A sneak peek into what’s next for reports in Xero

Xero

APRIL 13, 2023

If you have a Xero Premium plan and have added a foreign currency to your settings page, then you can jump in and give it a go.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Xero

APRIL 13, 2023

If you have a Xero Premium plan and have added a foreign currency to your settings page, then you can jump in and give it a go.

Nanonets

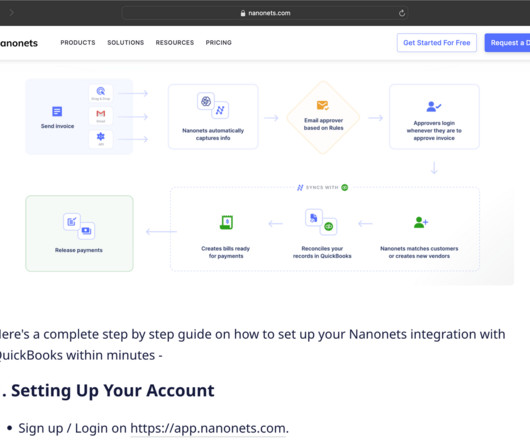

FEBRUARY 28, 2024

Welcome to our latest blog post, where we embark on a deep dive into the intricacies of the General Ledger (GL) — the bedrock of any business's financial system. We will start with the basics: What exactly is a General Ledger, and why is it paramount to your business's financial health?

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Live Demo - Supercharge your Month End Close

Doing More With Less: The Modern Finance Miracle

The Hidden Science Behind Why Finance Teams Resist Change—And How to Fix It

Protect What Matters: Rethinking Finance Ops In A Digital World

Why Tech-Forward Tax and Accounting Firms Have the Inside Track to the Future

Accounting Tools

MARCH 27, 2023

Related Courses Bookkeeper Education Bundle Bookkeeping Guidebook A general ledger is a file comprised of the accounts used to record the business transactions of an organization. The general ledger has a specifically-defined template, which is used to organize the myriad of transactions that may be stored in the file.

Live Demo - Supercharge your Month End Close

Doing More With Less: The Modern Finance Miracle

The Hidden Science Behind Why Finance Teams Resist Change—And How to Fix It

Protect What Matters: Rethinking Finance Ops In A Digital World

Why Tech-Forward Tax and Accounting Firms Have the Inside Track to the Future

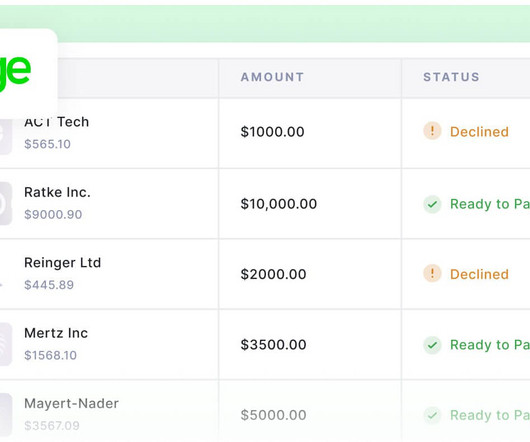

Compleatable

JANUARY 20, 2025

This visibility allows for better forecasting, budgeting, and financial decision-making. For example, once invoices are processed and approved through the purchase invoice management system, they are automatically transferred to the accounting software for recording in the general ledger.

Xero

JULY 11, 2022

These include the Budget Manager, Business Performance Dashboard, Payroll, Tax, and GST Reconciliation reports. Soon, we’ll be adding more reports into Xero — including General Ledger, Journal and Bank Reconciliation reports — as well as introducing foreign currency into new reports.

Xero

SEPTEMBER 5, 2022

We also offer each business the ability to issue 50 physical or virtual debit cards, making it easy to keep track and set budgets for team members and spending categories, like marketing and travel.”. “With Relay, each business can use up to 20 checking accountants to organise expenses and cash reserves.

Remote Quality Bookkeeping

APRIL 14, 2025

This helps you budget, control costs, and understand your profit margins. Maintaining the General Ledger: Ensuring all transactions are accurately recorded in your general ledger, which serves as the master document for your books. Track every purchase to stay in control of your budget.

The Successful Bookkeeper

APRIL 20, 2023

Additional services included: These services can look like budgeting, forecasting, and modelling. Some apps and software you should consider integrating include: •Accounting software: A general ledger like QuickBooks Online (QBO), Xero or MYOB should act as the core of your app ecosystem and the single source of truth.

oAppsNet

APRIL 24, 2025

Unapproved purchases can distort budgets and increase the risk of fraud. Reconciliations: Regularly match accounts payable (AP) with the general ledger to identify discrepancies early and ensure financial accuracy. oAppsNET Tip: Establish spend thresholds and enforce digital approval protocols.

Accounting Tools

SEPTEMBER 29, 2023

Collect Cost Information This information typically comes from the general ledger for actual costs , but the information can also be compiled through an activity-based costing system or some less formal collection methodology. Use exception analysis to highlight only those variances from budgeted costs that exceed a certain threshold.

Accounting Tools

JUNE 8, 2023

This may involve recording transactions in a specific journal, such as the cash receipts journal , cash disbursements journal , or sales journal , which are later posted to the general ledger. Such transactions may also be posted directly to the general ledger.

AvidXchange

MAY 10, 2016

This thing called “jobcost” was emerging, which was originally handled inside the general ledger system, but it was more than the general ledger could handle – it was a special, subsidiary ledger that budgets, revisions, actuals, and projections, all needed to be pledged against, so it turned into jobcost.

accountingfly

APRIL 24, 2025

TAX & ACCOUNTING CANDIDATES FTE Tax and Accounting Senior | Candidate ID #24143645 Certifications: EA Education: BA Accounting Experience (years): 9+ years accounting and tax experience Work experience (detail): All in public accounting Currently a tax senior 200+ SMB and HNWI returns per season Review of 40%, prepares more complex returns Tax (..)

Nanonets

APRIL 12, 2024

The umbrella term “Book Reconciliation” includes the following types of matching processes: General Ledger Reconciliation : The general ledger serves as the foundation for book reconciliation. Any discrepancies, such as incorrect calculations or missed payments, are corrected.

Nanonets

MAY 22, 2025

GL Outlier Assistant It is an AI-powered system that monitors transactions in your general ledger for anomalies and potential errors. Now you can simply ask Sage Copilot to give you the differences between budgeted and actual figures. More of continuous accounting rather than periodic sprints.

Compleatable

JANUARY 20, 2025

This visibility allows for better forecasting, budgeting, and financial decision-making. For example, once invoices are processed and approved through the purchase invoice management system, they are automatically transferred to the accounting software for recording in the general ledger.

Compleatable

JANUARY 20, 2025

This visibility allows for better forecasting, budgeting, and financial decision-making. For example, once invoices are processed and approved through the purchase invoice management system, they are automatically transferred to the accounting software for recording in the general ledger.

Nanonets

FEBRUARY 14, 2024

In the world of business, keeping track of money matters is crucial, and that's where General Ledger Codes, or GL Codes, come into play. General Ledger Codes, or GL Codes, are unique alphanumeric strings that classify and record financial transactions within a company’s general ledger.

Nanonets

SEPTEMBER 23, 2023

It is a method that helps businesses reserve funds for future liabilities, ensuring accurate financial reporting, budgeting, and analysis. These encumbrances can be tracked manually or automatically through specialized systems like Oracle General Ledger.

Accounting Tools

JULY 27, 2023

Related Courses Credit and Collection Guidebook Bookkeeping Guidebook Budgeting CFO Guidebook Cost Accounting Fundamentals New Controller Guidebook Payables Management Payroll Management Project Accounting Someone wanting to enter the accounting field can choose to train for a number of possible positions.

Jetpack Workflow

SEPTEMBER 1, 2024

Review and Adjust Financial Statements At the annual close, you need to thoroughly review the financial statements prepared by your bookkeeping team against the client’s general ledger accounts. What to put on your checklist for this task: Compare financial statements with the general ledger.

accountingfly

APRIL 11, 2024

Client-facing, experienced in client management and development Client niches: medical, dental, and legal practices, small businesses, real estate, entertainers and hospitality, estates, trusts, S Corps, partnerships, and sole proprietorships Tech Stack: Drake, LaCerte, ProSystems Tax and Engagement, QuickBooks, etc.

accountingfly

APRIL 18, 2024

Extensive supervisory experience Client niches: professional services, manufacturing, hospitality, retail, etc.

Nanonets

APRIL 10, 2024

Plan the implementation steps and a timeline with milestones, teams, and budget. Include add-on AP automation software in your software budget for integrated payables through Sage 100 integration. Analyze your business process workflows.

Accounting Tools

FEBRUARY 5, 2024

The approver may also want to know which general ledger account will be charged. However, this is actually a relatively weak control if the approver only sees the supplier invoice, since there is no way to tell if the goods or services were received, or if the prices being charged were what the company originally agreed to.

Jetpack Workflow

FEBRUARY 16, 2023

Chart of Accounts In this section, you’ll list the company’s general ledger account names and numbers. The chart of accounts also ensures consistency in your general ledger structure, cost collection, and financial reporting. Internal control over labor costs by division of duties and reconciliations.

Accounting Tools

JULY 28, 2023

Must be detail oriented and comfortable using computer-based accounting systems.

Nanonets

APRIL 23, 2024

NetSuite vs QuickBooks: Feature Level Comparison General Ledger Both tools have a General ledger to record, analyze, and report financial transactions. NetSuite and QuickBooks support them and allow for data import and access to historical data for Budgeting and Forecasting.

Accounting Tools

OCTOBER 25, 2023

But this is simply internal reporting that does not impact the general ledger. When there is a variance from a budgeted amount, there is no need to record this variance, since the only number that matters is the one relating to the actual transaction, not the budget being used for comparison purposes.

Cloud Accounting Podcast

NOVEMBER 4, 2018

Show Notes Sage Intacct delivers quadruple win for Finance teams — Enterprise Times — Sage Intacct announced new features at its annual conference, including Sage Intacct Budgeting and Planning, an Interactive Custom Report Writer, and General Ledger Allocations.

Accounting Tools

AUGUST 23, 2023

Reconcile the balance in the fixed asset subsidiary ledger to the summary-level account in the general ledger. Track company expenditures for fixed assets in comparison to the capital budget and management authorizations. Calculate depreciation for all fixed assets. Prepare property tax returns. Must be detail oriented.

Nanonets

SEPTEMBER 21, 2023

The essential steps of the accounting cycle include analyzing and recording transactions, posting to the general ledger, preparing a trial balance, making adjusting entries, preparing financial statements, making closing entries, and sometimes making reversing entries.

AvidXchange

APRIL 14, 2021

Here’s the list: AP reports (cover one month or less) – verify bill payments and manage cashflow AP trial balance (end of every month) – similar to balancing a checkbook; this report makes sure payments have matching entries in the general ledger. Like data entry, general ledger coding takes lots of time. There’s more.

CapActix

MARCH 23, 2023

Financial Performance Improvement The use of data analytics and forecasting tools helps businesses in forecasting, planning, and budgeting. Accountants use data analytics tools for risk management, budgeting, tax consulting, forecasting, and auditing. With proactive financial decisions, businesses can boost their profitability.

AvidXchange

OCTOBER 11, 2017

Then, you still have to check the budget, enter it into your accounting system, and add it to the general ledger before you can even think about cutting a check and filing the thing away. And, this is to say nothing of the paper envelopes and postage required.

Nanonets

JUNE 19, 2023

Generally, there are four key areas that an AP audit focuses on: 1. Completeness Auditing for completeness involves verifying account payable balances against general ledger balances. They also check cash flow and income statements, tracing general ledger entries back to their origins.

Nanonets

JULY 21, 2023

To ensure the integrity of financial data, accountants and bookkeepers rely on the general ledger account reconciliation process. This process involves comparing general ledger accounts with supporting documents using reconciliation software to identify discrepancies and take corrective measures.

Accounting Tools

MARCH 8, 2024

These modules include accounts payable , accounts receivable , inventory , payroll , general ledger , and reporting. Related Articles Accounting System Design Budgeting and Planning Software Financial Information Systems Treasury Workstations Types of Accounting Software

Nanonets

MAY 7, 2023

This is important for budgeting purposes and for avoiding credit card fraud. To begin, check that the interest charges associated with credit cards are also recorded in the general ledger. Next, most people find it easiest to match the total amounts of payments and other credits on the statement to those in the general ledger.

Nanonets

APRIL 30, 2023

Step #4: Post Payroll After entering the journal entries, you must post them to the general ledger. This step ensures that your payroll accounts tie to the general ledger. Furthermore, payroll reconciliations also help you stay on track with a budget. Does it fit your budget constraints?

Billing Platform

JULY 15, 2024

Recognize and Report: The revenue recognition pillar spans ASC 606/IFRS 15, revenue allocation, contract modifications, subledger, and general ledger. Pay and Collect: This accounts receivable pillar includes payments, cash app, and payment retries.

Nanonets

APRIL 12, 2024

Accounts Payable Reconciliation reconciling the accounts payable ledger with supplier invoices and payments to ensure accurate recording of liabilities and timely payment of obligations. Flexibility: With outsourcing, you only pay for the reconciliation services you need, providing flexibility in managing your budget and resources.

Invoicera

APRIL 28, 2024

Proper coding determines which budget the expense will be charged to. Manage approval assignments, general ledger posting, workflow, approval and review or notifications. Tip 6: Consciously budget your expenses Proactively creating business budgets can help you improve the AP process and avoid late payments.

CapActix

FEBRUARY 24, 2023

A real estate accountant’s primary responsibilities include: Bookkeeping : maintaining accurate financial records, including rent roll, accounts payable, accounts receivable, and general ledger. Budgeting : creating and maintaining the budget for the property, predicting income and spending, and keeping track of cash flow.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content