Balance per books definition

Accounting Tools

MARCH 28, 2024

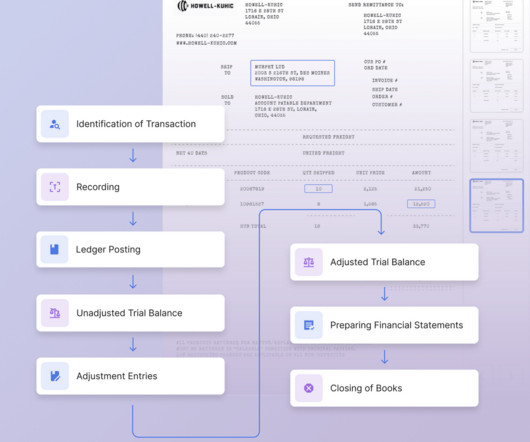

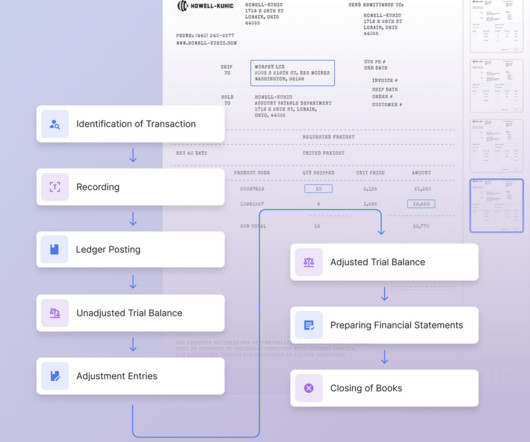

What is Balance per Books? Balance per books is the ending balance of an account that appears in the general ledger. The concept is commonly used in regard to the ending cash balance, which is then compared to the cash balance in the monthly bank statement as part of a bank reconciliation.

Let's personalize your content