How to reconcile a bank statement

Accounting Tools

JULY 29, 2023

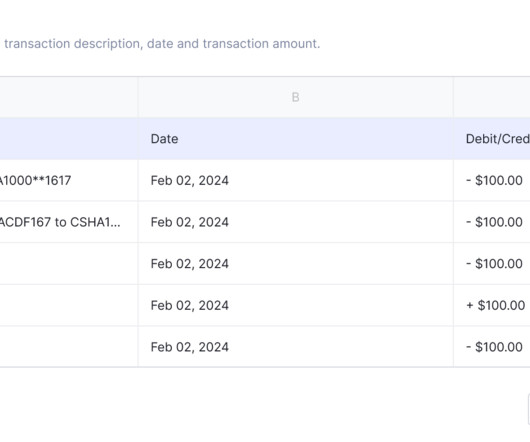

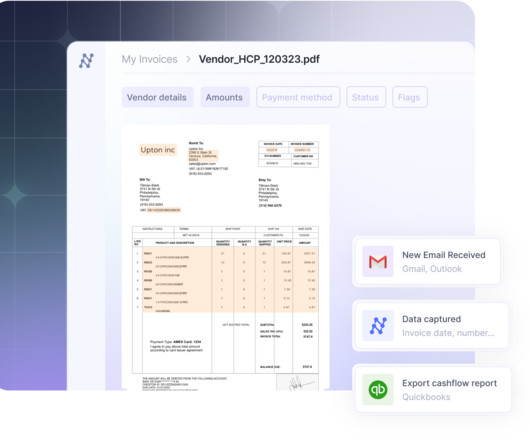

Related Courses Bookkeeping Guidebook Corporate Cash Management How to Audit Cash Reconciling a bank statement involves comparing the bank's records of checking account activity with your own records of activity for the same account. To reconcile a bank statement, follow the steps noted below.

Let's personalize your content