Bookkeeping now fully automated, tax compliance not far behind

Accounting Today

JUNE 11, 2025

A recent report from CPA.com says that semi-autonomous AI bots are already completing bookkeeping workflows start to finish, fully automating the process.

Accounting Today

JUNE 11, 2025

A recent report from CPA.com says that semi-autonomous AI bots are already completing bookkeeping workflows start to finish, fully automating the process.

Intuit

JUNE 11, 2025

How to become a data scientist Data scientists are in high demand—and for good reason. Companies rely on them to turn large, messy datasets into insights that drive smarter decisions. It’s a role that offers strong job growth, competitive pay, and the flexibility to work across industries (and even remotely). In fact, data scientists command a median salary in the six figures ($112,590), according to US Bureau of Labor Statistics data.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Accounting Department

JUNE 10, 2025

Financial management is the backbone of any business, enabling owners to steer toward growth, stability, and long-term success. However, as businesses evolve and financial complexities escalate, choosing the right accounting model becomes a pressing decision. Should you rely on in-house expertise or entrust an outsourced accounting service? With rapid advancements in technology, talent shortages, and the rise of remote work, this decision is even more significant as we approach 2025.

Ascend Software blog

JUNE 10, 2025

The Legacy Automation Problem Enterprise finance has outpaced the platforms built to support it. Automation was supposed to simplify invoice processing — faster approvals, fewer errors, cleaner workflows. But for many organizations, it’s introduced a different kind of inefficiency. Most AP automation tools are built on fixed templates, rigid routing paths, and logic that assumes your business will operate the same way tomorrow as it does today.

Speaker: Joe Wroblewski, Sales Engineer Manager

Automating time-consuming manual tasks can save your firm hundreds of hours–and thousands of dollars. But it can also have longer-lasting benefits, like helping you attract and retain the next generation of CPAs, and we don’t need to tell you how important that is amid the current generational staffing crisis in the tax and accounting profession. You'll want to save your seat for this new webinar with industry expert Joe Wroblewski, where we'll explore how to: Maximize ROI with Cost-Effective Te

Intuit

JUNE 10, 2025

Giovani, a Polytechnic High School senior, is graduating high school with a spatula in one hand and big dreams in the other. He’s part of the Intuit Food Truck Program at his school in Los Angeles, CA. This free program provides students with hands-on business experience using an Intuit donated food truck, curriculum, grants, and Intuit’s QuickBooks Online and Mailchimp products.

Compleatable

JUNE 13, 2025

Introduction: Summer Is the Smart Season for Change For multi-academy trusts , summer brings a much-needed lull. With schools closed and fewer day-to-day pressures, it’s the ideal time to step back and tackle improvements that are hard to prioritise during the academic year. One of the most valuable changes you can make? Automating your purchasing and accounts payable processes.

Financial Ops World brings together the best financial operations content from the widest variety of thought leaders.

Ace Cloud Hosting

JUNE 11, 2025

Most accounting firms want more clients. However, few have a system to attract them consistently. Too often, growth is left to chance, relying on referrals, generic marketing, or time-consuming tactics.

Ascend Software blog

JUNE 9, 2025

In recent years, the finance function in higher education has quietly become one of the most operationally strained areas across institutions. Behind the scenes, accounts payable (AP) teams are managing increasing volumes of invoices, dispersed across departments, campuses, and sometimes even continents — all while working with outdated systems and lean staffing models.

Accounting Department

JUNE 12, 2025

When it comes to scaling and growing your business, understanding and managing your finances is more crucial than ever. Financial Planning and Analysis (FP&A) services from AccountingDepartment.com offer small to medium-sized businesses (SMBs) a powerful tool to not just survive but thrive in an increasingly competitive market.

Accounting Today

JUNE 11, 2025

Author Login Subscribe ACCOUNTING Accounting Accounting standards International accounting ESG CAS Accounting Accounting standards International accounting ESG CAS TAX Tax Tax preparation IRS Tax Planning Corporate taxes Tax fraud Tax Legislation International taxes Tax Tax preparation IRS Tax Planning Corporate taxes Tax fraud Tax Legislation International taxes AUDIT Audit Audit standards PCAOB SEC Audit Audit standards PCAOB SEC PRACTICE MANAGEMENT Practice management Recruiting Retention Acc

Advertisement

Automation generally supercharges any process and brings its value to the forefront. See how infusing automation such as ART (our month-end close solution), into your close can get you to the next level of closing. We will share a live demo of SkyStem's solution, ART and share the key elements of month-end close automation. Through ART, we'll take a look at: What month-end close automation entails Which process steps can and should be automated Benefits of achieving process automation, and Why i

Xero

JUNE 9, 2025

We’re fast approaching the 2025 Xero Asia Awards ceremony in August! With nominations closing on 20 June, it’s now or never if you’d like to submit your entry and be a part of this highly anticipated night. What are the Xero Asia Awards? A Quick Recap Every year, the Xero Asia Awards recognise the very best in our partner community across the region, honouring their efforts to drive digital accounting forward and enable SMEs across the region to thrive.

Compleatable

JUNE 9, 2025

As we move through the 2024–2025 academic and financial year, academy trusts (MATs and SATs alike) are preparing for one of their most critical financial compliance exercises, the Budget Forecast Return (BFR). This annual submission to the Department for Education (DfE) is more than just a formality, it provides the government with a detailed financial picture of each trust’s position and sustainability over a multi-year horizon.

Intuit

JUNE 11, 2025

What is a data engineer, and what do they do? Your online orders. Your favorite playlists. Even your personalized news feed. It all runs on data. But raw data on its own doesn’t deliver those experiences. It has to be collected, cleaned, and moved into place. That’s where data engineers come in. But what is a data engineer, exactly? Simply put, they’re the people who make sure data gets where it needs to go in a clean, reliable format that’s ready for action.

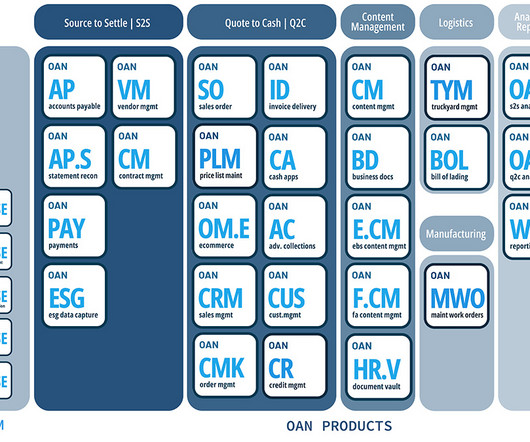

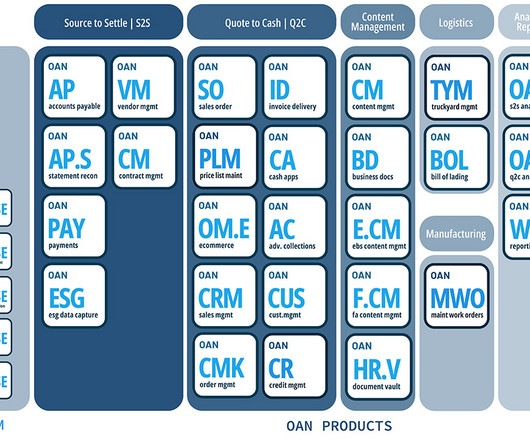

oAppsNet

JUNE 10, 2025

Understanding key performance indicators (KPIs) like return on equity (ROE) is essential for finance professionals, especially those in the CFO’s office. DuPont Analysis is one of the most effective methods for breaking down ROE into its components and uncovering the drivers behind a company’s profitability. Originally developed by DuPont in the 1920s, this robust analytical framework helps businesses see the bigger picture of their financial health and understand where to focus their effo

Advertiser: Paycor

Mid-year performance reviews aren’t just boxes for HR to check. Paycor’s toolkit empowers leaders to: Identify high-potential team members. Boost engagement with meaningful feedback. Support struggling employees. Nurture top talent to drive results. Learn how to ignite employee potential through meaningful feedback. When you nurture top talent, everybody wins.

Accounting Today

JUNE 10, 2025

Author Login Subscribe ACCOUNTING Accounting Accounting standards International accounting ESG CAS Accounting Accounting standards International accounting ESG CAS TAX Tax Tax preparation IRS Tax Planning Corporate taxes Tax fraud Tax Legislation International taxes Tax Tax preparation IRS Tax Planning Corporate taxes Tax fraud Tax Legislation International taxes AUDIT Audit Audit standards PCAOB SEC Audit Audit standards PCAOB SEC PRACTICE MANAGEMENT Practice management Recruiting Retention Acc

Trade Credit & Liquidity Management

JUNE 9, 2025

When reviewing a company’s financial statements to determine an appropriate credit limit, there are a multitude of things to consider. Trends related to revenue, profit, and equity, for example. Reviewing the relationship between key financial factors enables you to dig into the details and have a better perspective on how a company is performing.

Gaviti

JUNE 11, 2025

The Basics of Payment Systems in Business As modern commerce continues to evolve, businesses are adopting more efficient and customer-friendly ways to receive payments. Among the most commonly used digital payment systems in the B2B landscape are credit card payments and ACH (Automated Clearing House) transfers. These systems not only accelerate cash flow but also streamline the payment process, reducing friction in the order-to-cash cycle.

accountingfly

JUNE 9, 2025

As a CPA or accounting firm, you’re always looking for ways to add value to your clients, especially when it comes to their financial operations. One of the best ways you can assist your clients in this area is by helping them hire a remote Controller or Bookkeeper for their in-house positions. More companies are seeking to hire remote financial talent.

Speaker: Victor C. Barnes, CPA, MBA

In the climb from contributor to leader, the rules quietly change. If you’re aiming for the summit, the air gets thinner—and what got you here won’t be enough to get you to the top (a concept first popularized by Marshall Goldsmith in his book What Got You Here Won’t Get You There ). What made you successful early in your finance career—technical accuracy, sharp analysis, flawless execution—won’t be what carries you to the next level.

oAppsNet

JUNE 14, 2025

In today’s fast-paced business environment, managing cash flow effectively is paramount for sustaining operations and fueling growth. For finance leaders, Days Payable Outstanding (DPO) is one of the most important financial ratios to track. This ratio measures how long it takes a company, on average, to pay its bills, including invoices from suppliers, vendors, and creditors.

Accounting Today

JUNE 9, 2025

Fifty-two percent of accountants expect their firms to shrink in headcount by 20% in the next five years, according to a report by the Indiana CPA Society.

Trade Credit & Liquidity Management

JUNE 11, 2025

By Robert DiNozzi Merchant Cash Advance (MCA) agreements have become a prevalent form of alternative financing, particularly among small and distressed businesses. Marketed as sales of future receivables rather than traditional loans, these agreements allow funders to withdraw fixed daily or weekly payments directly from a business’s bank account until a predefined “purchase amount” has been satisfied.

Gaviti

JUNE 13, 2025

In the fast-paced world of finance, businesses are under constant pressure to make smarter, faster, and more accurate decisions. From managing liquidity and evaluating creditworthiness to optimizing collections and forecasting risk, finance teams rely on data to power their every move. Despite this fast pace, traditional approaches to financial management, often rule-based and reactive, are beginning to show their limitations in a dynamic global economy.

Speaker: Kim Beynon, CPA, CGMA, PMP

The most overlooked, yet most critical, element of transformation is preparing people for change. Automation and AI aren't just technical upgrades, they’re cultural shifts which can challenge identities. That’s why change management isn’t a side project—it’s the foundation. In finance, where precision and process rule, navigating change can feel especially disruptive.

Remote Quality Bookkeeping

JUNE 15, 2025

Business bankruptcy is rarely the result of a single misstep. It’s usually a culmination of warning signs that go unnoticed or unaddressed for too long. With recent data showing that overall bankruptcy filings rose 13.1% during the 12-month period ending March 31, 2025 , the need to recognize trouble early has never been more urgent for small businesses.

Insightful Accountant

JUNE 11, 2025

Skip to main content Search Learn More About Our Premium Content | Subscribe To Our Newsletters facebook twitter youtube linkedin instagram RSS Accounting Platforms General Ledger Payroll & Merchant Services Vendor Corner APPS Directory Top ProAdvisor Awards Top ProAdvisor Awards People & Business Practice Management APP Academy Tax Practice News Webinars/Events In Person Events Free Webinars Webinar Archives Podcasts Premium Content General Ledger Payroll & Merchant Services Vendor

Accounting Today

JUNE 13, 2025

The New York State Legislature passed a bill establishing an additional pathway to CPA licensure, and another bill authorizing the use of electronic signatures.

Trade Credit & Liquidity Management

JUNE 12, 2025

From a Press Release dated June 9, 2025, Fort Lee, NJ Cross River Bank has launched its Request for Payment (RfP) solution, a new feature designed to enable secure, real-time inbound payments via the RTP® (Real-Time Payments) network. This innovation addresses a longstanding imbalance in money movement: while outbound payments have become nearly instantaneous, incoming payments have typically relied on slower methods like ACH and wire transfers, which are limited by batch processing and ban

Speaker: Mark Gilham, FCCA, CPP

Finance used to be the function that counted, now it's the one that’s counted on. 📊 For accounting firms, controllers, and finance leaders, expectations are rising faster than headcount. Businesses want agile forecasts, granular analysis, seamless reporting, and smart automation—often without added resources while demanding uncompromised accuracy and compliance.

Gaviti

JUNE 15, 2025

In the dynamic world of B2B transactions, managing financial risk is crucial to ensuring sustainable growth. One area that often gets overlooked until disaster strikes is the exposure embedded in outstanding receivables. When a customer defaults or declares bankruptcy, your company might be left scrambling to recover payment, if recovery is even possible.

Nolan Accounting Center

JUNE 15, 2025

Accurate bookkeeping is essential for the success of every business enterprise. And central to accurate bookkeeping is the concept of double-entry accounting, where debit and credit entries are used to record all transactions. What Do Debit and Credit Mean? Keeping the financial records of every business in order requires tracking all the money flowing in and out of the company.

Compleatable

JUNE 12, 2025

Watch: Control & Streamline Business Purchases with Compleat & Amazon Business Fill in the form to access the on-demand recording of our webinar session looking specifically at how Compleat customers can save time and money with our integration with Amazon Business. Name Work Email Address Job Title Watch the video Watch: Control & Streamline Business Purchases with Compleat & Amazon Business The post Control & Streamline Business Purchases with Compleat & Amazon Busine

Accounting Today

JUNE 11, 2025

Author Login Subscribe ACCOUNTING Accounting Accounting standards International accounting ESG CAS Accounting Accounting standards International accounting ESG CAS TAX Tax Tax preparation IRS Tax Planning Corporate taxes Tax fraud Tax Legislation International taxes Tax Tax preparation IRS Tax Planning Corporate taxes Tax fraud Tax Legislation International taxes AUDIT Audit Audit standards PCAOB SEC Audit Audit standards PCAOB SEC PRACTICE MANAGEMENT Practice management Recruiting Retention Acc

Speaker: Andrew Skoog, Founder of MachinistX & President of Hexis Representatives

Manufacturing is evolving, and the right technology can empower—not replace—your workforce. Smart automation and AI-driven software are revolutionizing decision-making, optimizing processes, and improving efficiency. But how do you implement these tools with confidence and ensure they complement human expertise rather than override it? Join industry expert Andrew Skoog as he explores how manufacturers can leverage automation to enhance operations, streamline workflows, and make smarter, data-dri

Let's personalize your content