What is an Expense Report & How to create it?

Nanonets

JANUARY 17, 2024

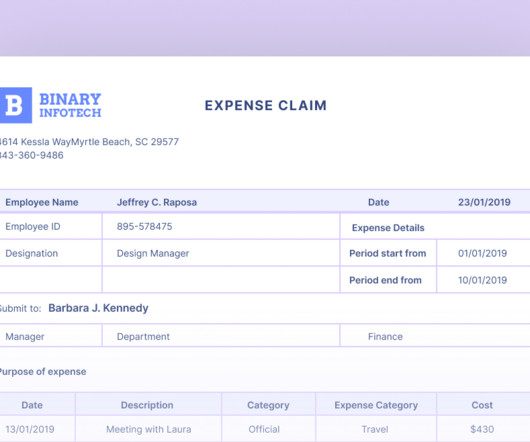

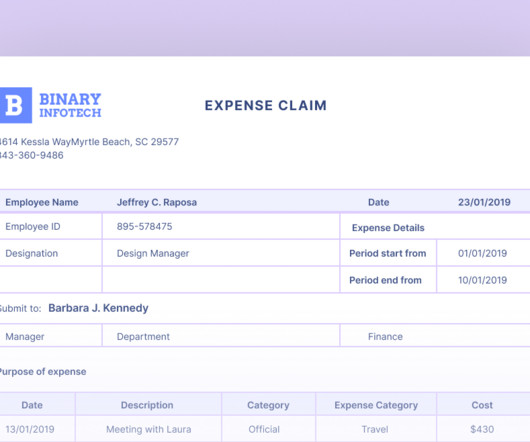

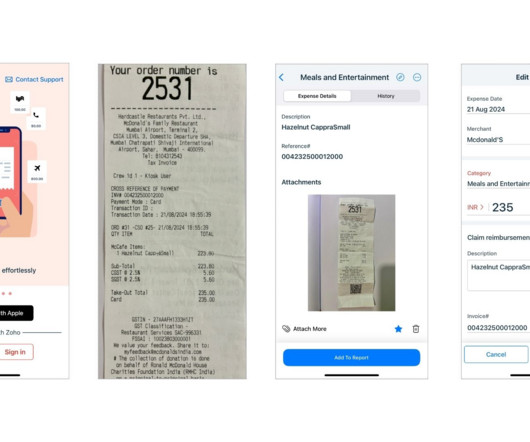

Let me start by defining the expense report. An expense report is made for recording and reporting all the expenses made by the company during the month, quarter, or year. However, this report also includes all the purchases and taxes paid during the period. What is an expense report?

Let's personalize your content