New York passes licensure changes bill

Accounting Today

JUNE 13, 2025

The New York State Legislature passed a bill establishing an additional pathway to CPA licensure, and another bill authorizing the use of electronic signatures.

Accounting Today

JUNE 13, 2025

The New York State Legislature passed a bill establishing an additional pathway to CPA licensure, and another bill authorizing the use of electronic signatures.

Accounting Department

JUNE 17, 2025

We are delighted to announce that AccountingDepartment.com has been included in the Inc. Best Workplaces list for the fourth year in a row, along with 514 other amazing companies that prioritize their people! This 2025 recognition underscores the success of the workplace environment we have nurtured over the past 21 years. We are honored to be recognized as an Inc.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Accounting Today

JUNE 11, 2025

A recent report from CPA.com says that semi-autonomous AI bots are already completing bookkeeping workflows start to finish, fully automating the process.

Ascend Software blog

JUNE 16, 2025

In many enterprise organizations, accounts payable has long been seen as a quiet, operational function — efficient, reliable, and often overlooked. But that perception is changing. Leading finance teams are beginning to recognize AP not just as a transactional necessity, but as a strategic asset. With the right systems in place, AP becomes a source of real-time financial insight, operational resilience, and cross-functional agility.

Speaker: Joe Wroblewski, Sales Engineer Manager

Automating time-consuming manual tasks can save your firm hundreds of hours–and thousands of dollars. But it can also have longer-lasting benefits, like helping you attract and retain the next generation of CPAs, and we don’t need to tell you how important that is amid the current generational staffing crisis in the tax and accounting profession. You'll want to save your seat for this new webinar with industry expert Joe Wroblewski, where we'll explore how to: Maximize ROI with Cost-Effective Te

Intuit

JUNE 11, 2025

How to become a data scientist Data scientists are in high demand—and for good reason. Companies rely on them to turn large, messy datasets into insights that drive smarter decisions. It’s a role that offers strong job growth, competitive pay, and the flexibility to work across industries (and even remotely). In fact, data scientists command a median salary in the six figures ($112,590), according to US Bureau of Labor Statistics data.

Compleatable

JUNE 13, 2025

Introduction: Summer Is the Smart Season for Change For multi-academy trusts , summer brings a much-needed lull. With schools closed and fewer day-to-day pressures, it’s the ideal time to step back and tackle improvements that are hard to prioritise during the academic year. One of the most valuable changes you can make? Automating your purchasing and accounts payable processes.

Financial Ops World brings together the best financial operations content from the widest variety of thought leaders.

Ace Cloud Hosting

JUNE 11, 2025

Most accounting firms want more clients. However, few have a system to attract them consistently. Too often, growth is left to chance, relying on referrals, generic marketing, or time-consuming tactics.

Accounting Department

JUNE 12, 2025

When it comes to scaling and growing your business, understanding and managing your finances is more crucial than ever. Financial Planning and Analysis (FP&A) services from AccountingDepartment.com offer small to medium-sized businesses (SMBs) a powerful tool to not just survive but thrive in an increasingly competitive market.

Intuit

JUNE 17, 2025

How to become an entrepreneur: 8 actionable steps Is your heart steering you toward being your own boss and making an impact in the world? If so, you may have researched entrepreneurship but don’t know where to start. Fortunately, this 8-step guide offers actionable advice on how to become an entrepreneur. We’ll break down the process to set you on the right path.

Stephanie Peterson

JUNE 17, 2025

If you’re earning well and considering what to do with that extra cash — the thought has probably crossed your mind: Should I invest in a luxury car… or real estate?It’s a conversation I’ve had with many clients across Murrieta, Temecula, Wildomar, Menifee, and Southern California. As a virtual bookkeeper and QuickBooks ProAdvisor, I help business owners and high earners make financial decisions that protect their cash flow and grow their net worth.

Advertisement

Automation generally supercharges any process and brings its value to the forefront. See how infusing automation such as ART (our month-end close solution), into your close can get you to the next level of closing. We will share a live demo of SkyStem's solution, ART and share the key elements of month-end close automation. Through ART, we'll take a look at: What month-end close automation entails Which process steps can and should be automated Benefits of achieving process automation, and Why i

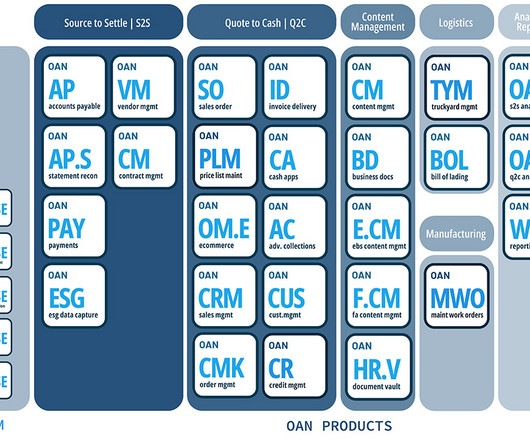

oAppsNet

JUNE 14, 2025

In today’s fast-paced business environment, managing cash flow effectively is paramount for sustaining operations and fueling growth. For finance leaders, Days Payable Outstanding (DPO) is one of the most important financial ratios to track. This ratio measures how long it takes a company, on average, to pay its bills, including invoices from suppliers, vendors, and creditors.

Trade Credit & Liquidity Management

JUNE 11, 2025

By Robert DiNozzi Merchant Cash Advance (MCA) agreements have become a prevalent form of alternative financing, particularly among small and distressed businesses. Marketed as sales of future receivables rather than traditional loans, these agreements allow funders to withdraw fixed daily or weekly payments directly from a business’s bank account until a predefined “purchase amount” has been satisfied.

Intuit

JUNE 11, 2025

What is a data engineer, and what do they do? Your online orders. Your favorite playlists. Even your personalized news feed. It all runs on data. But raw data on its own doesn’t deliver those experiences. It has to be collected, cleaned, and moved into place. That’s where data engineers come in. But what is a data engineer, exactly? Simply put, they’re the people who make sure data gets where it needs to go in a clean, reliable format that’s ready for action.

Gaviti

JUNE 11, 2025

The Basics of Payment Systems in Business As modern commerce continues to evolve, businesses are adopting more efficient and customer-friendly ways to receive payments. Among the most commonly used digital payment systems in the B2B landscape are credit card payments and ACH (Automated Clearing House) transfers. These systems not only accelerate cash flow but also streamline the payment process, reducing friction in the order-to-cash cycle.

Advertiser: Paycor

Mid-year performance reviews aren’t just boxes for HR to check. Paycor’s toolkit empowers leaders to: Identify high-potential team members. Boost engagement with meaningful feedback. Support struggling employees. Nurture top talent to drive results. Learn how to ignite employee potential through meaningful feedback. When you nurture top talent, everybody wins.

Accounting Today

JUNE 11, 2025

Author Login Subscribe ACCOUNTING Accounting Accounting standards International accounting ESG CAS Accounting Accounting standards International accounting ESG CAS TAX Tax Tax preparation IRS Tax Planning Corporate taxes Tax fraud Tax Legislation International taxes Tax Tax preparation IRS Tax Planning Corporate taxes Tax fraud Tax Legislation International taxes AUDIT Audit Audit standards PCAOB SEC Audit Audit standards PCAOB SEC PRACTICE MANAGEMENT Practice management Recruiting Retention Acc

Ace Cloud Hosting

JUNE 18, 2025

In the fast-evolving accounting landscape of 2025, staying ahead means embracing technology that enhances efficiency, accuracy, and client satisfaction. Accounting Practice Management Software (APMS) has emerged as a game-changer for.

Trade Credit & Liquidity Management

JUNE 12, 2025

From a Press Release dated June 9, 2025, Fort Lee, NJ Cross River Bank has launched its Request for Payment (RfP) solution, a new feature designed to enable secure, real-time inbound payments via the RTP® (Real-Time Payments) network. This innovation addresses a longstanding imbalance in money movement: while outbound payments have become nearly instantaneous, incoming payments have typically relied on slower methods like ACH and wire transfers, which are limited by batch processing and ban

Intuit

JUNE 17, 2025

An ‘aha! moment’ happens when sudden insight breaks through the usual stream of thoughts. This moment of clarity can arise during problem-solving efforts, or it can emerge unexpectedly, providing a fresh perspective or novel idea. These leaps of insights can lead to innovation breakthroughs—especially when technologists are encouraged to embrace a builder’s mindset that extends beyond mere creation.

Speaker: Victor C. Barnes, CPA, MBA

In the climb from contributor to leader, the rules quietly change. If you’re aiming for the summit, the air gets thinner—and what got you here won’t be enough to get you to the top (a concept first popularized by Marshall Goldsmith in his book What Got You Here Won’t Get You There ). What made you successful early in your finance career—technical accuracy, sharp analysis, flawless execution—won’t be what carries you to the next level.

Gaviti

JUNE 13, 2025

In the fast-paced world of finance, businesses are under constant pressure to make smarter, faster, and more accurate decisions. From managing liquidity and evaluating creditworthiness to optimizing collections and forecasting risk, finance teams rely on data to power their every move. Despite this fast pace, traditional approaches to financial management, often rule-based and reactive, are beginning to show their limitations in a dynamic global economy.

Accounting Today

JUNE 16, 2025

AICPA chair Lexy Kessler looks ahead at the challenges and opportunities that are facing the profession, and what accountants need to do to be ready for them.

Remote Quality Bookkeeping

JUNE 15, 2025

Business bankruptcy is rarely the result of a single misstep. It’s usually a culmination of warning signs that go unnoticed or unaddressed for too long. With recent data showing that overall bankruptcy filings rose 13.1% during the 12-month period ending March 31, 2025 , the need to recognize trouble early has never been more urgent for small businesses.

Trade Credit & Liquidity Management

JUNE 16, 2025

A properly managed Accounts Receivables (AR) portfolio is essential to maintain the liquidity your company needs to sustain its business and grow. This requires efficient and effective collection practices, a well-trained staff, and some degree of process automation. Reaching out to customers by email to collect open balances is a key element in a comprehensive collection approach.

Speaker: Kim Beynon, CPA, CGMA, PMP

The most overlooked, yet most critical, element of transformation is preparing people for change. Automation and AI aren't just technical upgrades, they’re cultural shifts which can challenge identities. That’s why change management isn’t a side project—it’s the foundation. In finance, where precision and process rule, navigating change can feel especially disruptive.

Insightful Accountant

JUNE 11, 2025

Skip to main content Search Learn More About Our Premium Content | Subscribe To Our Newsletters facebook twitter youtube linkedin instagram RSS Accounting Platforms General Ledger Payroll & Merchant Services Vendor Corner APPS Directory Top ProAdvisor Awards Top ProAdvisor Awards People & Business Practice Management APP Academy Tax Practice News Webinars/Events In Person Events Free Webinars Webinar Archives Podcasts Premium Content General Ledger Payroll & Merchant Services Vendor

Gaviti

JUNE 15, 2025

In the dynamic world of B2B transactions, managing financial risk is crucial to ensuring sustainable growth. One area that often gets overlooked until disaster strikes is the exposure embedded in outstanding receivables. When a customer defaults or declares bankruptcy, your company might be left scrambling to recover payment, if recovery is even possible.

Accounting Today

JUNE 11, 2025

Author Login Subscribe ACCOUNTING Accounting Accounting standards International accounting ESG CAS Accounting Accounting standards International accounting ESG CAS TAX Tax Tax preparation IRS Tax Planning Corporate taxes Tax fraud Tax Legislation International taxes Tax Tax preparation IRS Tax Planning Corporate taxes Tax fraud Tax Legislation International taxes AUDIT Audit Audit standards PCAOB SEC Audit Audit standards PCAOB SEC PRACTICE MANAGEMENT Practice management Recruiting Retention Acc

FundThrough

JUNE 16, 2025

We’re excited to share the latest innovations in the FundThrough platform—updates designed to make your funding experience faster, easier, and more transparent. With improvements to reporting tools, customer management, and invoice uploads, along with a new way to fund for Enverus clients, these changes are all about helping you access capital more efficiently.

Speaker: Mark Gilham, FCCA, CPP

Finance used to be the function that counted, now it's the one that’s counted on. 📊 For accounting firms, controllers, and finance leaders, expectations are rising faster than headcount. Businesses want agile forecasts, granular analysis, seamless reporting, and smart automation—often without added resources while demanding uncompromised accuracy and compliance.

Trade Credit & Liquidity Management

JUNE 11, 2025

The vulnerability of applicants, customers, and their customers to cyberattacks should be a major concern of credit executives. Cyber-risks are a core vulnerability that your counterparts in Third Party Risk Management (TPRM) and Supply Chain Management (SCM) are already tracking. You should do the same. Cyberattacks are being perpetrated on customers of all sizes and industries.

Nolan Accounting Center

JUNE 15, 2025

Accurate bookkeeping is essential for the success of every business enterprise. And central to accurate bookkeeping is the concept of double-entry accounting, where debit and credit entries are used to record all transactions. What Do Debit and Credit Mean? Keeping the financial records of every business in order requires tracking all the money flowing in and out of the company.

Jetpack Workflow

JUNE 11, 2025

With a constant barrage of client work and administrative tasks, you’ve decided you need help – and virtual assistants (VAs) seem like the most cost-effective solution. So far, so good. But are you setting your VAs up for success… or failure? Hiring a virtual assistant for CPAs isn’t as simple as conducting a virtual interview and sending a few emails.

Accounting Today

JUNE 13, 2025

Author Login Subscribe ACCOUNTING Accounting Accounting standards International accounting ESG CAS Accounting Accounting standards International accounting ESG CAS TAX Tax Tax preparation IRS Tax Planning Corporate taxes Tax fraud Tax Legislation International taxes Tax Tax preparation IRS Tax Planning Corporate taxes Tax fraud Tax Legislation International taxes AUDIT Audit Audit standards PCAOB SEC Audit Audit standards PCAOB SEC PRACTICE MANAGEMENT Practice management Recruiting Retention Acc

Advertiser: Paycor

Great leadership development is the key to sustainable business growth. Are you ready to design an effective program? HR can use Paycor’s framework to: Set achievable goals. Align employee and company needs. Support different learning styles. Empower the next generation of leaders. Invest in your company’s future with a strong leadership development program.

Let's personalize your content