Five ways to work smarter in Xero this FY25

Xero

APRIL 2, 2024

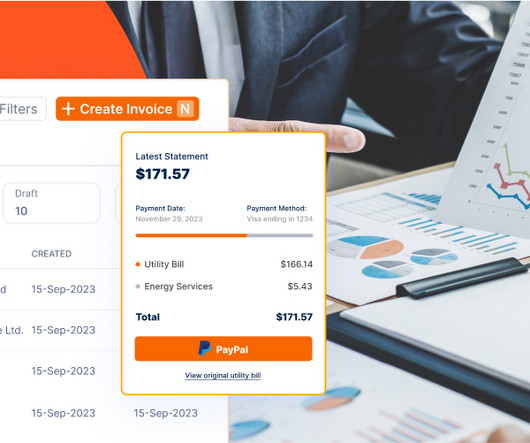

So, why not try batch payments in Xero to speed up the process? With batch payments, you can bundle several bills into one payment file before importing it into your bank account for processing. You can schedule payment dates in Xero and customise what details you want to appear on both your bank statement and your supplier’s.

Let's personalize your content