Bookkeeping now fully automated, tax compliance not far behind

Accounting Today

JUNE 11, 2025

A recent report from CPA.com says that semi-autonomous AI bots are already completing bookkeeping workflows start to finish, fully automating the process.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Accounting Today

JUNE 11, 2025

A recent report from CPA.com says that semi-autonomous AI bots are already completing bookkeeping workflows start to finish, fully automating the process.

Xero

NOVEMBER 18, 2024

We’re excited to announce that partnership tax has arrived in Xero Tax. You can now manage most of your clients’ tax needs – corporate, personal, and ordinary partnerships – in one simple, secure platform. Your practice can now gain all the benefits of Xero Tax across your ordinary partnership clients.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Protect What Matters: Rethinking Finance Ops In A Digital World

Why Tech-Forward Tax and Accounting Firms Have the Inside Track to the Future

Your Accounting Expertise Will Only Get You So Far: What Really Matters

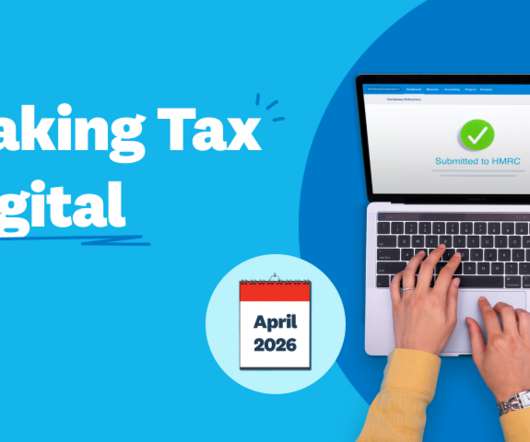

Xero

FEBRUARY 26, 2025

The next phase of Making Tax Digital is coming. In April 2026, Making Tax Digital for Income Tax (MTD for IT) will be introduced, and its set to shake up the record keeping, reporting and tax requirements for self-employed people and landlords. MTD for IT filing will be available in all Xero business plans.) Whats next?

Xero

DECEMBER 9, 2024

This month, we’ve introduced updates designed to help you to get paid faster, streamline tax rules and regulations compliance, and manage your sales tax with ease. With enhancements from the ability to send invoices via SMS to improvements in Xero Tax and sales tax reporting, we continue to make Xero even better.

Xero

JUNE 3, 2025

From April 2026, small businesses, sole traders and landlords will need to change how they report income tax to HMRC. New legislation, known as Making Tax Digital for Income Tax (MTD for IT ), is set to be introduced, sparking a shift in financial reporting requirements. The MTD for IT rollout will happen in phases.

Intuit

AUGUST 30, 2024

What’s the difference between bookkeeping and accounting? We’ll define each, explore the differences between bookkeeping and accounting, and discuss what it takes to pursue roles in the fields. We’ll define each, explore the differences between bookkeeping and accounting, and discuss what it takes to pursue roles in the fields.

Accounting Today

JUNE 11, 2025

The shift signifies growing apprehension across Main Street accounting firms serving as advisors on tax, payroll and compliance decisions amid a backdrop of historic tariff actions, continued inflation and unpredictable tax and trade policies. All rights reserved.

Accounting Today

JUNE 26, 2025

The AI agents include: Accounting Agent: Automates bookkeeping and transaction categorization, and helps with reconciliation of the books. By Chris Gaetano 1m ago Tax-related court cases Tax Fraud Blotter: Boundless energy Another Naughty list; a couple of sharks; Miami vice; and other highlights of recent tax cases.

Xero

APRIL 28, 2025

Delivering powerful, integrated tools for our accounting and bookkeeping partners to help their small business clients is a key focus for us at Xero. Imagine seamlessly managing, reviewing, and completing your bookkeeping, workpapers and tax all in one place. What does this mean for your practice?

Intuit

DECEMBER 6, 2023

Alvin became a TurboTax Live Tax Associate , and began growing his tax knowledge and skills immediately through the learning programs offered by Intuit. Intuit Experts can also take advantage of Intuit Academy’s educational programs to advance their tax and bookkeeping skills and grow their careers.

Accounting Today

JUNE 11, 2025

Practice management Private equity Succession planning MORE FROM ACCOUNTING TODAY Audit SEC plans ahead for PCAOB takeover The Securities and Exchange Commission is making plans in case it inherits the Public Company Accounting Oversight Boards duties if the tax bill passes. All rights reserved.

Intuit

SEPTEMBER 9, 2024

Table of Contents Bookkeeper resume sample template How to write a bookkeeping resume: What to include Resume writing best practices Update your resume to apply to bookkeeping jobs For bookkeeping roles and beyond, the job market is highly competitive these days. Not sure where to begin?

Intuit

DECEMBER 1, 2023

How Intuit provides additional opportunities for growing a tax career As a TurboTax Live Tax Prep Assistant, Anisha combines her tax experience with her passion for making a difference in people’s lives. Anisha is grateful she embraced the opportunity to become a TurboTax Live Tax Prep Assistant.

Intuit

NOVEMBER 30, 2023

She applied, and within three weeks was working remotely as a QuickBooks Live Expert Bookkeeper. The post Flexible Work that Works: Revolutionizing Tax and Bookkeeping Careers with Intuit appeared first on Intuit Blog. Nina’s part-time career with Intuit allows her the flexibility to create a schedule that works for her. “I

Accounting Today

JUNE 25, 2025

While much attention has been paid to artificial intelligence in audit, bookkeeping and reporting, one of the most overlooked opportunities lies in tax credits and incentives.

Intuit

MAY 28, 2024

As a Seasonal Tax Prep Associate for Intuit, I work remotely from my home in Kansas helping customers all over the country. If you want to transition from a bookkeeping position to a tax career like I did, keep scrolling and I’ll share the 4 ways Intuit makes it easy for you to do it. Spoiler alert: I love it! I’m Fatimah.

Xero

JULY 3, 2022

Your accountant or bookkeeper. . Earlier this month, Caveo Partners took to Xero’s social channels to ask small business owners which questions they wanted answered come tax season. How often should I see my advisor at tax time? . Do I need an accountant and a bookkeeper, or just one of the two? .

Intuit

APRIL 29, 2025

How to Become a Certified Tax Preparer in Canada Ever wonder how you could become a tax preparer in Canada? Becoming a certified tax preparer could be your ticket to steady work, flexible hours, and helping people make sense of their finances (and maybe even save them some money). What does a tax preparer do in Canada?

Intuit

FEBRUARY 24, 2025

Today, 6,000 pages of tax code stands between American families and what is often their largest check of the year. At Intuit, we believe that a simpler tax code means simpler taxes for everyone. And for years, weve been publicly calling for a simpler US tax code for all Americans. The tax code is overly complex.

Xero

NOVEMBER 22, 2022

Surrounded by our amazing accounting and bookkeeping partners and small business customers, I understood the magnitude of what we are fighting for. . Accountants and bookkeepers are key to providing it. . A national campaign to promote accountants and bookkeepers.

Xero

SEPTEMBER 13, 2023

We are pleased to share the key findings from our study of the accounting and bookkeeping sector. This report involved engaging with over 600 accounting and bookkeeping professionals practising across the UK, from sole practitioners to large practices.

Less Accounting

NOVEMBER 18, 2024

As tax season approaches, many small business owners find themselves scrambling to organize their financial records and ensure they comply with the intricate web of tax regulations. Get Caught Up Overwhelming by bookkeeping backlog? Accurate bookkeeping throughout the year simplifies the tax filing process.

Accounting Today

JUNE 5, 2025

Of the roughly 100 students in our program, 15–20% are already working in accounting-related roles — bookkeepers, clerks or accounting assistants. By Chris Gaetano June 5 Tax By the numbers: IRS and PwC layoffs, accounting students and more The latest data on layoffs and growth in masters degree programs in accounting.

Xero

NOVEMBER 11, 2022

From April 2024, self-employed people and landlords earning over £10,000 annually, will need to follow Making Tax Digital for Income Tax Self Assessment (MTD for ITSA) rules. . As an accountant or bookkeeper, you will need to prepare yourself, your clients, and your practice for these changes. Four quarterly updates .

Intuit

JULY 30, 2024

As individual and business tax returns were set to be filed this past April, tens of millions of Intuit customers and thousands of experts saw the fruits of this labor firsthand, through hyper-personalized filing experiences, and the interweaving of digital and human expertise. On April 15, the U.S.

Xero

SEPTEMBER 8, 2022

Here, Marykate tells us about her journey from hair salon owner to founding her own bookkeeping business, and how Xero is helping DS Business Support best serve its clients. Discovering the basics of bookkeeping. Marykate turned to the internet to learn how to run her business, and to figure out the basics of bookkeeping.

Stephanie Peterson

JUNE 16, 2025

By Stephanie Peterson, Advanced QuickBooks ProAdvisor | Superior Virtual Bookkeeping LLCWhen you’re running a small business, it’s tempting to do everything yourself; especially your books. the owner of Superior Virtual Bookkeeping LLC i

Stephanie Peterson

MAY 31, 2025

By Stephanie Peterson, Superior Virtual Bookkeeping LLCServing Murrieta, Temecula, Wildomar, Menifee, and Surrounding AreasRunning a business in Murrieta or nearby cities like Temecula, Wildomar, or Menifee means wearing many hatsbut one role that cant afford mistakes is bookkeeping.

Intuit

FEBRUARY 20, 2025

This is complemented by personalized AI-driven insights and recommendations, and a seamless path to AI-powered human tax and bookkeeping experts whenever needed.

Xero

JUNE 13, 2022

While here may not be the best place to ponder the ebb and flow of time, it is worth bearing in mind when assessing the April 2024 starting date for Making Tax Digital for Income Tax Self Assessment (MTD for ITSA). Affected taxpayers or their accountant or bookkeeper can submit quarterly updates for MTD for ITSA.

Xero

JUNE 8, 2023

So if you’re looking to do the same (and tackle tax time while you’re at it), below are a few simple tips to consider ahead of the ‘23 year-end. Hire a tax pro to save yourself time and money Every small business owner needs a helping hand at tax time – especially retailers – who are notorious for wearing many hats.

Accounting Today

JUNE 13, 2025

Currently, the most common use cases for AI include: delivering faster and more responsive client services (33%), enhancing accuracy by reducing bookkeeping and accounting errors (33%), and streamlining workflows through the automation of routine tasks (32%). All rights reserved. By Jeff Stimpson June 12 Like what you see?

Intuit

MAY 28, 2024

If you have a bookkeeping background and want to develop the skills needed to have a more lucrative future, I can share with you the advantages of building a tax career with Intuit. I wanted to create a one-stop shop where I could help customers with taxes, bookkeeping, and investing. You can do that here, too.

Less Accounting

DECEMBER 2, 2024

Real-time bookkeeping, which provides up-to-date financial information at the click of a button, has become an indispensable tool for modern businesses. With real-time bookkeeping, you have immediate access to your financial data, enabling better decision-making, improved cash flow management, and enhanced business performance.

Xero

DECEMBER 20, 2022

HMRC has announced that Making Tax Digital (MTD) for Income Tax Self Assessment (ITSA) has been delayed until April 2026. With small businesses, accountants and bookkeepers facing challenging times, we understand and support the delay from HMRC – giving you more time to prepare. . Why has this happened?

Remote Quality Bookkeeping

MAY 15, 2025

And while it may feel manageable at first, handling small business bookkeeping without the right system or experience can quickly lead to costly missteps. Even small bookkeeping mistakes can snowball into inaccurate reporting, compliance issues, and cash flow problems. Owners often juggle every role, from customer service to CEO.

Accounting Today

JULY 17, 2024

Tyler Otto, president and owner of Specialty Bookkeepers & Tax, turned his wife's side hustle into a full-fledged firm after losing his job.

Accounting Today

MARCH 27, 2024

Is the age of the bookkeeper coming to an end? Are the days of the tax preparer who focuses on basic 1040s numbered? Is the payroll specialist an endangered species?

Remote Quality Bookkeeping

APRIL 14, 2025

In the content below, we seek to provide a helpful small business bookkeeping guide for startups looking to pave the way to long-term success. Bookkeeping is Critical for Business Success Whether youre launching a new business or managing day-to-day operations, bookkeeping plays a vital role in your long-term success.

Jetpack Workflow

JUNE 19, 2025

That’s why an engagement letter is a crucial piece of any new bookkeeping or accounting project. What is an Accounting or Bookkeeping Engagement Letter? What is an Accounting or Bookkeeping Engagement Letter? An accounting or bookkeeping engagement letter sets the tone and scope of the project.

Xero

NOVEMBER 28, 2024

We were an early adopter of Xero, and over the years we’ve helped many clients transition from manual bookkeeping to digital solutions like Xero, especially with Making Tax Digital. We’ve gone from a very small number of clients using Xero to nearly all of our bookkeeping clients on the platform.

Nolan Accounting Center

FEBRUARY 15, 2025

For remote workers, taking advantage of work-from-home tax deductions is important to have more money left over after taxes that can be saved, invested , or spent. There are the benefits of work-from-home tax deductions. However, remote employees can request tax-free reimbursements for work equipment and supplies.

Stephanie Peterson

MAY 1, 2025

If youre still trying to manage your own books or scramble each tax season, you may be missing opportunities to grow, and risking costly errors. Thats where we come in.Superior Virtual Bookkeeping LLC, helps small and medium sized business owners in Murrieta, Temecula, and surround

Xero

NOVEMBER 27, 2022

AccountingWeb Live Expo is taking place this week, with a huge number of the amazing accounting and bookkeeping community in attendance to enjoy keynotes, panels and mingling at an incredible two-day event. At Xero, we can’t wait to head to Coventry on the 30 November – 1 December and see so many of you in person. Yes, we said it!

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content