The benefits of non-PO invoice process automation

Cevinio

FEBRUARY 25, 2024

Automating non-PO invoices alongside PO invoices brings numerous advantages, contributing to a more efficient and reliable financial process […]

Cevinio

FEBRUARY 25, 2024

Automating non-PO invoices alongside PO invoices brings numerous advantages, contributing to a more efficient and reliable financial process […]

Accounting Today

FEBRUARY 26, 2024

The lowest-ranked states have property and unemployment insurance taxes like every state, but significantly they also have complex, non-neutral taxes with comparatively high rates.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Xero

FEBRUARY 28, 2024

We shared a number of product and tech updates at Xero’s Investor Day in Melbourne on how we are bringing new capabilities to help Xero customers run their operations and manage their finances more efficiently. However, with Generative AI (GenAI) being one of the more recent exciting and emerging technology developments, it was one of the big areas we wanted to share more detail around how we are approaching it and how we see it impacting accounting in the future.

Accounting Department

FEBRUARY 28, 2024

When you have a small or mid-size business, one of the issues you can run into is not having all the departments a larger company would have. In other words, you might not have dedicated employees for HR, accounting, and other areas. Fortunately, there are ways to outsource a number of services, including client accounting services. This helps keep your company growing and succeeding, without the need to bring on more employees or overwork yourself to get everything done.

Speaker: Nancy Wu, Head of Sales and Customer Success at SkyStem

Join us for an enlightening webinar as we delve into the transformative realm of modern accounting practices. In today's digital age, the convergence of outsourcing and automation has revolutionized how businesses manage their financial operations. In this webinar we will explore the synergistic potential of these two strategies to streamline processes, enhance accuracy, save cost and drive strategic decision-making.

Ace Cloud Hosting

FEBRUARY 28, 2024

Life moves fast in the cloud, mirroring the pace of our daily lives. In 2023, unpredictability defined everything from global events to economic trends. Cybersecurity, too, had its share of.

Accounting Today

FEBRUARY 26, 2024

The Federal Trade Commission filed a complaint against tax prep giant H&R Block accusing the company of deceptively marketing "free" online tax filing when its products often were not free and deleting consumers' data when they tried to downgrade to less expensive products.

Financial Ops World brings together the best financial operations content from the widest variety of thought leaders.

Blake Oliver

FEBRUARY 27, 2024

In my latest podcast episode, "How AI is Transforming and Disrupting Audit," I had the pleasure of speaking with Rob Valdez about the impact of artificial intelligence and generative chatbots, like ChatGPT, on the audit profession. We delve into how these technologies are not just automating routine tasks but are also revolutionizing how we train staff, improve quality, and save time on substantive testing.

Ace Cloud Hosting

FEBRUARY 28, 2024

Being targeted by a cyber-attack isn’t just embarrassing; it can also bring significant consequences for your business. As per PwC, the Accounting industry is at a 30% higher risk of.

Accounting Today

FEBRUARY 28, 2024

The ability to write off research and development expenses in the first year would be revived if the Senate ever manages to pass the Tax Relief for American Families and Workers Act.

Xero

FEBRUARY 28, 2024

Paying bills and getting paid on time are critical requirements for small businesses to effectively manage cash flow. However, this is still a very manual process for small businesses. Our Money Matters report found many small businesses utilize multiple payment strategies to manage their cash flow. To tackle this problem, we have announced a new partnership with BILL , a leading financial operations platform for small and midsize businesses (SMBs), to bring bill pay capabilities to our US custo

Speaker: Robbie Bhathal, Founder & CEO, and Matthew Acalin, Head of Credit Intelligence

In today's volatile financial environment, how confident are you in your company’s financial forecasting? To get the most accurate cash predictions that will lead to long-term financial survival, real-time data is critical. Innovative cash management strategies can lead to better credit opportunities, more sustainable growth, and long-term financial prosperity.

FundThrough

FEBRUARY 29, 2024

Welcome to 2024, a year that’s already presenting a significant challenge for small businesses with the one-two punch of high interest rates and rising inflation. It’s a scenario that’s putting the financial resilience of entrepreneurs to the test. With the Bank of Canada’s key rate steady at 5% and similar U.S. rates peaking at a […] The post Small Business in 2024: Tackling High Interest Rates and Credit Crunch appeared first on FundThrough.

Ace Cloud Hosting

FEBRUARY 28, 2024

When it comes to tax preparation software, accounting professionals often find themselves at a crossroads, debating between popular options like Lacerte and ProSeries. Intuit has developed both Lacerte tax and.

Accounting Today

FEBRUARY 27, 2024

The Public Company Accounting Oversight Board is proposing a new rule to prevent auditing firms from making false or misleading statements about being registered or overseen by the PCAOB.

Insightful Accountant

FEBRUARY 28, 2024

With millions of tax refunds going out each week, the IRS reminded taxpayers today that recent improvements to “Where's My Refund?” on IRS.gov provide more information and remains the best way to check the status of a refund.

Advertisement

The status quo for AP in small and mid-market companies is broken. It consists of messy tech stacks of siloed solutions that give rise to manual work, a lack of control, wasted spend, and unnecessary risks. The benefits of shifting to spend management are tangible, measurable, and are felt across the whole organization. Spend management is a different way of thinking and an innovation whose time has come.

Accounting Tools

MARCH 1, 2024

What is Tax Accounting? Tax accounting refers to the rules used to generate tax assets and liabilities in the accounting records of a business or individual. Tax accounting is derived from the Internal Revenue Code (IRC), rather than one of the accounting frameworks , such as GAAP or IFRS. Tax accounting may result in the generation of a taxable income figure that varies from the income figure reported on an entity's income statement.

Ace Cloud Hosting

FEBRUARY 28, 2024

QuickBooks is a popular accounting software choice for businesses of all sizes, but the decision can get tricky when it comes to QuickBooks Enterprise and QuickBooks Online. Both offer excellent.

Accounting Today

MARCH 1, 2024

The lack of help means current accountants' hours and workloads can be grueling, upping the odds of mistakes and burnout.

Insightful Accountant

FEBRUARY 28, 2024

Accelerating the companies’ joint vision for a connected suite of e-invoicing and indirect tax solutions for customers across the globe.

Speaker: Carolina Aponte - Owner and CEO, Caja Holdings LLC

In today's rapidly changing business environment, building a resilient balance sheet is crucial to the survival of any business. A resilient balance sheet allows a company to withstand financial shocks and adapt to changing market conditions. To achieve this, companies need to focus on key strategies such as maintaining adequate liquidity, managing debt levels, diversifying revenue streams, and prioritizing profitability over growth.

Accounting Tools

FEBRUARY 26, 2024

What is a General Ledger? A general ledger is the master set of accounts that summarize all transactions occurring within an entity. The general ledger is comprised of all the individual accounts needed to record the assets , liabilities , equity , revenue , expense , gain , and loss transactions of a business. What is a Trial Balance? The trial balance is a report run at the end of an accounting period, listing the ending balance in each general ledger account.

Ace Cloud Hosting

MARCH 1, 2024

Are you looking to integrate Sage 50 cloud hosting into your business’s operations? If so, this guide is the perfect place to start. Cloud-based accounting solutions like Sage 50 offer.

Accounting Today

FEBRUARY 26, 2024

Planners who recommend the increasingly popular charitable vehicles could face penalties for what's currently a pretty common practice in the industry, experts say.

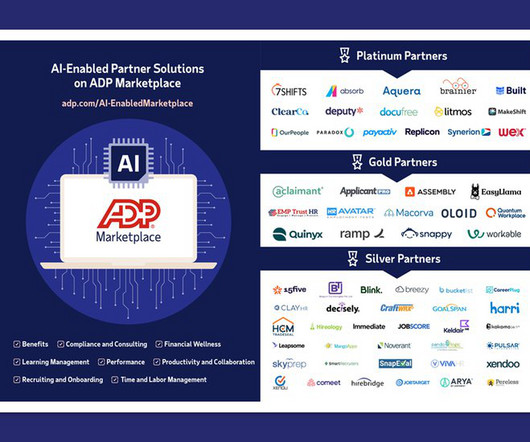

Insightful Accountant

FEBRUARY 25, 2024

ADP® is offering AI-Enabled Partner Solutions on their powerful, simple and secure ADP Marketplace so HR leaders can rapidly source and implement the benefits of AI across their HCM ecosystems.

Advertisement

All accounting teams know what it is like to dread the inevitable month-end scaries. If there was a way to feel less burdened and maybe even a little enthusiastic to work on your month-end close and reconciliation process, would you do it? No, don't answer that, of course you would! Automate your month-end close process by up to 40% with SkyStem's ART and see how much more alive you feel!

Accounting Tools

FEBRUARY 25, 2024

What is Net Present Value? Net present value (NPV) discounts the stream of expected cash flows associated with a proposed project to their current value, which presents a cash surplus or loss for the project. It is used to evaluate a proposed capital expenditure. A desirable investment is one that yields a positive net present value, which implies that a business will receive excess cash over time as a result of the investment.

Ace Cloud Hosting

FEBRUARY 28, 2024

QuickBooks is a popular accounting software choice for businesses of all sizes, but the decision can get tricky when it comes to QuickBooks Enterprise and QuickBooks Online. Both offer excellent.

Accounting Today

FEBRUARY 27, 2024

The Internal Revenue Service issued a notice granting an administrative exemption from the electronic filing requirements for the Annual Withholding Tax Return for U.S. Source Income of Foreign Persons.

Insightful Accountant

FEBRUARY 27, 2024

FinQuery’s new contract management solution is purpose-built to provide insight and intelligence into organizations’ contractual financial obligations

Speaker: Wayne Spivak, President and CFO of SBA * Consulting Ltd., Industry Writer, Public Speaker

If you’re lost in the world of spend management needs and your GAP analysis is lacking perspective on the future state of your business performance, listen up! With the advancement of technology, the implementation of spend management best practices and concrete GAP analyses is more streamlined and accessible than ever before. And while this may sound like great news for you and your clients, it won’t be worthwhile unless you have the latest techniques to back up your ambitions!

Accounting Tools

FEBRUARY 26, 2024

What is Capital Budgeting? Capital budgeting is a set of techniques used to decide when to invest in projects. For example, one would use capital budgeting techniques to analyze a proposed investment in a new warehouse, production line, or computer system. There are a number of capital budgeting techniques available, which include the following alternatives.

IMA's Count Me

FEBRUARY 25, 2024

Welcome to the Count Me In Podcast, where we bring you conversations with top industry professionals and thought leaders. In this episode, host Adam Larson sits down with Jonathan Smalley , Co-Founder at Proxymity , for a deep dive into shareholder engagement in the corporate world. They discuss the critical importance of strengthening shareholder engagement, the impact on investor relations, and the ongoing digital transformation of proxy voting.

Accounting Today

MARCH 1, 2024

Stubbornly persistent differences between white and Black households' income and assets present financial advisors with the big-picture implications of their work.

Insightful Accountant

FEBRUARY 28, 2024

In a dynamic conversation, Gary and Randy explore ways for tax professionals to expand their business leveraging the U.S. Tax Code.

Speaker: Ryan Dillard, Chief of Staff Director at CBIZ ARC Consulting LLC; Kelly Hicks, Global Controller at Airbase

ASC 606 is the revenue recognition standard that sets global accounting principles for all private or public companies that enter sales agreements or contracts with customers. Along with ASC 606, ASC 340-40 was added to address accounting costs to obtain a contact and costs to fulfill a contract. Join us for this webinar when Airbase Controller Kelly Hicks and Ryan Dillard, a Director at CBIZ ARC Consulting explore how to approach capitalizing sales commissions under ASC 340-40.

Let's personalize your content