Reporting expenses by function

Accounting Tools

MAY 9, 2024

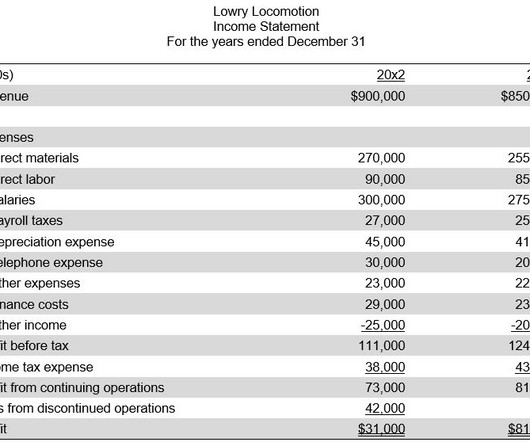

This approach does not yield expense totals by department. Instead, separate expense reports must be prepared for each department. A sample income statement that reports expenses by their nature appears next.

Let's personalize your content