IRS adjusts HSA amounts for inflation in 2025

Accounting Today

MAY 9, 2024

The Internal Revenue Service issued the annual inflation adjustments for health savings accounts in 2025 as prices continue to rise.

Accounting Today

MAY 9, 2024

The Internal Revenue Service issued the annual inflation adjustments for health savings accounts in 2025 as prices continue to rise.

Intuit

MAY 9, 2024

This interview was originally published on POCIT. Petagae Butcher’s introduction to technology started with a love of Super Nintendo in the 90s. She later graduated from the University of Central Florida with a degree in Management Information Systems, initially majoring in Computer Programming, finding her niche bridging the technology and business worlds.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Accounting Today

MAY 9, 2024

Overall, a better experience, but there were still some bumps on the road to April 18.

Accounting Department

MAY 9, 2024

The government contracting sector is highly regulated and requires strict compliance with Defense Contract Audit Agency (DCAA) regulations. With ever-evolving regulations and a complex accounting system to manage, the government contract (GovCon) industry has a steep learning curve for small and medium-sized contractors. However, technology has revolutionized business processes by simplifying accounting and ensuring DCAA compliance.

Speaker: Joe Wroblewski, Sales Engineer Manager

Automating time-consuming manual tasks can save your firm hundreds of hours–and thousands of dollars. But it can also have longer-lasting benefits, like helping you attract and retain the next generation of CPAs, and we don’t need to tell you how important that is amid the current generational staffing crisis in the tax and accounting profession. You'll want to save your seat for this new webinar with industry expert Joe Wroblewski, where we'll explore how to: Maximize ROI with Cost-Effective Te

Accounting Today

MAY 9, 2024

CliftonLarsonAllen, a Top 10 Firm, has acquired Engine B, a London-based company that helps accounting firms get more insights from their clients' data, effective May 1.

Insightful Accountant

MAY 9, 2024

While we received some 'generic' App interest to our last posting, Insightful Accountant is currently looking for a few good ProAdvisors who can provide analysis specifically of eCommerce apps.

Financial Ops World brings together the best financial operations content from the widest variety of thought leaders.

Counto

MAY 9, 2024

Essential Steps When Changing Your Company’s Registered Address in Singapore When you change your company’s registered address in Singapore, it’s crucial to ensure all related legal and operational updates are handled meticulously to comply with local regulations and maintain smooth communications. 1. Update Your Company Secretary Records As a general rule, it is crucial to notify your company secretary of any changes to your company’s information and/or address.

Accounting Today

MAY 9, 2024

Sikich LLC, a Top 50 Firm based in Chicago, has snagged a $250 million minority investment from private equity firm Bain Capital to fund further acquisitions and growth, becoming the latest in a series of firms to score PE money.

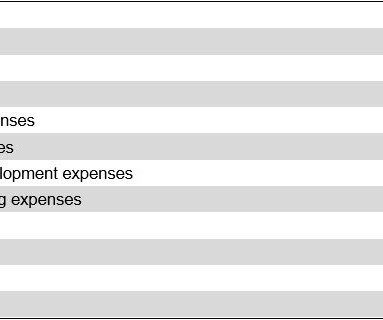

Accounting Tools

MAY 9, 2024

What Does it Mean to Report Expenses by Function? When expenses are reported by function, they are being reported by the type of activity being conducted. Examples of income statement line items that are presented by function are administrative expenses , financing expenses, manufacturing expenses, marketing expenses, and selling expenses. Or, a nonprofit entity that reports expenses by function could do so by aggregating its expenses into the following general functions: Programs, fund raising,

Accounting Today

MAY 9, 2024

An interpreter for the Los Angeles Dodgers star has agreed to plead guilty to criminal charges including filing a false tax return after secretly transferring about $17 million from the player's account to pay off gambling debt.

Advertisement

Automation generally supercharges any process and brings its value to the forefront. See how infusing automation such as ART (our month-end close solution), into your close can get you to the next level of closing. We will share a live demo of SkyStem's solution, ART and share the key elements of month-end close automation. Through ART, we'll take a look at: What month-end close automation entails Which process steps can and should be automated Benefits of achieving process automation, and Why i

Accounting Tools

MAY 9, 2024

Acquisition integration is the process of combining the operations and systems of an acquired business with those of the acquirer. This is needed so that the acquirer can achieve benefits from its acquisition as soon as possible. There are a number of steps involved in acquisition integration, of which the following are the most essential. Step 1: Appoint an Integration Manager Assign the integration task to one of the acquirer's managers who has significant experience and seniority within the c

Accounting Today

MAY 9, 2024

The Internal Revenue Service and the Treasury Department plan to issue regulations on the interplay between foreign tax credits, dual consolidated losses and OECD rules.

Accounting Tools

MAY 9, 2024

What are the Elements of Financial Statements? The elements of financial statements are the general groupings of line items contained within the statements. These groupings will vary, depending on the structure of the business. Thus, the elements of the financial statements of a for-profit business vary somewhat from those incorporated into a nonprofit business (which has no equity accounts ).

Accounting Today

MAY 9, 2024

Bodies of evidence; the Ultimate crime; one expensive ghost; and other highlights of recent tax cases.

Advertiser: Paycor

Mid-year performance reviews aren’t just boxes for HR to check. Paycor’s toolkit empowers leaders to: Identify high-potential team members. Boost engagement with meaningful feedback. Support struggling employees. Nurture top talent to drive results. Learn how to ignite employee potential through meaningful feedback. When you nurture top talent, everybody wins.

Insightful Accountant

MAY 9, 2024

Tax pros post-tax season: vacation or dive into to-do list? Heavy workload can overwhelm, hindering productivity. Strategic techniques help navigate overwhelm efficiently and reduce stress.

Accounting Today

MAY 9, 2024

The first step in identifying invoice fraud and stopping it is knowing what you're looking for.

Jetpack Workflow

MAY 9, 2024

Podcast Summary In this episode of Growing Your Firm, brought to you by Jetpack Workflow, host David Cristello welcomes back Geni Whitehouse, founder of The Impactful Advisor and Information Technology Alliance (ITA) president, who specializes in the wine industry. Geni, also known as the Countess of Communication and author of “ How to Make a Boring Subject Interesting: 52 Ways Even a Nerd Can Be Heard ,” discusses the latest trends in her membership base, the importance of niche a

Billing Platform

MAY 9, 2024

The finance industry is experiencing a paradigm shift driven by the rapid advancements in artificial intelligence (AI) and machine learning (ML). These technologies are not just buzzwords. At the forefront of this transformation is the implementation of AI in various financial processes , including billing. AI in finance is redefining how financial institutions operate, manage risks, and interact with customers.

Speaker: Victor C. Barnes, CPA, MBA

In the climb from contributor to leader, the rules quietly change. If you’re aiming for the summit, the air gets thinner—and what got you here won’t be enough to get you to the top (a concept first popularized by Marshall Goldsmith in his book What Got You Here Won’t Get You There ). What made you successful early in your finance career—technical accuracy, sharp analysis, flawless execution—won’t be what carries you to the next level.

accountingfly

MAY 9, 2024

Top Remote Accounting Candidates This Week Looking for remote accountants? Accountingfly can help! With our ‘ Always-On Recruiting ‘ program, you can access highly skilled and experienced remote accountants with no upfront cost. These are just a few of our top candidates this week. Sign up now to receive the full list of top accounting candidates available weekly!

Insightful Accountant

MAY 9, 2024

A new 'Generative AI' report from Thomson Reuters shows 60% of corporate tax professionals now believe Gen AI should be applied to their work, up from 53% in 2023.

Counto

MAY 9, 2024

An Expert Guide to Setting Up a Retail Outlet in Singapore Singapore’s vibrant retail landscape presents a plethora of opportunities for entrepreneurs eager to establish a retail outlet. Whether you are launching a physical store or an online platform, understanding the regulatory, operational, and strategic aspects is crucial. This guide provides a detailed overview of the necessary steps and considerations for starting a retail business in Singapore.

Accounting Tools

MAY 9, 2024

Accumulated depreciation has a credit balance, because it aggregates the amount of depreciation expense charged against a fixed asset. This account is paired with the fixed assets line item on the balance sheet , so that the combined total of the two accounts reveals the remaining book value of the fixed assets. Over time, the amount of accumulated depreciation will increase as more depreciation is charged against the fixed assets, resulting in an even lower remaining book value.

Speaker: Kim Beynon, CPA, CGMA, PMP

The most overlooked, yet most critical, element of transformation is preparing people for change. Automation and AI aren't just technical upgrades, they’re cultural shifts which can challenge identities. That’s why change management isn’t a side project—it’s the foundation. In finance, where precision and process rule, navigating change can feel especially disruptive.

oAppsNet

MAY 9, 2024

Accounts receivable is a fundamental concept in business finance, serving as an essential component of a company’s working capital and cash flow management. This article aims to demystify the accounts receivable process, elucidating its significance, operational mechanisms, challenges, and optimization strategies. By comprehensively exploring its facets, readers will understand how accounts receivable functions within a business context, empowering them with knowledge to enhance financial

Accounting Tools

MAY 9, 2024

What is Management’s Discussion and Analysis? Management's discussion and analysis is part of the disclosures section of the financial statements , in which prior period performance and projected results are discussed. This is one of the most closely reviewed parts of the financial statements, since a reader can interpret from it the opinions of management regarding the performance and future prospects of a business.

Cloud Accounting Podcast

MAY 9, 2024

The SEC charged Trump's audit firm with a massive fraud – 1,500 fake filings over 2.5 years! Plus, hundreds of small US banks are at risk due to commercial real estate loan exposure. We're also talking about the potential of AI tools like Claude and ChatGPT to automate various accounting and business tasks, the controversial Corporate Transparency Act's beneficial ownership reporting requirements, and the possibility of its repeal.

Accounting Tools

MAY 9, 2024

What is a Cost-Benefit Analysis? Cost-benefit analysis involves weighing the costs associated with a decision against the benefits arising from that decision. The analysis is used to decide whether to proceed with a course of action or not. Cost-benefit analysis can include both quantitative factors and qualitative factors. For example, the analysis of a decision to construct a facility in a particular city could include quantitative factors, such as the amount of tax breaks that can be obtained

Speaker: Mark Gilham, FCCA, CPP

Finance used to be the function that counted, now it's the one that’s counted on. 📊 For accounting firms, controllers, and finance leaders, expectations are rising faster than headcount. Businesses want agile forecasts, granular analysis, seamless reporting, and smart automation—often without added resources while demanding uncompromised accuracy and compliance.

Let's personalize your content