A sneak peek into what’s next for reports in Xero

Xero

APRIL 13, 2023

If you have a Xero Premium plan and have added a foreign currency to your settings page, then you can jump in and give it a go.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Xero

APRIL 13, 2023

If you have a Xero Premium plan and have added a foreign currency to your settings page, then you can jump in and give it a go.

AvidXchange

NOVEMBER 13, 2024

Managing ad budgets can be difficult for agencies due to the complexity and variability of campaigns across different client accounts. Spend management software can help agencies more effectively track, control, and optimize their ad budgets across multiple clients, projects, and campaigns.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Live Demo - Supercharge your Month End Close

Doing More With Less: The Modern Finance Miracle

The Hidden Science Behind Why Finance Teams Resist Change—And How to Fix It

Protect What Matters: Rethinking Finance Ops In A Digital World

Why Tech-Forward Tax and Accounting Firms Have the Inside Track to the Future

Xero

SEPTEMBER 1, 2022

GoCardless makes it easy for you to collect one-off, or automated, bank payments for your Xero invoices. Add GoCardless as a payment service in Xero, and apply it to an invoice or invoice template today. You can also attend their breakout session to learn more about the real reasons why you need invoice payments with Stripe.

Live Demo - Supercharge your Month End Close

Doing More With Less: The Modern Finance Miracle

The Hidden Science Behind Why Finance Teams Resist Change—And How to Fix It

Protect What Matters: Rethinking Finance Ops In A Digital World

Why Tech-Forward Tax and Accounting Firms Have the Inside Track to the Future

AvidXchange

DECEMBER 3, 2024

Businesses often use these cards to handle specific types of payments, such as supplier invoices, subscriptions, or employee purchases. Some businesses use ghost cards for spend management, setting budget limits for projects. The controlled spending reduces the risk of going over budget and helps break down spending by campaign.

Nanonets

JULY 14, 2023

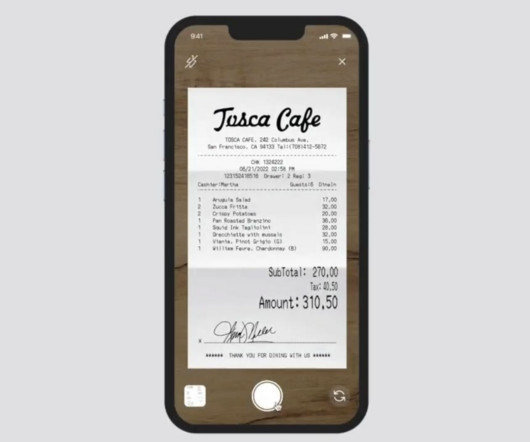

This post is mostly going to focus on invoice OCR and invoice information extraction using OCR and deep learning. We will also touch upon what is wrong with the current state of invoice recognition OCR and information extraction in invoice processing. Want to automate invoice processing ? Why digitize invoices?

Counto

FEBRUARY 22, 2025

Regularly Reconcile Transactions Reconciling sales data with bank statements and payment processors prevents discrepancies. Steps include: Matching invoices with actual deposits Reviewing transaction reports for inconsistencies Ensuring marketplace fees and commissions are properly recorded 6.

Intuit

AUGUST 30, 2024

Management teams rely on them to make strategic decisions about resource allocation and budgeting. Account management: They manage accounts payable and receivable, process invoices, reconcile accounts, and ensure timely payments and collections. For instance, investors might use them to assess the risk of investing in a company.

Remote Quality Bookkeeping

MAY 15, 2025

Not Exploring All Your Bookkeeping Options Too often, small business owners settle on a bookkeeping approach without considering which method best suits their needs, budget, and time. Technology has made it easier to track, categorize, and reconcile financial activity with far less effortand far fewer errors. Consistency is key.

Less Accounting

DECEMBER 1, 2023

Reconcile Accounts You won’t get far if your books aren’t up to date. Take the time to reconcile bank statements, credit card statements, and any other financial accounts. The best way to avoid unpaid invoices is to send invoices promptly, automate reminders, and offer convenient ways to pay.

Counto

DECEMBER 7, 2024

Solution: Use forward-looking tools like cash flow forecasting and budgeting to make data-driven decisions. Not Reconciling Accounts Payable and Receivable Why This Happens: In the rush of running a business, SMEs in Singapore often overlook regular reconciliation, leading to discrepancies that can affect cash flow.

Compleatable

OCTOBER 29, 2024

As finance experts, we excel at building robust budgets and forecasts. Just like doctors may meddle in their own diagnoses, we finance professionals often neglect our own needs, especially when it comes to the resources that would make our jobs easier. Let me explain. When the development team needed three more developers?

Invoicera

JULY 10, 2023

To streamline this process, businesses are embracing automated invoicing, which facilitates efficient expense management while saving valuable time you would have otherwise spent on manual invoicing. Set and adhere to a budget Going out of your budget eventually leads you into debt. How to Manage Expenses Effectively?

Invoicera

JULY 10, 2023

To streamline this process, businesses are embracing automated invoicing, which facilitates efficient expense management while saving valuable time you would have otherwise spent on manual invoicing. Set and adhere to a budget Going out of your budget eventually leads you into debt. How to Manage Expenses Effectively?

Counto

DECEMBER 16, 2024

Ensures you stay on top of critical tasks like reconciling accounts or submitting documents for compliance. Managing Financial Communication with Clients or Vendors Clear communication with clients and vendors is crucial when discussing invoices, payments, or contracts. What should I focus on first based on deadlines and importance?

Remote Quality Bookkeeping

APRIL 14, 2025

However, it may not reflect outstanding invoices or upcoming expenses, which can lead to an incomplete picture of your financial health. Reconciling Bank and Credit Card Statements: Comparing your internal records to your bank and credit card statements to ensure all transactions match. Timely collections improve your cash flow.

Invoicera

DECEMBER 19, 2023

Introduction Have you ever found yourself juggling incomplete payments on your invoices? Imagine sending out a substantial invoice for a project, eagerly anticipating the full payment to fuel your operations, only to receive a fraction of the expected amount. ” In this case, the right tool is an invoicing solution like Invoicera.

MineralTree

OCTOBER 5, 2023

The process involves a series of steps and tasks that are designed to reconcile financial accounts, verify transactions, and produce accurate financial statements. For example, they may reconcile vendor statements with the AP ledger to ensure there are no discrepancies or missed invoices.

Invoicera

DECEMBER 19, 2023

Introduction Have you ever found yourself juggling incomplete payments on your invoices? Imagine sending out a substantial invoice for a project, eagerly anticipating the full payment to fuel your operations, only to receive a fraction of the expected amount. ” In this case, the right tool is an invoicing solution like Invoicera.

Nanonets

SEPTEMBER 21, 2023

To effectively manage procurement and financial processes, it is crucial to understand the distinction between a purchase order and an invoice. On the other hand, an invoice is sent by the seller to request payment once the order is fulfilled.

Gaviti

AUGUST 27, 2024

It can also be difficult to accurately predict these costs ahead of time, making budgeting for the project challenging. One of the main benefits of vendor solutions is the smaller commitment to costs and ability to budget and use the resources for investment opportunities. These costs can be even bigger for a larger company.

Nanonets

FEBRUARY 20, 2024

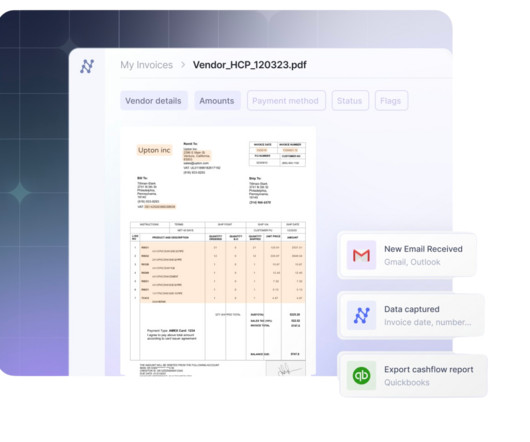

In the bustling world of business, managing accounts payable and invoice processing manually is becoming more and more challenging. The Evolution of Invoice Processing The journey of invoice processing from its traditional, manual roots to the digital frontier is a tale of technological evolution.

Nanonets

FEBRUARY 20, 2024

Yet, despite its advanced capabilities, managing accounts payable and invoice processing manually in Xero is becoming more and more challenging. The Evolution of Invoice Processing The journey of invoice processing from its traditional, manual roots to the digital frontier is a tale of technological evolution.

Nanonets

MAY 31, 2023

These tasks include data entry, invoice processing, and financial analysis for decision-making, operational planning, and risk management. This process is also time-consuming, as tasks like reconciling accounts, generating reports, and conducting financial analysis require several manhours.

Nanonets

FEBRUARY 21, 2024

In essence, while QuickBooks provides the foundation for solid financial management, the manual processing of invoices acts as a brake on potential efficiency gains. Real-Time Data Sync with Workflow Automation : OCR and invoice scanning software today synchronize data with QuickBooks and other apps (Slack, Email, Stripe, etc.)

Invoicera

MAY 14, 2023

Invoice automation solutions control how customers pay and lower the investment cost on an Account Payable (AP) team. The AP team manages customer service and orders and tackles the arduous task of keying hundred of invoices and verifying them against their original purchase orders. It is a laborious and time-intensive task.

Nanonets

APRIL 3, 2024

Bank Reconciliation: They reconcile bank statements with the company's financial records to ensure consistency and identify discrepancies. Invoicing and Accounts Receivable: Traditional bookkeepers generate invoices, track payments, and manage accounts receivable to ensure timely collection of funds owed to the company.

Gaviti

JULY 18, 2024

Make better credit decisions, lower DSO, and reconcile payments with near perfection. Consider these common methods: Cash budgeting: This approach creates a projected cash flow for a specific period, usually one year. Streamline the tracking, coding, routing, and resolution of customer invoice deductions and disputes.

Nanonets

SEPTEMBER 22, 2023

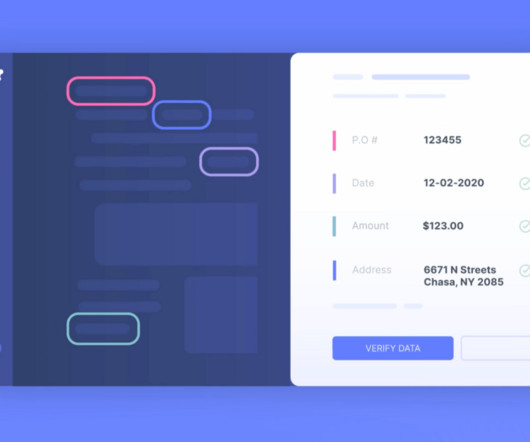

Managing your vendor invoices effectively is crucial for efficient payment processing and budget management. To ensure smooth processing, it is essential to understand the key details that should be looked for on an invoice.

Nanonets

APRIL 1, 2024

If you've ever spent hours chasing down missing invoices, manually entering data , or chasing colleagues for approvals, you know the pain of inefficient accounts payable (AP) processes. Both offer features like invoice processing, approval workflows, payment execution, and integrations with popular accounting software.

Nanonets

APRIL 12, 2024

Here are some examples: · Bank Statements · Credit Card Statements · Vendor Invoices · Customer Invoices · Loan Agreements · Lease Agreements · Insurance Policies · Government Tax Notices. Any discrepancies, such as incorrect calculations or missed payments, are corrected.

Nanonets

JUNE 19, 2024

Accounts payable teams must reconcile payments regularly to avoid double-processing them. Provides Better Budgeting : With accurate and up-to-date vendor payment data, businesses can create more informed budgets and make better financial decisions. Each invoice can contain mistakes in vendor names, amounts, and invoice numbers.

Nanonets

MAY 7, 2024

This process typically involves reviewing transactions, invoices, receipts, and other financial documents to verify that they match up with the company's records and budget. By reconciling expenses, businesses can ensure that they comply with these regulations and avoid potential penalties or legal issues.

Bookkeeping Express

OCTOBER 10, 2023

This last-minute scramble typically involves gathering scattered receipts, invoices, and financial statements, reconciling accounts, calculating tax obligations, and preparing financial statements for tax filing. Create a Comprehensive Budget A well-structured budget is your financial roadmap.

Less Accounting

JUNE 15, 2023

It helps you keep track of your expenses, invoices, and bank statements, and allows you to make informed decisions about the future of your business. We will cover everything you need to know , from tracking expenses and invoices to reconciling bank statements and choosing the right bookkeeping software.

Less Accounting

APRIL 2, 2024

Failure to Reconcile Bank Statements: Ignoring bank reconciliation is a recipe for disaster. Failing to reconcile your bank statements regularly can result in missed transactions, overdrafts, and errors in financial reporting. Invest in accounting software or hire a professional bookkeeper to maintain organized and up-to-date records.

Nanonets

JULY 22, 2024

This guide covers crucial tools for automating key financial processes, from ERP selection to processing invoices, bank reconciliation, journal entries, accounts receivable, spend audits, and financial planning.

Bookkeeping Express

DECEMBER 12, 2023

Organize Receipts and Invoices Gather all receipts, invoices, and financial documents. Reconcile Bank Accounts Ensure your bank statements align with your accounting records. Reconcile bank accounts to identify discrepancies, such as outstanding checks or unrecorded transactions.

Nanonets

JUNE 21, 2023

As transactions flow in and out, reconciling payments becomes crucial to ensure accuracy, identify discrepancies, and maintain a clear financial picture. This article will provide a comprehensive guide to reconciling payments, its importance, challenges faced, best practices, and the role of automation in enhancing the process.

CapActix

MARCH 12, 2025

With automated reconciliation, your ecommerce accounting services will reconcile sales, bank deposits, and expenses across Shopify, Etsy, eBay, and other channels so that every dollar is accounted for. No more lying awake at night worrying that payments are missing or that there are duplicate postings.

AvidXchange

SEPTEMBER 30, 2015

Applying automation to your AP and payment processes means removing paper invoices and checks which helps make the month-end closing process a painless experience. The Problem with Paper If your company is still receiving paper invoices or paying bills, you’re not capitalizing on today’s best practices.

NextProcess

JANUARY 18, 2025

When everything goes well, invoices enter the system and the software handles processing all the way through to payment approvals. The workflow starts with invoices being digitally entered into the system, either from electronic files (like an emailed invoice) or scans of printed files.

NextProcess

JANUARY 18, 2025

When everything goes well, invoices enter the system and the software handles processing all the way through to payment approvals. The workflow starts with invoices being digitally entered into the system, either from electronic files (like an emailed invoice) or scans of printed files.

Nanonets

APRIL 12, 2024

The Importance of Accounts Reconciliation Companies handle a variety of finance-related documents, ranging from bank statements to invoices and payroll records. Integrate Nanonets Reconcile financial statements in minutes Try for Free What is Accounts Reconciliation?

Nanonets

AUGUST 21, 2023

B2B payment automation involves everything from the automation of capturing and processing invoices to making payments to vendors and reconciling those payments in your books. What if you could reduce these costs by 80% and increase the speed of processing invoices by up to 10 times? Sounds too good to be true?

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content