Tech news: KPMG announces new partnerships

Accounting Today

AUGUST 2, 2024

KPMG announces new partnerships; CAQ releases generative AI guide for audit committees; US Bank announces new AR solution; and other accounting tech news.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Accounting Today

AUGUST 2, 2024

KPMG announces new partnerships; CAQ releases generative AI guide for audit committees; US Bank announces new AR solution; and other accounting tech news.

Accounting Today

JUNE 5, 2025

Walking through the actual processes of how a business operates — how invoices and bills are created, how the AP and AR cycle functions — has been one of the most impactful components of the program. By Michael Cohn 11h ago Audit Auditors' pessimism about economy surges Audit partners pessimism about the U.S.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

How To Overcome Change Fatigue In Finance With Neuroscience-Backed Strategies

Protect What Matters: Rethinking Finance Ops In A Digital World

Why Tech-Forward Tax and Accounting Firms Have the Inside Track to the Future

Your Accounting Expertise Will Only Get You So Far: What Really Matters

Gaviti

JUNE 15, 2025

According to a recent NACM article titled To Insure or Not to Insure—That is the Question , companies are increasingly turning to AR insurance as geopolitical and economic instability continues to impact customer reliability worldwide. Reasons to Insure Accounts Receivable So, why should you consider insuring your AR?

How To Overcome Change Fatigue In Finance With Neuroscience-Backed Strategies

Protect What Matters: Rethinking Finance Ops In A Digital World

Why Tech-Forward Tax and Accounting Firms Have the Inside Track to the Future

Your Accounting Expertise Will Only Get You So Far: What Really Matters

Fidesic blog

DECEMBER 6, 2023

Whether internal or external, financial audits can be an extremely stressful time. Accounts receivable auditing is among the most critical of financial audits. An internal AR audit will give deep insight into the business' incoming cash and can be a determining factor in planning the financial future of the company.

Xero

MARCH 29, 2023

The metaverse is a form of internet that operates as a blended and immersive virtual world, powered by a mix of virtual reality (VR) and augmented reality (AR). What’s interesting is that the foundations of the metaverse are being built into technology you may already use today. This is so important,” Hayley said. “A

Intuit

JUNE 5, 2025

These events bring together top minds in tax, audit, and financial technology, offering insights that can shape the future of your career. Notable topics: The conference features nine tracks of expert content, including: Advanced accounting and auditing: Stay updated on the latest standards and practices.

Compleatable

MAY 1, 2025

We are thrilled to announce our partnership with Compleat Software, a proven innovator in financial process automation. This partnership represents a shared vision to simplify, automate, and optimize financial workflows empowering organizations to achieve greater efficiency, control, and growth.

accountingfly

APRIL 24, 2025

The post Top Remote Audit, Tax and Accounting Candidates | April 24, 2025 appeared first on Accountingfly. Sign up now to check out Top Candidates.

Gaviti

MAY 8, 2025

Real-Time Processing With AI, transactions are processed in real time, which accelerates the accounts receivable (AR) cycle and supports timely financial reporting. AI That Transforms Your Cash Application Process Discover how Gavitis AI-powered cash application reduces costs, improves accuracy, and accelerates your AR workflow.

oAppsNet

APRIL 18, 2025

Conduct Targeted AR Reviews to Recover Missed Opportunities Many accounts payable (AP) departments avoid reviewing accounts receivable (AR) statements due to the labor-intensive nature of the task. But AR reviews remain one of the most effective ways to identify duplicate payments and unclaimed credits.

Gaviti

JUNE 13, 2025

In this blog post, we’ll dive into how agentic AI systems are transforming finance, particularly in credit risk assessment and accounts receivable (AR) management. That’s the intelligence layer agentic AI adds to AR workflows. Audit trails are automatically generated for every decision or action taken.

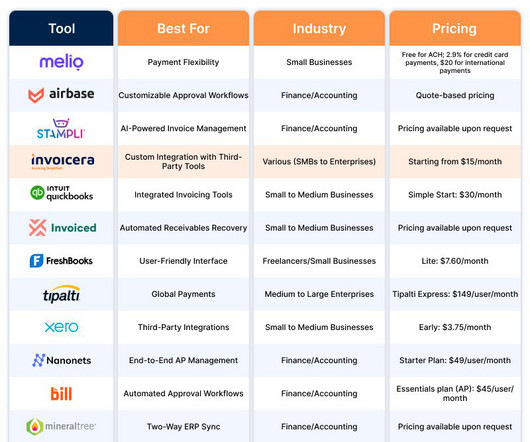

Invoicera

NOVEMBER 8, 2024

For many companies, managing accounts receivable (AR) and accounts payable (AP) is a constant challenge, with delayed payments, manual errors, and lack of real-time visibility causing significant disruptions. are paid late, impacting the financial health of businesses. This blog will highlight: Potential AR and AP management issues.

Gaviti

JANUARY 20, 2025

How the Matching Principle Aligns with AR Automation Accounts receivable automation simplifies and streamlines the management of the status of invoices, making it easier to track payments, monitor customer interactions, and maintain cash flow. AR solutions provide detailed records of invoices, due dates, and payment statuses.

Invoicera

JANUARY 19, 2025

In this blog, we will discuss the top 7 benefits of automating AR and AP processes to help you become competitive. How Automating AR and AP Benefits You? Let’s take a look at the Top 7 Benefits of automating AR and AP and how these improvements can impact your business. Why should your business embrace this rising trend?

Accounting Tools

APRIL 8, 2023

Related Courses Guide to Audit Sampling How to Conduct an Audit Engagement The Audit Risk Model What is the Audit Risk Model? The audit risk model determines the total amount of risk associated with an audit , and describes how this risk can be managed. The nature of the audit procedures conducted.

accountingfly

JULY 18, 2024

TAX CANDIDATES FTE Tax Manager | Candidate ID #22002360 Certifications: CPA Education: BS Accounting, MS Finance Experience (years): 8+ years tax experience Work experience (detail): 5+ in public accounting 5+ with a Big 4 firm, preparation and review ASC 740 implementation and advisory Workflow process automation Waterfall analysis, financial reporting (..)

accountingfly

APRIL 4, 2024

Salary: $85K+ Time zone: MT Sign up to learn more about this candidate FT Accounting (Permanent) | Candidate ID #20143451 Certifications: Bill.com certification Education: BS in Business, MBA in Accounting Experience (years): 7+ total, 3+ in public accounting Work experience (highlight): Accounting Manager at an outsourced accounting services firm (..)

Gaviti

DECEMBER 6, 2023

These are the key advantages you should keep in mind when trying to decide between accounts receivable outsourcing vs. A/R collection management software. You’ll also have a comprehensive history and documentation for future analysis or in the event of an audit. Book a demo today to see how Gaviti works.

Gaviti

MARCH 5, 2025

In these cases, transactions are fabricated, and funds are misappropriated under the guise of legitimate business activities. The complexity of such fraud often requires detailed audits and advanced analytical tools to detect discrepancies in reported revenue versus actual collections. Schedule a demo today!

Nanonets

MAY 8, 2023

Start your free trial Accounts receivable (AR) is an asset on a company's balance sheet. Here's why you should consider Nanonets for AR automation. Everything You Need to Know About an Audit Trail Credit Card Reconciliation: What It is and How to Do It? Looking to automate accounting processes?

accountingfly

JUNE 2, 2025

Instead, embed them into your bullet points: Led onboarding for three junior accountants, mentoring them through first-year audits Streamlined the new client onboarding and bookkeeping cleanup processes and documented procedures in standard operating protocols (SOPs).

Outsourced Bookeeping

DECEMBER 19, 2024

The sources and uses of cash are accounts payable and accounts receivable, and proper management of the two functions keeps the business financially fit and able to meet its obligations as and when due. The Importance of Accurate Accounts Payable and Receivable Tracking Why AP and AR Control is Important?

oAppsNet

MARCH 5, 2024

One area where digital transformation can profoundly impact is accounts receivable (AR) processes. Organizations can streamline AR processes, improve cash flow management, and enhance customer satisfaction by leveraging digital technologies and automation tools.

Nanonets

MARCH 23, 2023

These roles will complement the tasks performed by cognitive technology and ensure the work of machines is effective, responsible, fair, transparent, and auditable. Gartner reports that 40% of small-to-midsize businesses are already evaluating AR/VR for their operations.

oAppsNet

MAY 21, 2024

The rapidly evolving business landscape has spotlighted the critical function of accounts receivable (AR). AR practices are undergoing significant transformations as technologies advance and global markets expand.

Trade Credit & Liquidity Management

MAY 8, 2025

Here are some of the most common issues that finance teams encounter: Inaccurate or outdated contact information: Invoices go unpaid when they’re sent to the wrong place. Up to 20% of customer data changes annually, and without updates, AR suffers. Collections slow down. Bad addresses lead to returns and wasted postage.

Jetpack Workflow

MARCH 23, 2023

This process is why an accounts receivable (AR) ledger is your best friend. An AR ledger allows you to manage outstanding payments by tracking an invoice’s due date. An AR ledger allows you to manage outstanding payments by tracking an invoice’s due date. Here are a few accounting software providers to consider.

Remote Quality Bookkeeping

MAY 15, 2025

Managing accounts receivable (AR) and accounts payable (AP) protects cash and builds stronger relationships with clients and vendors.Set up clear payment terms, follow up consistently, and review aging reports to stay ahead of potential issues. Lets talk about how outsourced bookkeeping can save you time and help your business thrive.

Invoicera

NOVEMBER 14, 2024

Features Automated Recurring Billing & Reminders : Set up automated recurring billing for repeat transactions and send timely reminders to ensure payments are received on time, minimizing manual follow-ups. Designed with RIA compliance in mind, AdvicePay meets regulatory needs, so you stay audit-ready.

accountingfly

FEBRUARY 13, 2025

TAX AND ACCOUNTING CANDIDATES FTE Senior Tax and Accounting | Candidate ID#23814240 Certifications: CPA Education: BA, MA Financial Accounting Experience (years): 15+ years accounting experience Work experience (detail): 3+ in public accounting Accounting, payroll and tax filing with 40+ clients Client advisory, tax planning, financial review Prepares (..)

Nanonets

JULY 22, 2024

However, with a shift towards Workflow Automation, application of AI is going beyond automating specific tasks but instead automating entire workflows including Accounts Payable, Accounts Receivable, Financial Close, Financial Reporting and Audits.

Gaviti

FEBRUARY 6, 2023

And with the proliferation of AI and machine learning tools in the digital landscape, 2023 is the perfect time for accounts receivable (AR) teams to examine their processes and find areas for improvement through better technologies, tactics, and process management.

Trade Credit & Liquidity Management

APRIL 30, 2025

Accounts Receivable (AR): Serrala was recognized for its use of predictive analytics to personalize collection strategies, forecast and reduce deduction risks, and automate invoice generation and formatting. This ensures that AI-driven insights are auditable, models remain current, and outcomes support tangible business performance.

accountingfly

JUNE 5, 2025

Remote Work Experience: Y Salary: $75k Time Zone: Central Sign up for FREE to learn more about this candidate ACCOUNTING CANDIDATE FTE Accounting | Candidate ID #24321414 Certifications: QB ProAdvisor Education: Office Assistant Certification Experience (years): 14 years bookkeeping and accounting experience Work experience (detail): All in public (..)

Nanonets

APRIL 18, 2024

In today's fast-paced business environment, efficient management of accounts receivable (AR) and accounts payable (AP) is crucial for maintaining a healthy cash flow. Invoices are an essential part of this. Invoice creation and Invoice processing are critical steps in these processes.

Nanonets

APRIL 14, 2024

This accounts receivable automation platform uses AI and machine learning to accurately forecast cash flow, help resolve payment disputes, and improve AR turnover metrics. Versapay Automated invoice delivery, payment processing, and account reconciliation capabilities take a lot of stress off of AR professionals.

accountingfly

OCTOBER 10, 2024

ACCOUNTING CANDIDATES FTE Accounting | Candidate ID # 22574493 Certifications: EA in process Education: BA Business Experience (years): 20+ years accounting experience Work experience (detail): Currently Accountant & Office Manager at a CPA firm Full cycle accounting, reconciliations, financial reporting AP/AR, payroll processing and quarterly (..)

accountingfly

APRIL 11, 2024

Prepares financial statements, payroll, cash forecasts, supervises AP/AR, etc. Also has substantial audit experience Client niches: real estate, construction, manufacturing, distribution, nonprofits, etc.

Trade Credit & Liquidity Management

APRIL 30, 2025

For seasonal businesses, the past three annual statements are usually sufficient. Public companies’ historical data is readily available, but with private firm customers, you will need to request audited yearly financial statements and be diligent in keeping those records in each customer’s permanent credit file.

Nanonets

FEBRUARY 8, 2024

BILL, which used to be known as Bill.com, is a financial operations platform that gives businesses the tools to manage AP, AR, spend, and expense automation all in one place. Since everything is in one place, annual audits are no longer a massive undertaking. Users feel a bit limited on the reporting options within BILL.

Nanonets

JUNE 15, 2023

Optimized Accounts Payable (AP) and Accounts Receivable (AR): Accounting automation software improves cash flow management by optimizing AP and AR processes. Poorly managed AR can result in delayed payments and working capital challenges. This ensures accurate and secure audit documentation.

AvidXchange

AUGUST 8, 2022

They are responsible for crafting the budget, AP/AR, grant writing and reporting, annual audit, internal assessments and reporting, reconciling cash receipts and transactions, recording payments as well as reviewing and approving employee timesheets. Nearly every aspect of nonprofits is touched by the finance department.

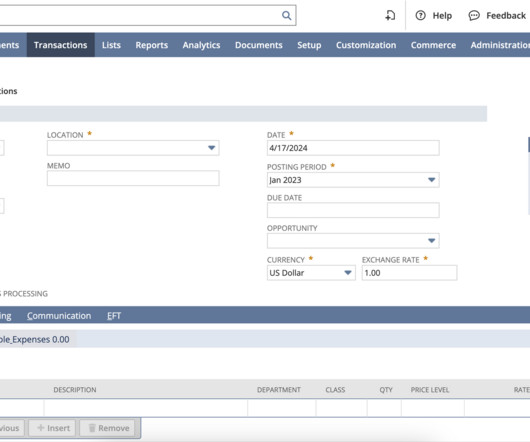

Nanonets

APRIL 23, 2024

Quickbooks has a slight edge in analyzing with Tags and dimensions, while NetSuite is better at Journal entries and Audit Trials. Accounts Receivable & Accounts Payable NetSuite has a robust AR section with invoice customization facilities, but Quickbooks' automation features make AR and collection much more accessible.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content