Top 10 Bookkeeping Mistakes Small Businesses Make and How to Avoid Them

Less Accounting

APRIL 2, 2024

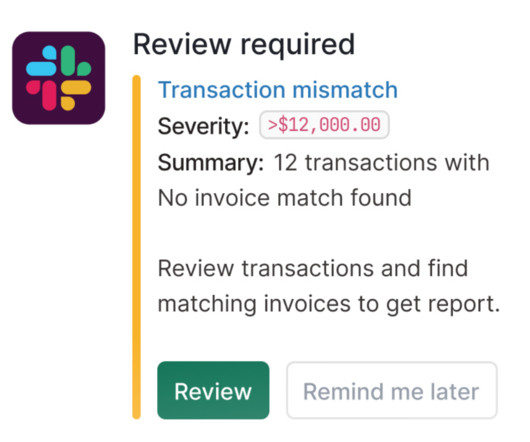

Mixing personal expenses with business transactions can lead to confusion, inaccuracies, and tax complications. Without accurate records of income, expenses, and receipts, it becomes challenging to track your business’s financial health, prepare tax returns, or analyze profitability. We can help!

Let's personalize your content