The elements of financial statements

Accounting Tools

MAY 9, 2024

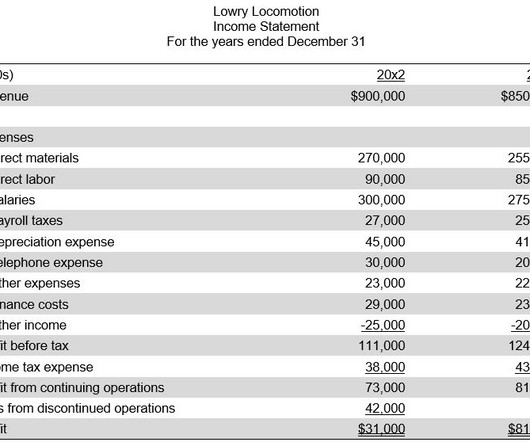

This is an increase in assets or decrease in liabilities caused by the provision of services or products to customers. Examples are product sales, service sales, and subscription fees. This is the reduction in value of an asset as it is used to generate revenue. Revenues and expenses are included in the income statement.

Let's personalize your content