6 Ways to Seize Market Opportunities with Metered Billing

Billing Platform

NOVEMBER 15, 2023

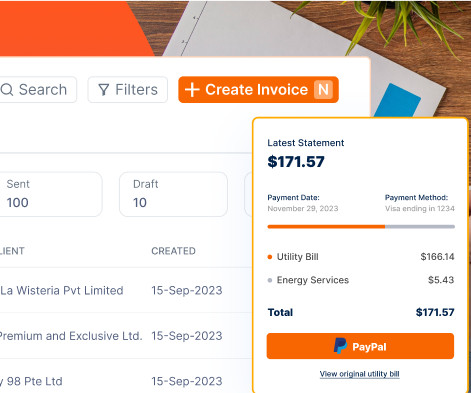

While the terms are typically used interchangeably, there are a few subtle differences between usage-based billing and metered billing – the most significant being in how charges are calculated. Usage-based billing calculates charges based on how much of a product or service is used. per active user/per month when paid monthly.

Let's personalize your content