there is always a constant feed of materials being forwarded from upstream workstations.

Speaker: Andrew Skoog, Founder of MachinistX & President of Hexis Representatives

Manufacturing is evolving, and the right technology can empower—not replace—your workforce. Smart automation and AI-driven software are revolutionizing decision-making, optimizing processes, and improving efficiency. But how do you implement these tools with confidence and ensure they complement human expertise rather than override it? Join industry expert Andrew Skoog as he explores how manufacturers can leverage automation to enhance operations, streamline workflows, and make smarter, data-dri

Accounting Tools

SEPTEMBER 4, 2023

Related Courses Constraint Management How to Locate a Constraint in a Business The location of the constraint is a central concept in optimizing company resources. Optimization is centered around the idea that there must be a constrained resource, or bottleneck. Before engaging in any optimization, we must first locate the constrained resource. In a large facility that contains many employees and processes, it can be quite difficult to locate.

Accounting Tools

SEPTEMBER 4, 2023

Related Courses Constraint Management When there is a constraint in the operations of a business, the logical question to ask is how much it costs the company to not have that constraint operational at all times. That is, what is the opportunity cost of not maximizing the constraint? Opportunity Cost in Traditional Accounting Under an old-style cost accounting system, the answer to the preceding question would be that the business is not earning a gross margin on any goods that would otherwise h

Accounting Tools

SEPTEMBER 4, 2023

Related Courses Constraint Management What are Policy Constraints? A policy constraint is an internal rule that keeps a business from maximizing the amount of throughput that it generates. Throughput is sales minus all totally variable expenses. An example of a policy that can cause a constraint is when a rule on the production floor mandates that a storage bin be filled before transport to the next workstation for additional processing of units in process.

Let's personalize your content