The clock is ticking on beneficial ownership reporting

Accounting Today

JULY 19, 2023

Starting Jan. 1, 2024, many small businesses will face a major new reporting requirement — and many of them are completely unaware of it.

Accounting Today

JULY 19, 2023

Starting Jan. 1, 2024, many small businesses will face a major new reporting requirement — and many of them are completely unaware of it.

Xero

JULY 19, 2023

Ahead of the FIFA Women’s World Cup 2023, we sat down with Karen Bardsley to find out her perspective on the growth of the women’s game. Karen was goalkeeper for the England Women’s team, and she played for and now oversees the women’s teams at Manchester City F.C. Q: When you were younger, did you dream of becoming a professional footballer or did you have another career in mind?

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Accounting Today

JULY 19, 2023

The island's top economic development official says he's actively cooperating with U.S. tax authorities as they investigate about 100 high-income individuals.

Xero

JULY 19, 2023

Xero’s commitment to diversity and inclusion (D&I) across our global business extends to championing D&I in the communities in which we operate, including Indigenous communities globally. We believe driving better D&I outcomes can help amplify our positive impact on the world. This commitment aligns with our values and our purpose to make life better for people in small business, their advisors and communities around the world.

Speaker: Victor C. Barnes, CPA, MBA

In the climb from contributor to leader, the rules quietly change. But if you’re aiming for the summit, the air gets thinner, and what got you here won’t be enough to get you to the top. 🗻 What made you successful early in your finance career—technical accuracy, sharp analysis, flawless execution—won’t be what carries you to the next level. The higher you go, the more your effectiveness depends on how you connect, adapt, and communicate.

Accounting Today

JULY 19, 2023

While artificial intelligence does have the ability to take on some aspects of an accounting professional's role, there's no reason to fear the worst just yet.

Blake Oliver

JULY 19, 2023

How will generative AI change the accounting profession? Learn how in this video of my presentation, “How Artificial Intelligence Will Save Accounting.” We’ll explore the transformative impact artificial intelligence will have on the accounting industry in the coming years. With talent shortages causing pressing problems, AI represents a long-awaited solution to boost productivity.

Financial Ops World brings together the best financial operations content from the widest variety of thought leaders.

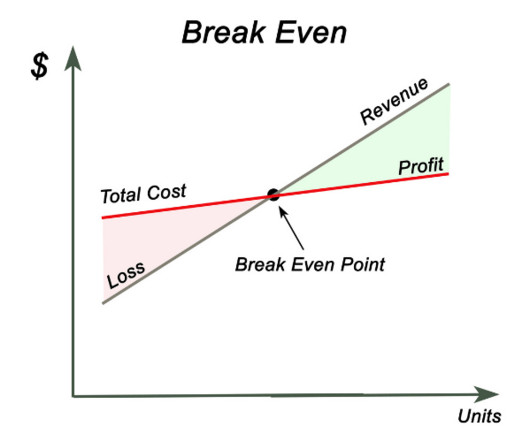

CSI Accounting & Payroll

JULY 19, 2023

When you own a small business, you need to be aware of your financial health. This is done through tracking KPIs (Key Performance Indicators). An important KPI that's easy to calculate on your own is your break-even point. Knowing your break-even point helps you find out what it takes for your business to be profitable, and it's especially valuable to product-based businesses and startups.

Accounting Today

JULY 19, 2023

Jan Marsalek was a key figure at Wirecard before its implosion in an accounting scandal in June 2020.

Ace Cloud Hosting

JULY 19, 2023

Some aspects of accounting are universal to all businesses, such as recording transactions, collecting revenue, and paying bills. But accounting for a manufacturing business involves some unique ones. The manufacturing.

Accounting Today

JULY 19, 2023

The store faces lawsuits from customers for alleged failure to deliver prepaid wine, is delinquent on $2.8 million in taxes, and reportedly could be evicted from its midtown home.

Speaker: Kim Beynon, CPA, CGMA, PMP

The most overlooked, yet most critical, element of transformation is preparing people for change. Automation and AI aren't just technical upgrades, they’re cultural shifts which can challenge identities. That’s why change management isn’t a side project—it’s the foundation. In finance, where precision and process rule, navigating change can feel especially disruptive.

Insightful Accountant

JULY 19, 2023

Continuing his series on clues for Top 100 2024 candidates from this year's award winners, Murph presents 'Tales from the Niche.

Accounting Today

JULY 19, 2023

Baker Tilly International CEO Francesca Lagerberg has been presiding over the accounting firm network for over a year and overseeing growth at a time when some of its Big Four rivals seem to be retrenching on their staff numbers.

Accounting Tools

JULY 19, 2023

What is an Accounting Schedule? An accounting schedule is a supporting document that provides additional details or proof for the information stated in a primary document. In business, accounting schedules are needed to provide proof for the ending balances stated in the general ledger , as well as to provide additional detail for contracts. Examples of accounting schedules are: A list of the aged accounts payable A list of the aged accounts receivable An itemization of all fixed assets and thei

Accounting Today

JULY 19, 2023

This summer, KPMG launched the inaugural KPMG U.S. Empower High School Experience, a three-week paid internship focused on introducing high school students to accounting careers.

Speaker: Mark Gilham, FCCA, CPP

Finance used to be the function that counted, now it's the one that’s counted on. 📊 For accounting firms, controllers, and finance leaders, expectations are rising faster than headcount. Businesses want agile forecasts, granular analysis, seamless reporting, and smart automation—often without added resources while demanding uncompromised accuracy and compliance.

Jetpack Workflow

JULY 19, 2023

A good introduction email to a new bookkeeping client shows you’re eager to get to work and dedicated to your services. The key is to be brief, professional, and friendly and continue building your client’s confidence in your business relationship. A lot is riding on this introductory email, but there’s no need to reinvent the wheel to nail it. Below is a sample introduction email template you can use to make that first impression with a new client account.

Accounting Today

JULY 19, 2023

OneStream Software CEO Tom Shea discusses the corporate performance management platform's growth and future plans.

Earmark Accounting Podcast

JULY 19, 2023

Follow the journey of Keeley Favoino, CPA, from her background in accounting at various organizations, including EY, Starbucks, OfferUp, and Farmer's Fridge, before joining Foxtrot, a modern corner store concept. Foxtrot's accounting department was initially focused on bookkeeping, but as the company grew, so did the need for a more robust accounting system.

Accounting Today

JULY 19, 2023

The board unveiled six new search filters for its inspection report database, allowing new ways to compare and analyze reports.

Advertiser: Paycor

Great leadership development is the key to sustainable business growth. Are you ready to design an effective program? HR can use Paycor’s framework to: Set achievable goals. Align employee and company needs. Support different learning styles. Empower the next generation of leaders. Invest in your company’s future with a strong leadership development program.

Jetpack Workflow

JULY 19, 2023

A good introduction email to a new bookkeeping client shows you’re eager to get to work and dedicated to your services. The key is to be brief, professional, and friendly and continue building your client’s confidence in your business relationship. A lot is riding on this introductory email, but there’s no need to reinvent the wheel to nail it. Below is a sample introduction email template you can use to make that first impression with a new client account.

Future Firm

JULY 19, 2023

I am able to scale my Future Firm business over the years, with over 700 active paying customers while having a consistent 30-hour workweek. In this podcast episode, I shared my insights and strategies that allowed me to accomplish such feat, and hopefully inspire you when you want to create a scalable business model. Listen Below. 0:57 – My firm excelled in scalability due to our selective client approach, streamlined workflow, predefined package offerings, and a highly effective team. 1:

Billah and Associates

JULY 19, 2023

Running a small business involves several task and responsibilities. But one aspect that should never be overlooked is bookkeeping. Proper bookkeeping basics practices ensure accurate financial recording, allowing you to make informed decisions and comply with legal and tax requirements. In this guide, we will explore the essential accounting principles every small business owner should know.

Accounting Tools

JULY 19, 2023

Related Courses Revenue Management What is Value Billing? Value billing is a charge to a customer based on the value received, rather than the cost of the services provided. This type of billing is most common in situations where the value provided is unique and essential to the customer. For example, an investment banker or criminal defense attorney can issue value billings because the value provided is so great.

Speaker: Andrew Skoog, Founder of MachinistX & President of Hexis Representatives

Manufacturing is evolving, and the right technology can empower—not replace—your workforce. Smart automation and AI-driven software are revolutionizing decision-making, optimizing processes, and improving efficiency. But how do you implement these tools with confidence and ensure they complement human expertise rather than override it? Join industry expert Andrew Skoog as he explores how manufacturers can leverage automation to enhance operations, streamline workflows, and make smarter, data-dri

Accounting Today

JULY 19, 2023

The Treasury released partial guidance on supply-chain requirements that lets some vehicles qualify — but it hasn't yet clarified how to classify so-called foreign entities of concern.

Accounting Tools

JULY 19, 2023

Related Courses Payroll Management Small Business Tax Guide What is Self-Employment Tax? The self-employment tax is a federal tax paid by small business owners, which is used to fund the social security and Medicare programs. A self-employed person pays double the amount normally paid by an employee of a firm, since the self-employed person is paying both the employee share of the tax and the employer's matching amount.

NACM

JULY 19, 2023

Credit management can be described as both an art and a science. The art side of credit is earned through experience with skills in communication, problem solving, negotiation and that gut feeling when assessing creditworthiness. The science side of credit is based on technical skills earned through educational programs and on-the-job training."Wi.

Accounting Tools

JULY 19, 2023

Related Courses Financial Analysis What is Seasonality? Seasonality is a recurring and predictable pattern in the level of business activity over the course of a year. This pattern can be used to predict sales levels throughout the year, and so is incorporated into the annual budgeting process. When reviewing the results of a business, the analyst must take into account the impact of seasonality on reported results.

Speaker: Cheryl J. Muldrew-McMurtry

Distributed finance teams are rewriting how the back-office runs, and attackers are taking notes. Disconnected workflows, process blind spots, and rising cyber threats are more than just growing pains—they’re liabilities. The challenge isn’t just going remote. It’s building resilient systems that protect accuracy, control, and speed across every transaction and touchpoint.

Accounting Tools

JULY 19, 2023

Related Courses Business Combinations and Consolidations Divestitures and Spin-Offs Mergers and Acquisitions What is a Short Form Merger? A short form merger combines a parent company and a subsidiary that is substantially owned by the parent. Either entity can be designated as the survivor of the merger. The requirements for a short form merger are set forth in the statutes of the applicable state government.

Accounting Tools

JULY 19, 2023

Related Courses Fixed Asset Accounting How to Audit Fixed Assets What is Useful Life? Useful life is the estimated lifespan of a depreciable fixed asset , during which it can be expected to contribute to company operations. This is an important concept in accounting, since a fixed asset is depreciated over its useful life. Thus, altering the useful life has a direct impact on the amount of depreciation expense recognized by a business per period.

Accounting Tools

JULY 19, 2023

Related Courses The Balance Sheet What is a Comparative Balance Sheet? A comparative balance sheet presents side-by-side information about an entity's assets , liabilities , and shareholders' equity as of multiple points in time. For example, a comparative balance sheet could present the balance sheet as of the end of each year for the past three years.

Accounting Tools

JULY 19, 2023

Related Courses Cost Accounting Fundamentals What are Mixed Expenses? Mixed expenses contain both fixed and variable components. There is a baseline fixed cost that does not vary, irrespective of changes in activity levels, as well as a variable cost component that will change in conjunction with activity. This means that a mixed expense will not be entirely eliminated, even when the activity level drops to zero.

Advertiser: Paycor

Before you can achieve success, you have to define it. Objectives and Key Results (OKRs) give you the framework to do just that. Paycor’s free guide includes a step-by-step process leaders can use to work toward – and achieve – their loftiest business goals.

Let's personalize your content