California Construction Company Goes Paperless with AP Automation

AvidXchange

OCTOBER 12, 2022

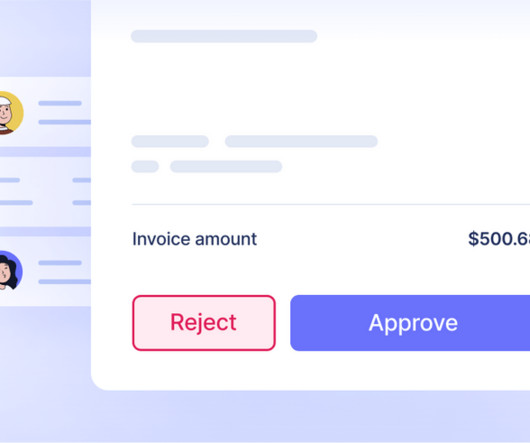

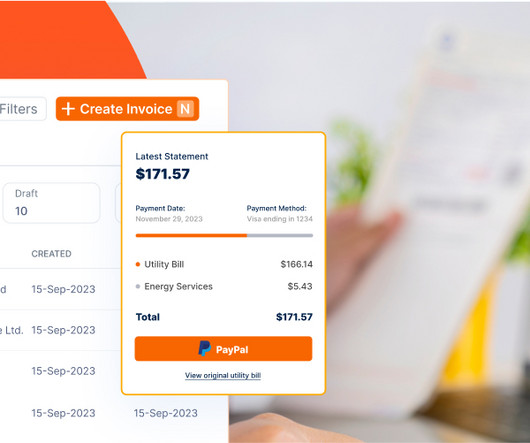

He oversees the firm’s AP work with TimberScan Titanium and Acumatica, handling routing and permission setups, onboarding of new users and day-to-day administration of the financial software solutions. With a few clicks, they can run monthly reports of invoices and approvals to submit to their clients for reimbursement.

Let's personalize your content