What is Accounts Receivable Automation, and how can you leverage it for your business?

Cevinio

FEBRUARY 1, 2024

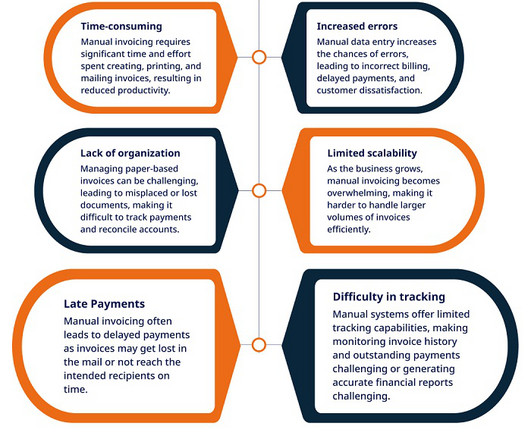

What is Accounts Receivable Automation, and how can you leverage it for your business? Introduction The efficiency and accuracy of your financial processes play a pivotal role in the success of your business. One such critical aspect is managing Accounts Receivable (AR).

Let's personalize your content