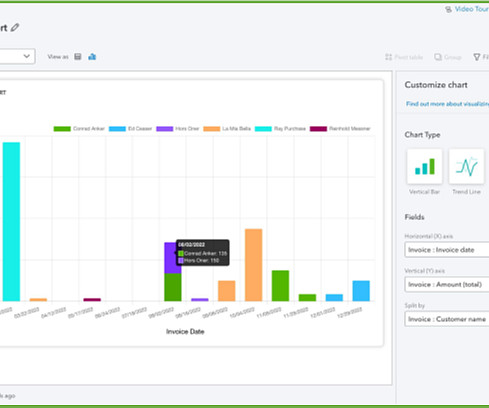

A sneak peek into what’s next for reports in Xero

Xero

APRIL 13, 2023

Our team hit the ground running in 2023, introducing a number of exciting features to new reports that we know you’ve been waiting for — including the addition of foreign currency to new reports. Here are some of the highlights and a sneak peek into what’s coming next. Don’t forget, the older versions of our reports will be retired on 31 July 2023. We urge you to start using new reports now , so you have plenty of time to get used to them before the older versions are retired.

Let's personalize your content