Purchase requisition vs Purchase order: The differences

Nanonets

NOVEMBER 27, 2023

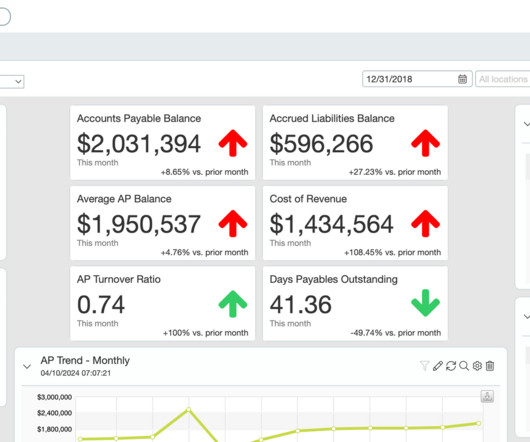

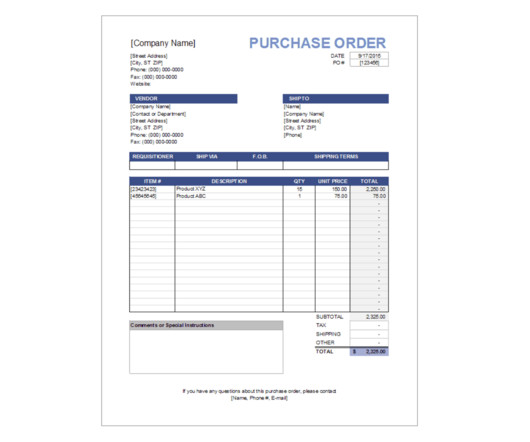

Establishing clear guidelines for purchase requisitions and purchase orders is an important first step in measuring what you intend to manage. Purchase Order vs. Purchase Requisition: What’s the Difference? What is a Purchase Requisition?

Let's personalize your content