The best states to be middle class

Accounting Today

JUNE 25, 2024

Middle-class residents in these states pay a smaller percentage of their paychecks to taxes.

Accounting Today

JUNE 25, 2024

Middle-class residents in these states pay a smaller percentage of their paychecks to taxes.

Insightful Accountant

JUNE 25, 2024

Earlier this year, Intuit introduced a new version of QuickBooks Online for solopreneurs, it's designed for individuals who submit IRS Form 1040 - Schedule C tax filings.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Accounting Today

JUNE 25, 2024

A coalition of accounting educators and tech leaders released a generative AI governance framework as a starting point for organizations.

Accounting Tools

JUNE 25, 2024

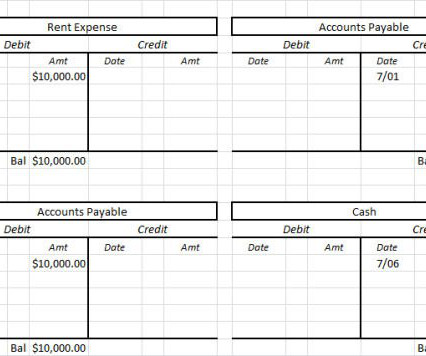

What is a T Account? A T account is a graphic representation of a general ledger account. The name of the account is placed above the "T" (sometimes along with the account number). Debit entries are depicted to the left of the "T" and credits are shown to the right of the "T". The grand total balance for each "T" account appears at the bottom of the account.

Speaker: Joe Wroblewski, Sales Engineer Manager

Automating time-consuming manual tasks can save your firm hundreds of hours–and thousands of dollars. But it can also have longer-lasting benefits, like helping you attract and retain the next generation of CPAs, and we don’t need to tell you how important that is amid the current generational staffing crisis in the tax and accounting profession. You'll want to save your seat for this new webinar with industry expert Joe Wroblewski, where we'll explore how to: Maximize ROI with Cost-Effective Te

Accounting Today

JUNE 25, 2024

Collecting payments is essential for business operations, but it's often not a top priority for business owners who are juggling numerous other tasks and demands daily.

Outsourced Bookeeping

JUNE 25, 2024

Are you in a financial bind due to invoice errors that are costing you a significant amount of money? The importance of accurate invoicing cannot be overstated. It’s not just about getting paid, it’s about the financial health and reputation of your business. Superficially, invoicing may seem like a straightforward and tedious task that might not require a business owner’s attention.

Financial Ops World brings together the best financial operations content from the widest variety of thought leaders.

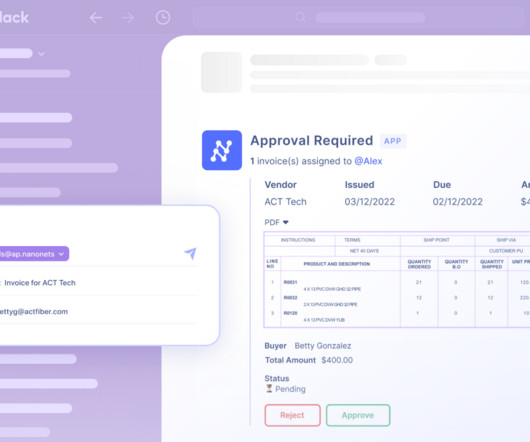

Nanonets

JUNE 25, 2024

Invoice coding involves categorizing expenses and assigning them to specific accounts. It seems simple, which is why it's often overlooked in AP efficiency discussions. But here's the kicker: it may be costing you more than you think. Companies without automation spend $6.30 per invoice , while automated counterparts pay just $1.45. That's right— automation could save you nearly 77% per invoice!

Accounting Today

JUNE 25, 2024

In a narrow holding, the Supreme Court upheld the provision, but emphasized that the ruling did not have broader implications.

Accounting Tools

JUNE 25, 2024

What is a Fixed Asset? A fixed asset is property with a useful life greater than one reporting period , and which exceeds an entity's minimum capitalization limit. A fixed asset is not purchased with the intent of immediate resale, but rather for productive use within the entity. Also, it is not expected to be fully consumed within one year of its purchase.

Accounting Today

JUNE 25, 2024

BDO USA released its 2023 Audit Quality Report Tuesday as it added a second independent member to its Audit Quality Advisory Council.

Advertisement

Automation generally supercharges any process and brings its value to the forefront. See how infusing automation such as ART (our month-end close solution), into your close can get you to the next level of closing. We will share a live demo of SkyStem's solution, ART and share the key elements of month-end close automation. Through ART, we'll take a look at: What month-end close automation entails Which process steps can and should be automated Benefits of achieving process automation, and Why i

Gaviti

JUNE 25, 2024

Wouldn’t it be nice to be able to accurately predict your future cash flow? You could better allocate funds and make more informed business decisions. Luckily, you can with accounts receivable forecasting. Accounts receivable forecasting is like having a financial crystal ball. While it might be a challenge, depending on how you manage your accounts receivable, forecasting is a powerful tool to help you grow your business.

Accounting Today

JUNE 25, 2024

Disaster planning; the flipside of an Employee Retention Credit mess; the QoE; and other highlights from our favorite tax bloggers.

Insightful Accountant

JUNE 25, 2024

New survey looks into the ways accountants are using technology, particularly AI, to balance business performance and industry challenges in today's macroeconomic environment.

Accounting Today

JUNE 25, 2024

The Internal Revenue Service agreed to settle a lawsuit brought by hedge fund manager Ken Griffin that accused the agency of failing to protect his confidential financial information from a contractor who stole his tax data and leaked it to ProPublica.

Advertiser: Paycor

Mid-year performance reviews aren’t just boxes for HR to check. Paycor’s toolkit empowers leaders to: Identify high-potential team members. Boost engagement with meaningful feedback. Support struggling employees. Nurture top talent to drive results. Learn how to ignite employee potential through meaningful feedback. When you nurture top talent, everybody wins.

Ace Cloud Hosting

JUNE 25, 2024

Welcome to our 4th blog of the series, “QuickBooks Cloud Accounting,”- where we explore the importance of prioritizing security, highlighting the potential risks and the measures necessary to safeguard financial.

Accounting Today

JUNE 25, 2024

When you announce the new tax season to your clients, let them know it's a new benefit you're offering to your customers.

oAppsNet

JUNE 25, 2024

As a business owner, partnering with a reliable and trustworthy supplier is not just a necessity, but a strategic move that can significantly influence the growth of your business. By establishing a solid relationship with your supplier, you open doors to enhanced efficiency, cost savings, and innovation. This is where the true value of supplier management shines.

Accounting Tools

JUNE 25, 2024

What is Amortization Expense? Amortization expense is the write-off of an intangible asset over its expected period of use, which reflects the consumption of the asset. This write-off results in the residual asset balance declining over time. Accounting for Amortization Expense Amortization is almost always calculated on a straight-line basis. Accelerated amortization methods make little sense, since it is difficult to prove that intangible assets are used more quickly in the early years of thei

Speaker: Victor C. Barnes, CPA, MBA

In the climb from contributor to leader, the rules quietly change. If you’re aiming for the summit, the air gets thinner—and what got you here won’t be enough to get you to the top (a concept first popularized by Marshall Goldsmith in his book What Got You Here Won’t Get You There ). What made you successful early in your finance career—technical accuracy, sharp analysis, flawless execution—won’t be what carries you to the next level.

Ace Cloud Hosting

JUNE 25, 2024

We already know how cloud accounting has become an essential tool for businesses in the current digital era, particularly those in the finance industry. QuickBooks Cloud Accounting offers unparalleled convenience.

Accounting Tools

JUNE 25, 2024

What is a Preaudit? A preaudit is preliminary work conducted by an auditor prior to the scheduled start date of an audit. The intent of a preaudit is to gather preliminary information about the client, which can be used to highlight any areas that may require special attention during the audit. The findings from the preaudit are then considered when deriving the budget for the audit.

Let's personalize your content