IRS warns of new tax scams spread by social media

Accounting Today

MAY 14, 2024

The Internal Revenue Service cautioned consumers to beware of inaccurate advice which prompted thousands of taxpayers to file overblown claims and held up their refunds.

Accounting Today

MAY 14, 2024

The Internal Revenue Service cautioned consumers to beware of inaccurate advice which prompted thousands of taxpayers to file overblown claims and held up their refunds.

Cevinio

MAY 14, 2024

AR Invoice Delivery Automation is a software solution designed to transform invoicing processes, mitigate errors, and enhance cash flow […]

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Accounting Today

MAY 14, 2024

The Internal Revenue Service published final regulations officially lowering the fees for new Preparer Tax Identification Numbers and renewed PTINs.

Insightful Accountant

MAY 14, 2024

Intuit, Inc. has appointed Vasant Prabhu, former Chief Financial Officer and Vice Chairman of Visa, to its board of directors.

Advertisement

You wouldn’t keep using a 2009 flip phone - so why settle for outdated close processes? It’s time for an upgrade. SkyStem's Guide to Month-End Close Software walks you through what today’s best tools can do (and what your team shouldn’t have to deal with anymore). Get smart, fast, and a whole lot less stressed when it’s time to close the books.

Accounting Today

MAY 14, 2024

Reliable data is the foundation of effective climate-related disclosures, and audit and tax professionals' experience is essential in supporting this data's integrity.

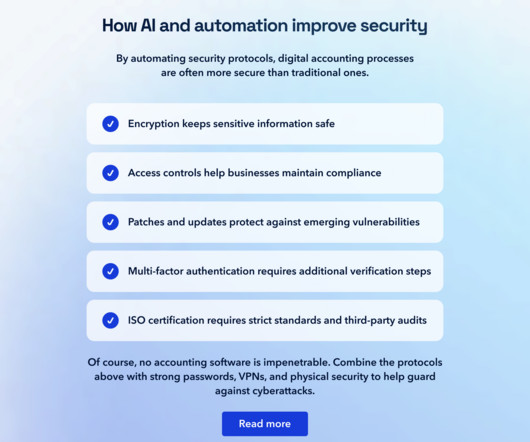

Plooto

MAY 14, 2024

Experienced accountants are hard-wired to remain audit-ready. But for small and medium-sized businesses (SMBs), are their financial team really prepared to provide detailed financial recordings, having their time monopolized and day-to-day responsibilities disrupted?

Financial Ops World brings together the best financial operations content from the widest variety of thought leaders.

Outsourced Bookeeping

MAY 14, 2024

Running a small business can cause you to shoulder a lot of burdens, especially in the financial realm. Keeping track of revenues and expenditures to maintain a proper cash flow must be cautiously organized so that you are not off track on your funds or financial records when you are filing taxes. However, in today’s world, you can hire a freelance accountant or a bookkeeper to help you focus on developing other aspects of your business.

Accounting Today

MAY 14, 2024

KKR & Co. is in talks for a new loan with private credit lenders for MYOB, an Australian accounting software firm that the private equity giant acquired in 2019, people familiar with the matter said.

Insightful Accountant

MAY 14, 2024

Alicia will host special guest Ted Callahan, Intuit’s Accountant Leader, Ted Callahan, to discuss how Intuit sees QuickBooks Live Expert Assist as a benefit to ProAdvisors.

Accounting Today

MAY 14, 2024

The convergence of machine learning, generative AI and autonomous sourcing gives organizations the ability to realize most of the ZBB ideal.

Speaker: Jason Chester, Director, Product Management

In today’s manufacturing landscape, staying competitive means moving beyond reactive quality checks and toward real-time, data-driven process control. But what does true manufacturing process optimization look like—and why is it more urgent now than ever? Join Jason Chester in this new, thought-provoking session on how modern manufacturers are rethinking quality operations from the ground up.

Insightful Accountant

MAY 14, 2024

Caseware Financials delivers the power of cloud, data, automation and localized content in one dynamic app for statutory reporting.

Accounting Today

MAY 14, 2024

Old IRS tech; lead, don't manage; an MP want-ad; and other highlights from our favorite tax bloggers.

oAppsNet

MAY 14, 2024

Streamlining accounts receivable collections is a strategic imperative for businesses to enhance their cash flow and operational efficiency. Efficient collection processes improve a company’s financial health and strengthen customer relationships by ensuring transparency and consistency. This article explores practical strategies and techniques for streamlining accounts receivable collections, addressing challenges, and leveraging technology to optimize this critical aspect of business fin

Tipalti

MAY 14, 2024

Material procurement is critical for any business that relies on direct procurement. Learn about the different types and steps of material procurement for efficient workflow.

Speaker: Gerald Ratigan

The accounts payable (AP) function is evolving and AI is leading the charge. As finance teams face rising invoice volumes and expectations for speed and accuracy, AI-powered automation has shifted from a futuristic concept to the most practical solution. But for finance leaders, success isn’t just about selecting the right tools, it’s about implementing the right strategy.

Billah and Associates

MAY 14, 2024

What is the Canadian Dental Care Plan (CDCP)? The Canadian Dental Care Plan (CDCP) provides much-needed assistance for qualified Canadians without dental insurance. The objective of this plan is to ensure the well-being of people across the country by providing critical dental care coverage for maintaining optimal oral health. Eligible residents can receive preventative, diagnostic, and restorative dental care for free.

Nanonets

MAY 14, 2024

Are you tired of the time-consuming and error-prone process of manually copying Excel tables into Word documents? Anyone who frequently works with data knows how frustrating it can be to ensure that your tables maintain their formatting and accuracy when transferred between applications. This comprehensive guide will explore various methods for seamlessly copying Excel tables into Word.

Ace Cloud Hosting

MAY 14, 2024

Since the tax season just ended pro and with the upcoming National Accounting Day on May 19th, Financial firms must recognize the unsung tax-saving heroes: CPAs and Accountants deserve an.

Accounting Tools

MAY 14, 2024

What is Realization in Accounting? Realization is the point in time when revenue has been generated. Realization is a key concept in revenue recognition. Realization occurs when a customer gains control over the good or service transferred from a seller. Realization Indicators There are numerous indicators of when realization can occur, such as the following: When the seller has the right to receive payment.

Speaker: Sean Yoder

Nonprofits are under more pressure than ever to demonstrate financial accountability while continuing to expand their impact. Traditional budgeting models often fall short, reinforcing silos, limiting flexibility, and stalling growth. Enter collaborative budgeting: a dynamic, team-driven process that enables smarter resource allocation and builds financial resilience at scale.

Let's personalize your content