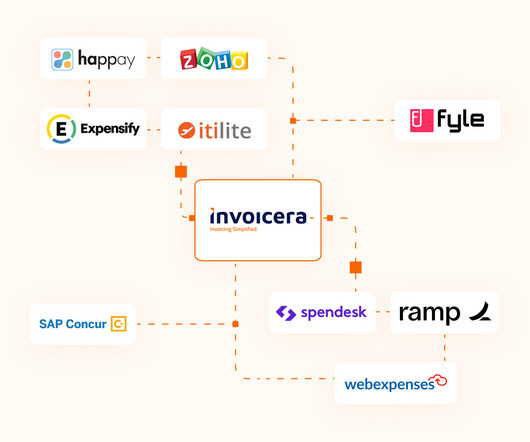

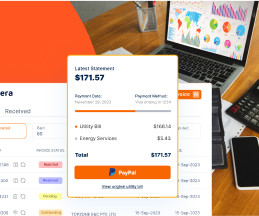

Guide to Streamline Vendor Payments

Nanonets

SEPTEMBER 29, 2023

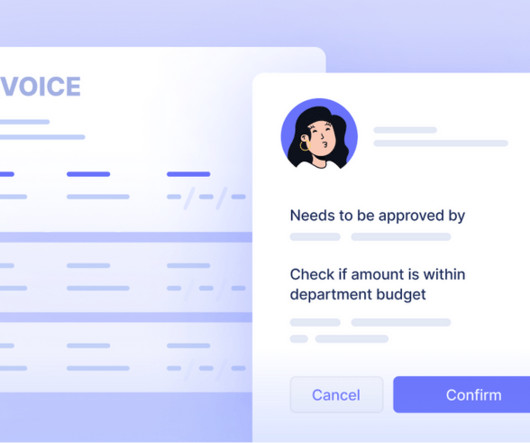

According to the American Productivity and Quality Center (APQC), the world’s top performing organizations receive an invoice and schedule payment in 2.8 Streamlining vendor payments is thus an important part of any business’ financial operations. days or faster. Let’s dive in.

Let's personalize your content