Record-keeping Best Practices: Organizing Financial Records for Tax Purposes

Outsourced Bookeeping

JUNE 22, 2023

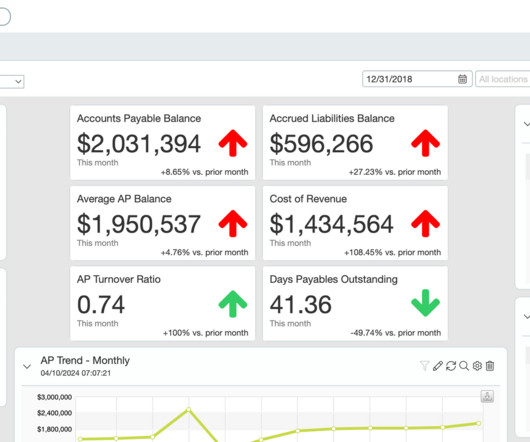

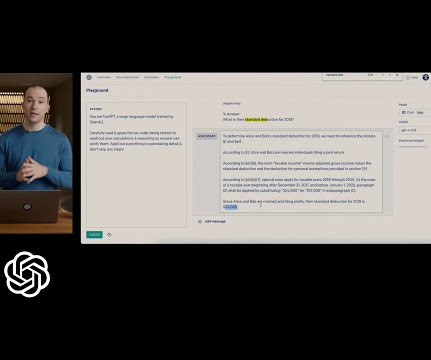

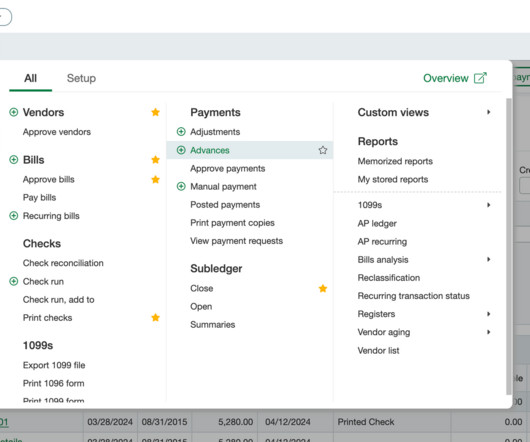

In this piece, we delve into the significance of proper record-keeping for tax-related reasons and discuss the optimal techniques to achieve it. By adhering to effective record-keeping procedures, companies can enhance their tax strategy, guarantee precise monetary recording, and simplify their billing and payment services.

Let's personalize your content