Accounts payable skills and responsibilities

AP Association

MARCH 1, 2022

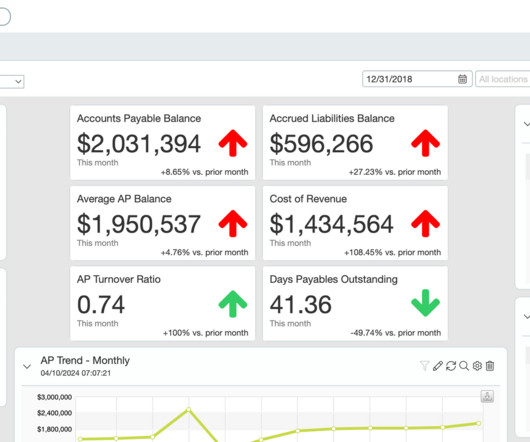

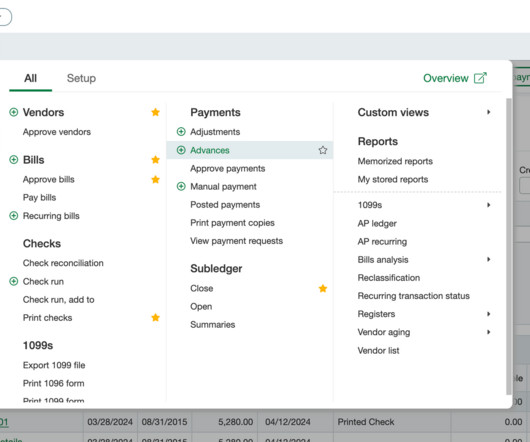

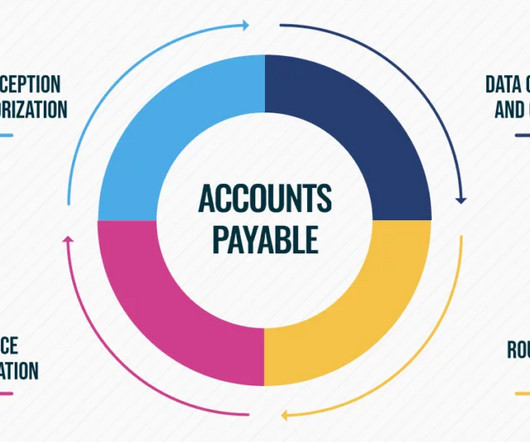

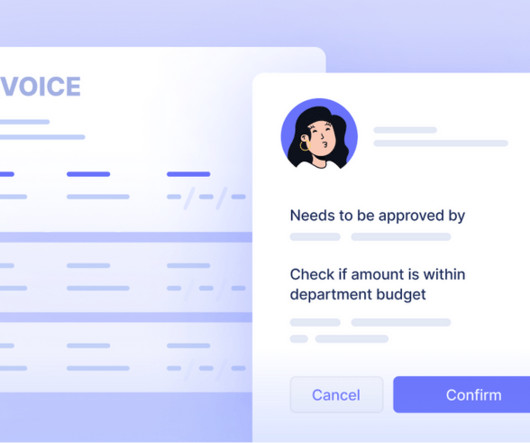

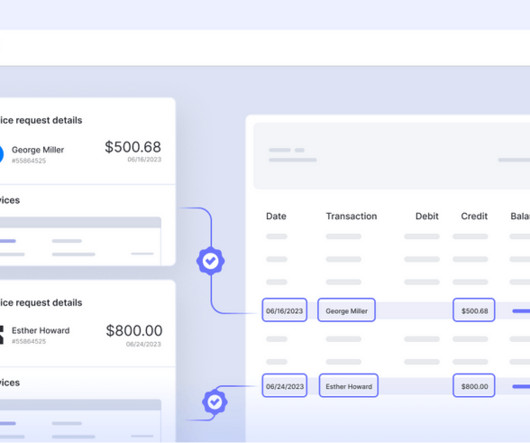

If you're considering embarking on a career as an Accounts Payable professional, it's essential to make sure that you have a full understanding of the key skills and responsibilities required. These records are essential to a business's financial health, as well as tracking all payments and cash flow to suppliers and vendors.

Let's personalize your content