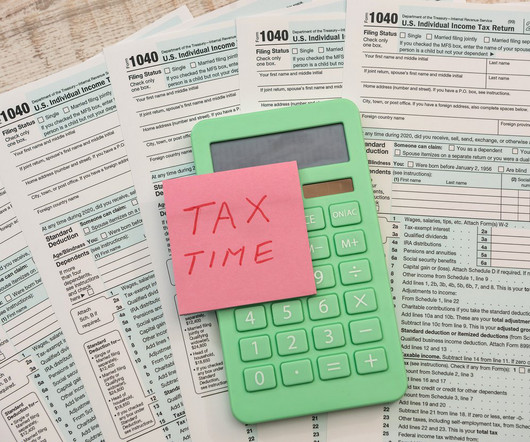

Bookkeeping Document Checklist: Collect and Organize Your Financial Documents

LedgerDocs

JULY 6, 2023

But collecting and organizing these documents can be a daunting task. The post Bookkeeping Document Checklist: Collect and Organize Your Financial Documents appeared first on LedgerDocs. Accurate record keeping can help you to remain organized, compliant and gain insight into the financial position of your business.

Let's personalize your content