Intuit debuts AI agents for QuickBooks

Accounting Today

JUNE 26, 2025

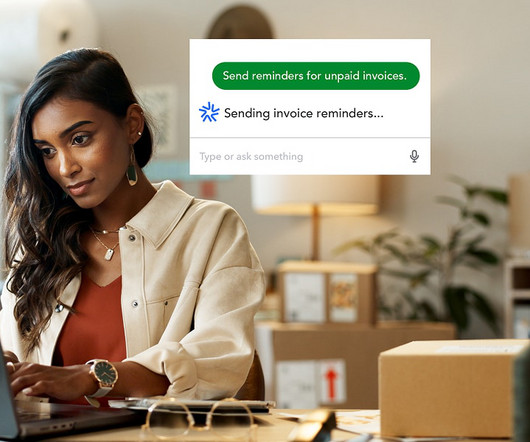

The new AI agents have been incorporated into a redesigned, personalized QuickBooks web layout. The QuickBooks mobile app interface has also been redesigned to deliver the AI agents on the go. All rights reserved. Project Management Agent: Manages project quotes, milestones and budgets to keep businesses on track with their projects.

Let's personalize your content