Intuit debuts AI agents for QuickBooks

Accounting Today

JUNE 26, 2025

The company demonstrated the products at an event in New York this week.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Accounting Today

JUNE 26, 2025

The company demonstrated the products at an event in New York this week.

Intuit

JULY 2, 2025

Blockchain and secure e-signature tools streamline audits and reduce legal risks. Value-based pricing shifts firms from commoditized billing to relationship-driven revenue, unlocking higher margins and steadier cash flow. With every transaction securely recorded in a decentralized ledger, blockchain creates an unchangeable audit trail.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

AI In Accounting: A Practical Roadmap For Smarter AP

Why Tech-Forward Tax and Accounting Firms Have the Inside Track to the Future

Stop Budget Burnout: A Better Way to Grow Your Nonprofit in 2026

Your Accounting Expertise Will Only Get You So Far: What Really Matters

Counto

FEBRUARY 19, 2025

Bill Payment Fraud: How to Protect Your Business from Scams and Unauthorised Transactions Bill payment fraud is a growing threat to small businesses in Singapore. To safeguard your business, it is essential to understand common types of bill payment fraud and implement preventive measures. Common Types of Bill Payment Fraud 1.

Accounting Tools

JUNE 12, 2023

Related Courses Bookkeeping Guidebook How to Audit Receivables New Controller Guidebook The reconciliation of accounts receivable is the process of matching the detailed amounts of unpaid customer billings to the accounts receivable total stated in the general ledger. This is the most common reason for a difference.

Accounting Tools

DECEMBER 23, 2023

Why Should You Reconcile Inventory? How to Reconcile Inventory in 9 Steps To reconcile inventory , compare the inventory counts in the company's records to the actual amounts on the warehouse shelves, figure out why there are differences between the two amounts, and adjust the records to reflect this analysis.

Outsourced Bookeeping

JUNE 20, 2025

If you want to avoid audits, missed deductions, or late filings, you need a solid bookkeeping checklist. This blog walks you through what your team should be doing month after month to stay audit-ready all year round. Mixing funds leads to tax issues, messy audits, and lost deductions. Cloud storage is the safest.

Xero

SEPTEMBER 7, 2022

We shared the first phase of this new feature — employee records — and explained how it will help you identify, audit, and reconcile your clients’ payroll quickly and accurately. . Another compliance update we shared with advisors at Xerocon Sydney was one of our most highly requested features: payroll history.

Jetpack Workflow

JUNE 19, 2025

Maybe they want you to bill a client for them “just this once.” Define billing No one wants to get into a billing dispute with a client. A proper engagement letter will outline when the client will be billed, payment terms, and even how much additional services will cost. Maybe they just have “a quick question.”

Accounting Tools

JUNE 14, 2023

Related Courses Accounting for Inventory How to Audit Inventory How to Conduct an Audit Engagement What are Inventory Audit Procedures? If your company records its inventory as an asset and it undergoes an annual audit , then the auditors will be conducting an audit of your inventory.

Outsourced Bookeeping

JULY 8, 2025

You can generate reports by property, set up class tracking, automate rent reminders, and reconcile transactions quickly. Most importantly, QuickBooks helps you stay audit-ready. You can even use recurring invoices to automate monthly rent billing. Every dollar that comes in or goes out is accounted for.

Outsourced Bookeeping

JUNE 29, 2025

Handling rental income, maintenance bills, deposits, and vendor payments is not simple. When personal and property transactions are made using the same bank account or credit card, confusion arises, deductions are missed, and there is a risk of audit. How to avoid it: Set aside one day a month to reconcile each account.

Remote Quality Bookkeeping

MAY 15, 2025

Technology has made it easier to track, categorize, and reconcile financial activity with far less effortand far fewer errors. For example, many platforms allow you to upload documents in bulk or sync directly with your bank and vendors rather than entering bills or invoices one at a time.

Remote Quality Bookkeeping

APRIL 14, 2025

It shows whether your business has enough money to cover its bills. Reconciling Bank and Credit Card Statements: Comparing your internal records to your bank and credit card statements to ensure all transactions match. Good documentation is crucial for tax deductions and audits. Are sales improving over time?

Accounting Tools

JUNE 19, 2023

Related Courses Bookkeeping Guidebook Corporate Cash Management How to Audit Cash Optimal Accounting for Cash What is a Cash Reconciliation? List on the form the amount of beginning cash in the cash drawer, which may be broken down by individual type of bill and coin. Reconcile the differences between the two columns.

Accounting Tools

AUGUST 6, 2023

It is especially necessary to create year-end adjustments when the financial statements are to be audited by the company’s auditors. For example, an interest billing from the bank may arrive late, so the expense is accrued. Accrual of revenue that has been earned but not yet billed.

Accounting Tools

SEPTEMBER 2, 2023

Related Courses How to Audit Receivables How to Conduct an Audit Engagement How to Audit Accounts Receivable If your company is subject to an annual audit , the auditors will review its accounts receivable in some detail. Investigate reconciling items. Test invoices listed in receivable report.

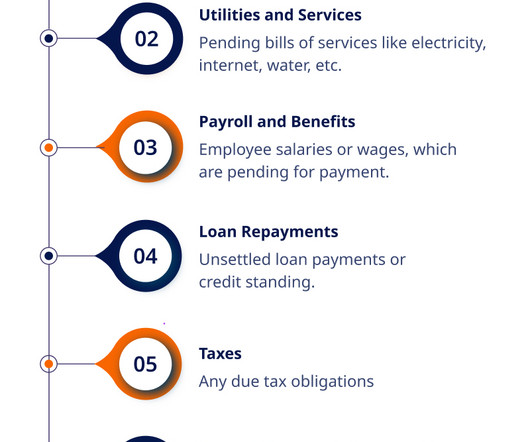

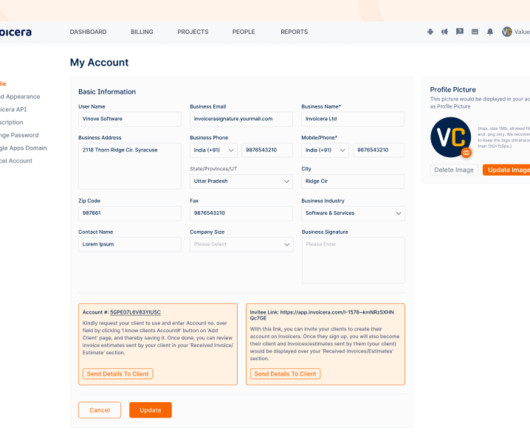

Invoicera

AUGUST 6, 2023

Bills payable management has a vital role in ensuring a business’s stability and financial health. Whether it’s a small or a large-scale entity, neglecting bills payable can bring consequences and several hurdles in growth. So, what is the solution to managing Bills Payable and multiple invoices simultaneously?

Invoicera

AUGUST 6, 2023

Bills payable management has a vital role in ensuring a business’s stability and financial health. Whether it’s a small or a large-scale entity, neglecting bills payable can bring consequences and several hurdles in growth. So, what is the solution to managing Bills Payable and multiple invoices simultaneously?

CapActix

APRIL 30, 2023

Keep on Reconciling When a human is inserting information into the machine, there is a very high chance that an error might occur. Thus, if you want to remove errors from your QuickBooks entries, you have to constantly reconcile transactions, bank accounts, and other details.

Invoicera

MAY 3, 2024

Fortunately, modern billing software has emerged as a beacon of relief in the often chaotic world of law firms. Most law firms adopting advanced billing software have witnessed a remarkable 40% increase in invoice processing efficiency. Explore how advanced billing software can transform your law firm’s invoicing processes.

Bookkeeping Express

APRIL 6, 2023

For many business owners, the mere mention of an audit can evoke feelings of stress and anxiety. The announcement of an actual audit can be overwhelming, prompting a scramble to locate important documents, reconcile accounts, and otherwise “get things together.” Master cash flow forecasting. Do deep accounts receivable analysis.

Less Accounting

DECEMBER 1, 2023

Reconcile Accounts You won’t get far if your books aren’t up to date. Take the time to reconcile bank statements, credit card statements, and any other financial accounts. The same goes for your own bill payments. This will give you a place to start if you have discrepancies you need to investigate.

Accounting Tools

NOVEMBER 1, 2023

Reconciling a bank statement , which likely produces adjustments to the cash account. For example, there are tax accountants , cost accountants , payroll clerks , billing clerks , general ledger accountants , and collection clerks. A CPA license is required before a person can audit the books of a client organization.

Accounting Tools

MAY 21, 2023

For example, a billing clerk, payables clerk, or payroll clerk may report to the bookkeeper. The position can be assisted by an outside CPA who advises on how to record certain of the more complicated business transactions. The full charge bookkeeper may supervise various accounting clerks.

Future Firm

MAY 24, 2023

The software then scanned related tax law and court cases to provide a degree of confidence on what the outcome would be if that very issue went to court: Tip 2: Seek an AI Accounting Technology for Audit Traditionally, the audit process would sample large sets of figures and perform certain tests to provide a level of assurance over that data.

Nanonets

FEBRUARY 8, 2024

BILL, which used to be known as Bill.com, is a financial operations platform that gives businesses the tools to manage AP, AR, spend, and expense automation all in one place. million businesses that either use BILL to make payments or get paid with BILL, it’s clear that this cloud-based solution offers immense value to its users.

Accounting Tools

JUNE 8, 2023

Related Courses Accountants' Guidebook Bookkeeper Education Bundle Bookkeeping Guidebook How to Conduct an Audit Engagement Records Management What are Source Documents? Sales Order A sales order , when coupled with a bill of lading and/or packing list, can be used to invoice a customer, which in turn generates a sale transaction.

Billing Platform

SEPTEMBER 14, 2023

However, for software-as-a-service (SaaS) organizations that bill on a recurring basis whether monthly, quarterly, or annually, recognizing revenue is much more complicated. For one-time purchases like buying a software package that is immediately installed, the process of recognizing revenue is pretty straightforward.

Invoicera

DECEMBER 13, 2024

It is becoming more apparent to businesses that GST billing processes can best be handled through automation. By automating these processes, businesses save time, minimize human errors, and focus on growth, making GST billing software an essential tool in todays business landscape. What is GST Billing Software? With more than 1.4

Billing Platform

JANUARY 2, 2025

As a matter of fact, by reconciling payments regularly, businesses can quickly detect discrepancies, such as missed or duplicate payments, incorrect amounts or unauthorized transactions. Accurate financial records are essential for businesses to meet auditing requirements and avoid potential fines or penalties for non-compliance.

oAppsNet

JANUARY 2, 2025

Improving Accuracy : Human errors, such as incorrect billing or misapplied payments, can delay payments and strain customer relationships. Ensuring Compliance : Automated systems help businesses comply with tax regulations, industry standards, and internal policies by maintaining accurate records and audit trails.

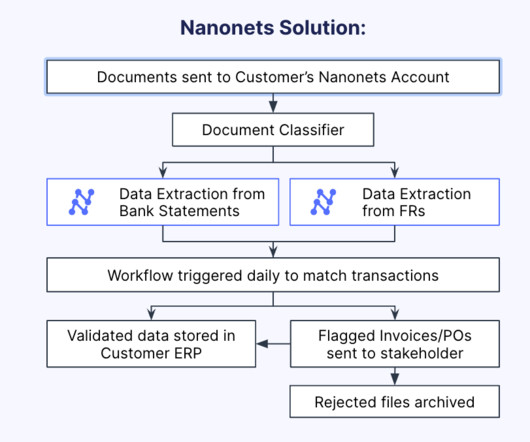

Nanonets

JULY 21, 2023

In addition to accelerating the reconciliation process, reconciliation software also enables an audit trail, significantly improving transparency and accountability. Once approved, the reconciled data is securely stored in a centralized database, ensuring an auditable trail.

Less Accounting

SEPTEMBER 16, 2024

Modern bookkeeping practices leverage technology to streamline expense management processes, making it easier than ever for small businesses to track, categorize, and reconcile expenses. Automating Invoicing and Billing Invoicing and billing are essential functions for small businesses, but they can also be tedious and labor-intensive tasks.

Analytix Finance & Accounting

MAY 7, 2025

If you choose incorrectly, youll risk audits, penalties, and the administrative nightmare of switching methods mid-year. This direct connection means you always know exactly where you stand cash-wise – no reconciling or additional reports needed. You can accelerate expenses by paying bills in December instead of January.

Future Firm

NOVEMBER 9, 2022

Manually reconciling bank statements. Most firms help their small business clients with different finance and accounting operations like their books, bill pay, payroll, accounts payable, etc., We rely on bank and credit card transaction data to help us reconcile a set of accounts. 10) Reconciling Uncategorized Transactions.

Nanonets

MAY 7, 2023

It's important to reconcile your credit card statements because it helps you make sure that: When it arrives, you have enough money in your checking account to pay the amount due on your statement. Why is reconciling credit cards difficult? Reconciling credit cards can be difficult for several reasons.

Accounting Tools

APRIL 12, 2024

As part of the closing process, the accounting staff may engage in the following reconciliation activities: Reconcile the bank statement Reconcile balance sheet accounts to the supporting detail Reconcile inventory records to on-hand balances (if a periodic inventory system is used) Reconciliations are considered an important control activity.

Nanonets

APRIL 3, 2024

By reconciling invoices and payments promptly, businesses can avoid overpaying or missing payments, thereby maintaining healthy cash flow levels. Compliance and Audit Readiness: Vendor reconciliation plays a crucial role in ensuring compliance with regulatory requirements and audit standards.

Counto

MARCH 27, 2024

Year-End Reporting: Prepare and file end-of-year payroll tax returns, including the IR8A and Appendix 8A (if applicable), to reconcile annual income and tax liabilities for each employee. Our payroll service comes with an advance bill payment and spend management software, offering AI-backed smart tools other providers can’t provide.

Nanonets

APRIL 24, 2024

Payment reconciliation software tools are designed to automate and streamline the process of matching and reconciling financial transactions within a business. Adjustment Recording : Adjustments in the accounting system are made to reconcile accounts, such as accounting for bank fees, interest earned, or rectifying errors.

Jetpack Workflow

AUGUST 24, 2023

However, these daily accounting tasks keep you organized, ensure your reporting remains accurate, and make audits much easier. Reconcile Cash and Receipts At the end of each day, reconcile all cash payments and payment receipts received in the general ledger to get a good idea of each client’s cash balance.

Nanonets

APRIL 2, 2024

The bank reconciliation process involves several steps: Gathering Necessary Documents: Collecting bank statements, checkbooks, deposit slips, and invoices, bills, and receipts for comparison. Cash Flow Management: By reconciling bank statements regularly, businesses can effectively manage their cash flow.

Nanonets

MAY 6, 2024

Businesses maintain a multitude of other financial documents, including bank statements, invoices , bills, cash payment receipts, and more. It ensures that all outstanding bills are accurately accounted for and paid in a timely manner. However, the GL is not the sole repository of financial data.

Accounting Tools

APRIL 8, 2024

One step in the prevention of this problem is to require the formal approval of a manager for credit memos, which are then verified at a later date by the internal audit staff. Restrict access to the billing software. You should password-protect access to the billing software to prevent the illicit generation of credit memos.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content