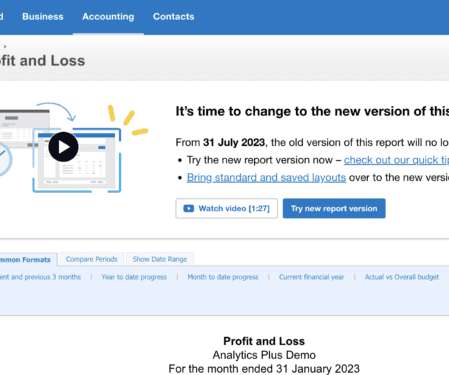

You can now enrol in STP Phase 2 – it’s crunch time to complete your transition

Xero

FEBRUARY 19, 2023

The moment is here; the final step of Xero’s Single Touch Payroll Phase 2 roll out is now available to all customers. Once your payroll data is updated and you’ve marked each step as complete in the STP2 Portal, you’ll be able to enrol in Phase 2 reporting – step four of the transition. This will see your business share more information with the ATO and other government agencies whenever you process a pay run.

Let's personalize your content