8 Best Quick Books Billing Solutions Alternatives For 2024

Outsourced Bookeeping

MAY 7, 2024

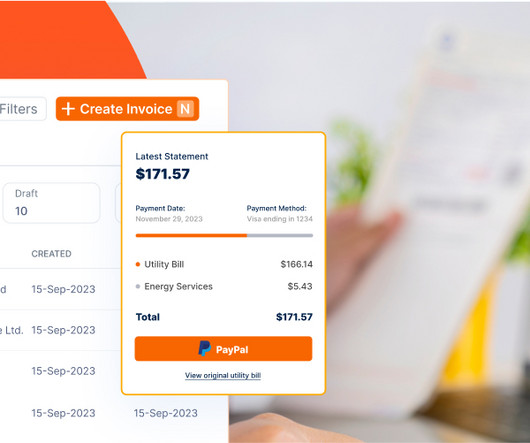

ZarMoney Yet another powerful alternative by QuickBooks is ZarMoney, a cloud-based billing software suitable for modern business accounting. Keeping in mind the user experience, ZarMoney offers a variety of billing features, such as automated billing, online invoicing, and online payment embedded in the same platform.

Let's personalize your content