Free Expense Report Template

Nanonets

MAY 9, 2023

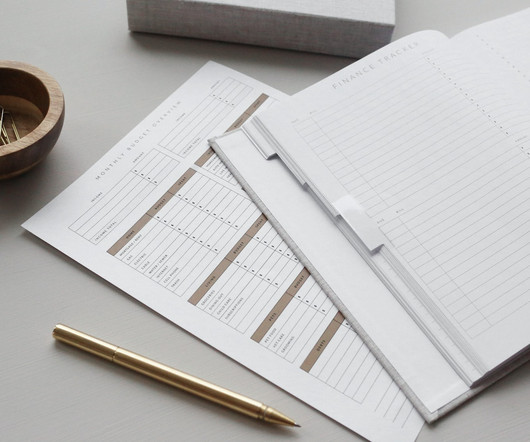

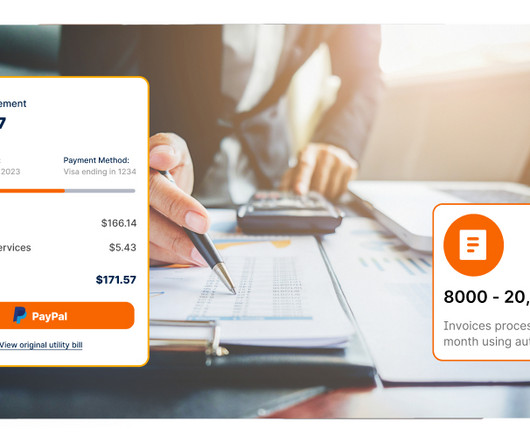

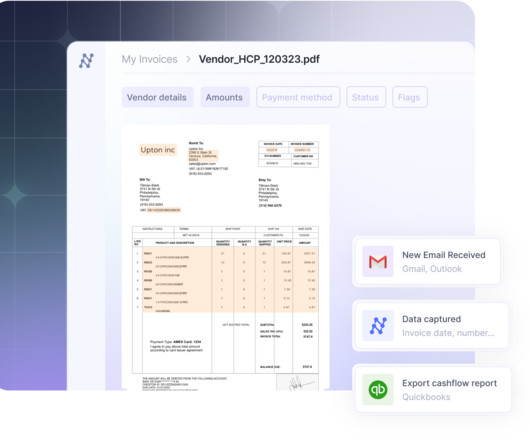

What is an Expense Report? The expense report aids in tracking employee expenses for office tasks. The expense report provides visibility into employee spending and acts as a reference point during employee reimbursement processes. How does expense report work? Learn more.

Let's personalize your content