FASB releases credit losses standard for AR and contract assets

Accounting Today

JULY 30, 2025

The Financial Accounting Standards Board is offering optional guidance on the measurement of credit losses for accounts receivable and contract assets.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Accounting Today

JULY 30, 2025

The Financial Accounting Standards Board is offering optional guidance on the measurement of credit losses for accounts receivable and contract assets.

Fidesic blog

JULY 2, 2025

While many organizations have implemented automation in either accounts payable (AP) or accounts receivable (AR), the real transformation occurs when both systems work together as an integrated financial ecosystem.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

AI In Accounting: A Practical Roadmap For Smarter AP

How to Streamline Payment Applications & Lien Waivers Through Innovative Construction Technology

Why Tech-Forward Tax and Accounting Firms Have the Inside Track to the Future

Precision in Motion: Why Process Optimization Is the Future of Manufacturing

Stop Budget Burnout: A Better Way to Grow Your Nonprofit in 2026

Gaviti

JULY 30, 2025

At the core of these challenges lies accounts receivable management – a critical function that directly impacts an organization’s liquidity, cash flow health, and overall financial health. Managing cash flow is critical for maintaining financial stability.

AI In Accounting: A Practical Roadmap For Smarter AP

How to Streamline Payment Applications & Lien Waivers Through Innovative Construction Technology

Why Tech-Forward Tax and Accounting Firms Have the Inside Track to the Future

Precision in Motion: Why Process Optimization Is the Future of Manufacturing

Stop Budget Burnout: A Better Way to Grow Your Nonprofit in 2026

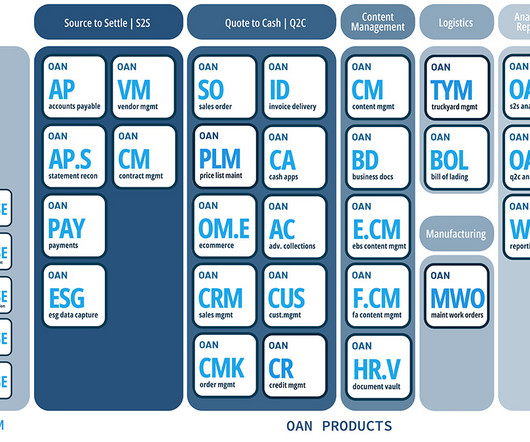

oAppsNet

NOVEMBER 1, 2024

Your Accounts Receivable (AR) team is your business’s critical cash flow driver. With a high-performing AR team, your business can expect accelerated payments, improved cash flow, and a reduced risk of falling behind on bills, payroll, and growth opportunities.

Gaviti

FEBRUARY 4, 2025

The world of Accounts Receivable (AR) is evolving rapidly. With increased interest rates and inflation, businesses are facing increasing pressure to collect cash faster. Here are the top five A/R strategies your business should adopt to thrive in the new year. Reassess what data you are using to measure success.

Gaviti

MARCH 5, 2025

Digital transformation and company expansion are great, but if you dont take the proper security precautions, you can find yourself a victim of fraud. Accounts receivable fraud is becoming an increasingly pressing threat for businesses of all sizes, especially companies that grow or make a lot of changes.

oAppsNet

FEBRUARY 20, 2025

Accounts Receivable (AR) management is a critical area where innovation can significantly impact cash flow and operational efficiency. By embracing the latest AR trends, businesses can optimize receivables workflows, reduce manual errors, and gain real-time insights into their financial operations.

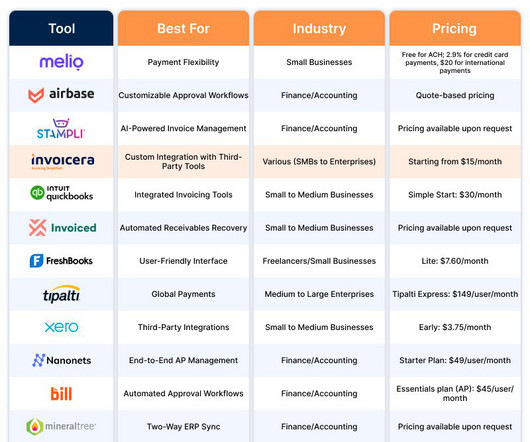

Invoicera

NOVEMBER 8, 2024

For many companies, managing accounts receivable (AR) and accounts payable (AP) is a constant challenge, with delayed payments, manual errors, and lack of real-time visibility causing significant disruptions. are paid late, impacting the financial health of businesses. 13 top AR and AP software solutions.

Fidesic blog

JULY 3, 2025

Hear from Sam Johnson, Partner Success Manager for PayTrace, and Kevin Pritchard, VP of Product and Growth for Fidesic, discuss how the complementary partnership between PayTrace and Fidesic provides a comprehensive AR/AP solution that integrates directly with Microsoft Dynamics Business Central.

Nanonets

DECEMBER 26, 2024

Automation has revolutionized the way finance teams operate, with accounts payable (AP) automation being the go-to first step for businesses looking to improve efficiency and cut costs. Siloed Data Hindering Decision-Making When AP and AR data are not integrated, financial leaders lack the full picture needed to make strategic decisions.

Gaviti

FEBRUARY 2, 2025

Understanding and improving the processes that influence your business operating cycleespecially accounts receivable (AR) managementcan significantly enhance financial performance. Understanding the operating cycle accounting principles behind this calculation can help identify inefficiencies and areas for improvement.

Trade Credit & Liquidity Management

JUNE 23, 2025

In today’s economic environment, few priorities are more critical, or more within your control, than improving how quickly you convert accounts receivable (AR) into cash. Yet in many organizations, AR collections remain reactive, fragmented, or overly dependent on customer goodwill.

Invoicera

JANUARY 19, 2025

Statistics say that in 2023 alone, the global accounts receivable automation market was valued at $3.81 Managing your business Accounts receivable and payable is tough! In this blog, we will discuss the top 7 benefits of automating AR and AP processes to help you become competitive. from 2024 to 2030.

Intuit

JUNE 5, 2025

The Top 15 Accounting Conferences to Attend in 2025 Staying ahead in the finance industry takes more than just crunching numbers. That’s where accounting conferences come in. This guide runs through some of the top accounting conferences in 2025, where industry leaders tackle must-know topics.

Gaviti

JUNE 15, 2025

That’s where accounts receivable insurance (also known as credit insurance) comes into play. It offers a safety net, protecting your business from potential losses tied to unpaid receivables. This guide explores every facet of insurance for accounts receivable, from benefits and drawbacks to cost analysis and how to get started.

Trade Credit & Liquidity Management

AUGUST 5, 2025

Automating accounts receivable processes has transformed the collections landscape. What once relied entirely on the judgment and initiative of individual collectors is now driven by systematic workflows embedded in AR platforms. Reminders for follow-up often took the form of calendar notes or manual ticklers.

oAppsNet

APRIL 18, 2025

When it comes to accounts payable (AP), no one wants to leave money on the table, but overpayments remain a costly reality for many organizations. As a digital transformation partner, oAppsNET brings deep ERP expertise and practical insights to help organizations optimize accounts payable (AP) processes and build stronger financial controls.

Gaviti

JUNE 18, 2025

Metrics such as DSO, cash flow forecasting accuracy, and budget variance are vital for measuring controller effectiveness. Regular KPI tracking builds accountability and improves decision-making across finance functions. What are the key performance indicators that you should be tracking?

oAppsNet

MARCH 6, 2025

In today’s fast-paced business environment, managing accounts receivables efficiently is more important than ever. However, traditional collections processes are often plagued by inefficiencies such as time-consuming manual tasks, repetitive follow-ups, and inconsistent tracking of payments. The solution?

Trade Credit & Liquidity Management

MAY 29, 2025

From a Press Release dated May 21, 2025, San Francisco, California Credit card giant Visa has announced the general availability of its new Visa AR Manager platform in the United States, marking a significant step in its mission to streamline business-to-business (B2B) payments and become the central hub for banks, fintechs, and enterprises.

Gaviti

JANUARY 20, 2025

In todays fast-paced business environment, achieving financial accuracy is critical for maintaining stakeholder trust and ensuring compliance with accounting standards. One cornerstone of accurate financial reporting is the matching principle in accounting, a concept that ensures revenues and expenses are recorded in the same period.

Accounting Today

AUGUST 8, 2025

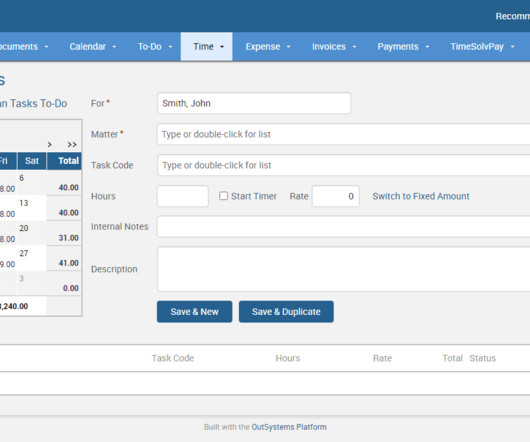

With the new bank import functionality, users can now securely connect to nearly any financial institution to import accounts payable and accounts receivable transactions, importing and matching transactions directly in CenterPoint. All rights reserved.

Trade Credit & Liquidity Management

JULY 24, 2025

As she reviews the aging accounts receivable, she notices a spike in late payments from several long-standing customers. Incorporate Risk Insights into All Reporting Reporting on accounts receivable (AR) should go beyond aging buckets and collection updates. Does This Sound Familiar?

Gaviti

JUNE 13, 2025

In this blog post, we’ll dive into how agentic AI systems are transforming finance, particularly in credit risk assessment and accounts receivable (AR) management. That’s the intelligence layer agentic AI adds to AR workflows. In financial applications, this technology has immense potential.

Accounting Today

AUGUST 1, 2025

Karbon, Ignition, SmartVault launch Intuit ProConnect Ecosystem for Tax Firms Gaj Rudolf/Gajus - stock.adobe.com Karbon , a practice management platform for accounting firms, announced a strategic partnership with Ignition , an automation platform for recurring revenue and billing, and SmartVault , a document management and client portal.

Trade Credit & Liquidity Management

JULY 7, 2025

Seamless AR automation: Suppliers receive daily, customizable remittance files that integrate smoothly with existing or future accounts receivable (AR) systems, helping automate cash application even for high-volume, small-dollar payments with incomplete remittance information.

Invoicera

NOVEMBER 13, 2024

Trust Accounting : Essential for handling client funds with care. Legal firms are held to high standards here, so make sure your invoicing software has this feature to stay compliant. Their zero AR feature is a dream for billing: batch-run payments on your schedule and keep your books clean!

Gaviti

JULY 31, 2025

Automated Clearing House ( ACH ) payments have emerged as a leading choice for companies aiming to streamline accounts receivable operations and eliminate inefficiencies in manual processing. That’s why partnering with an experienced Accounts Receivable Software Provider with a Payment Portal is critical to navigating the complexities.

Invoicera

NOVEMBER 27, 2024

Challenge 4: Lack Of Integration Options Trying to sync invoicing data with your accounting software manually takes a lot of work. Solution Automated invoicing tools integrate seamlessly with accounting software like QuickBooks, Xero, and PayPal, so your financial data stays up-to-date with minimal effort.

Gaviti

JULY 15, 2025

From proactive collections to intelligent prioritization, it’s what modern AR looks like. Better Alignment Across Teams When A/R, treasury, accounting, and sales all have access to real-time cash data, alignment improves. Don’t just read about it — watch the Gaviti demo to see real-time cash flow management in motion.

Gaviti

JUNE 30, 2025

Software accounts receivable software solutions enhance cash visibility and forecasting accuracy, helping companies stay agile and scalable. In contrast, a larger enterprise might misallocate cash into non-strategic assets, face mounting AR delays, and burn through reserves due to lack of visibility.

Remote Quality Bookkeeping

MAY 15, 2025

DIY Bookkeeping Without Proper Training Trying to manage your books without understanding basic accounting principles can be more damaging than neglecting them altogether. Keeping separate bank accounts and credit cards for your business isnt just good practiceits essential for clean, compliant financial records.

Gaviti

JUNE 11, 2025

Integration Capabilities: These methods can be integrated with accounting and ERP platforms to streamline the Automated Cash Application Process, ensuring faster recognition and allocation of incoming payments. ACH: Requires bank account details and authorization, which may be slightly more involved but offers better cost-efficiency.

Gaviti

JULY 2, 2025

This comprehensive guide explores the strategic imperatives of optimizing payment policies, how to execute payment strategy optimization effectively, and how accounts receivable/invoice to cash platforms can empower your team to gain control and clarity in your accounts receivable operations.

Trade Credit & Liquidity Management

AUGUST 7, 2025

From a Press Release dated July 31, 2025, Tinley Park, Illinois Payroc WorldAccess, LLC, a North American merchant acquirer and payment technology provider, has signed a definitive agreement to acquire BlueSnap, a Boston-based global payment orchestration and accounts receivable (AR) automation platform.

Gaviti

MAY 8, 2025

Real-Time Processing With AI, transactions are processed in real time, which accelerates the accounts receivable (AR) cycle and supports timely financial reporting. It uses predictive analytics to recommend matches or escalate the issue to the AR team. This reduces the backlog of unapplied cash.

Trade Credit & Liquidity Management

JUNE 10, 2025

The collectability of your accounts receivable (AR) portfolio also impacts your company’s operational and financial performance as well as borrowing capacity and costs. For a limited time, annual subscriptions are half off. These accounts will provide the greatest sales growth and profit potential.

Trade Credit & Liquidity Management

MAY 29, 2025

Automation and artificial intelligence (AI) are transforming accounts receivable (AR) and B2B trade credit management by replacing manual, error-prone processes with intelligent, AI-driven tools.

Trade Credit & Liquidity Management

JUNE 16, 2025

A properly managed Accounts Receivables (AR) portfolio is essential to maintain the liquidity your company needs to sustain its business and grow. Personalizing the email with the customer's name, specific account details, or any relevant past interactions shows attention to detail and may improve responsiveness.

Trade Credit & Liquidity Management

JULY 7, 2025

Lead efforts to address operational and process issues affecting accounts receivable (AR) results and profitability. Be willing to make difficult decisions: AR performance is a pivotal element of every company’s cash flow and liquidity, thereby creating the opportunity for the organization to grow and prosper.

Accounting Today

JULY 30, 2025

Accounting Payroll Paychex Small business Employment data MORE FROM ACCOUNTING TODAY Tax Corporate AMT proposed regs revised The IRSs Notice 2025-28 will affect applicable corporations with financial statement income attributable to investments in partnerships. All rights reserved.

Accounting Today

JULY 30, 2025

The service-providing sector added 74,000 jobs in July, including 9,000 in professional and business services such as accounting and tax preparation. "It All rights reserved. The 104,000 jobs added in July was a big improvement from a revised negative number of 23,000 in June.

Accounting Department

JANUARY 19, 2023

However, late payments and bad debts are a constant threat looming over an accounts receivables (AR) team. Accounts receivable reports are a key tool for businesses to manage their AR balances, forecast cash inflow, and stay on top of overdue payments.

Accounting Today

APRIL 16, 2024

The impact of providing accounts receivable staff with automated AR processes goes far beyond the finance function.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content